The Nigerian local currency, naira, has had what experts would call a “terrific year”.

It has been devalued twice in the last twelve months, from N155 in November 2014 to N197 in November 2015, relative to the dollar.

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), and President Muhammadu Buhari, have insisted that the naira would not be further devalued regardless of its movement at the parallel market.

The following charts show how the naira has behaved in the past 10 months, and the impact the CBN defense has had on the local currency.

Advertisement

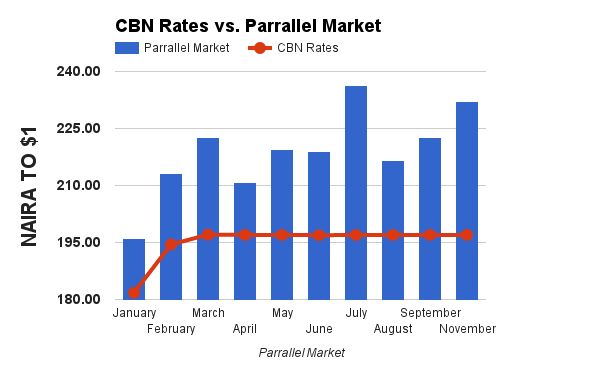

CHART 1: CBN INTERBANK RATES VS PARALLEL MARKET RATE

Since the devaluation of the naira in February 2015, the interbank trading rates have stayed at a rather constant level around the N196, N197 mark, but the parallel market has behaved other wise.

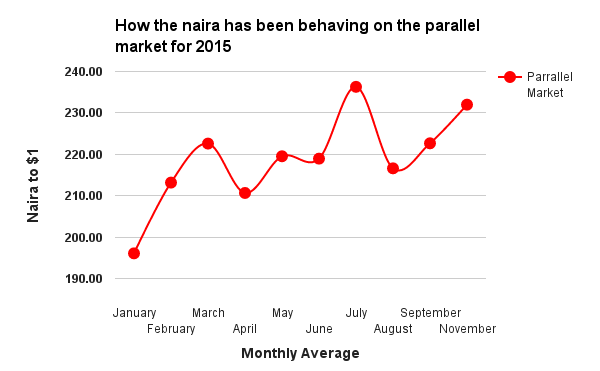

CHART 2: NAIRA MOVEMENT ON THE PARALLEL MARKET

Advertisement

Following the devaluation of the naira in February, the space between the official value of the naira and the black market value (parallel market), began to grow wider.

In July, the CBN initiated a weekly sale of over $80m to Bureau De Change (BDC) operators at interbank rate, to keep the official and black market rates close to each other.

The next chart shows the effect of that CBN policy on black market trading.

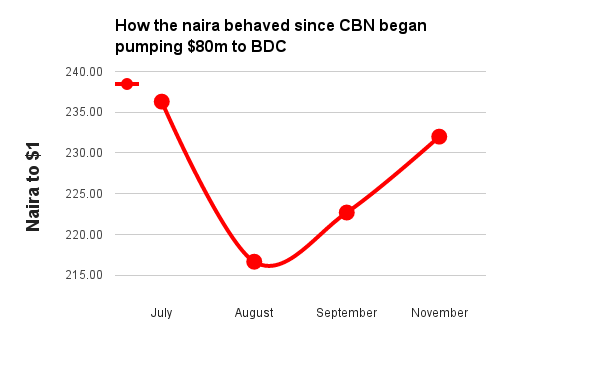

CHART: NAIRA MOVEMENT ON PARALLEL MARKET AFTER CBN INTERVENTION

Advertisement

According to the chart, the policy was effective in August, driving the naira to a monthly average of N216.64 to the dollar, only to rise to as high as N232 on Wednesday.

CBN black market defense of the naira is gradually losing the ability to minimise the gap between the official and the unofficial value of the local currency.

Data source: CBN

Advertisement

Add a comment