Nigerian stocks are leading continental peers amid renewed investors’ appetite in bellwether stocks, an analysis by TheCable has shown.

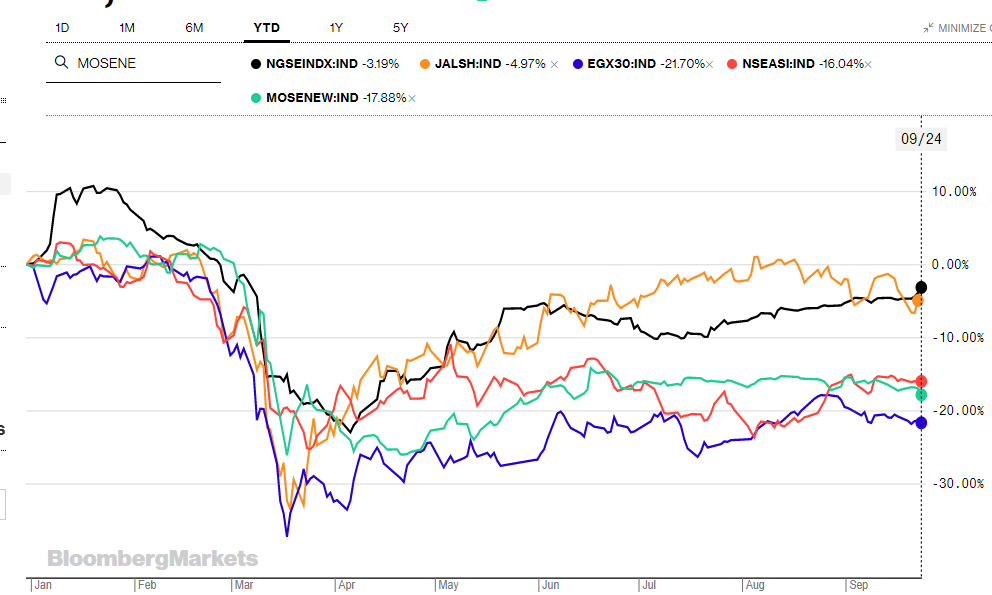

Nigerian stocks, still down -3.2 percent year-to-date is ahead of South Africa at -4.97 percent, Egypt at -21.85 percent, Kenya at -16.04 percent, and Morocco -11.88 percent.

Also Nigeria stocks currently have a cheap valuation at a price-to-earnings of 9.16x compared to South Africa’s 21.57x, Egypt’s 11.37x, Kenya’s 9.16x, and Morocco’s 19.23x.

At the close of trading on September 24, Nigeria’s all-share index rose by 0.8 percent to 25,987.14 points – the largest gain since August 12, 2020, consequently, the month-to-date gain increased to 2.6 percent.

Advertisement

Source: Bloomberg

The nation’s bourse just like various markets across the globe has been impacted by a decline in oil prices and the COVID-19 pandemic.

Advertisement

The increased participation of local investors in equities has been boosted by the low-interest-rate environment, which has positioned the equities market as a haven and viable market for the destination of private capital.

On the other hand, foreign investors are still cautious trading at the nation’s equity market. Gbolahan Ologunro, equity analyst at CSL Stockbrokers, said uncertainties around Nigeria’s foreign exchange window and inability to repatriate capital means new investments are put on hold.

According to Ologunro, foreign investors are also worried that gains on Nigerian stocks may be eroded due to currency adjustments.

‘‘Until there is better clarity on the exchange rate framework and improved flexibility such as the CBN allowing the market to determine prices in the I&E window, we are not likely to see significant demand from investors despite cheap valuation,’’ Ologunro said.

Advertisement

Amid scarcity of the dollar, backlog in FX demand rose to around $7 billion in June. The Central Bank of Nigeria (CBN) promised to fund “legitimate” dollar demand but its firepower has been questionable in the face of shrinking reserves.

The apex bank adjusted the Bureau De Change (BDC) to N380 per dollar from N360. It also adjusted the naira’s official rate from N307 to N360 which is a devaluation of 15 percent, while the official rate was further devalued from N360 per dollar to N381 earlier in August.

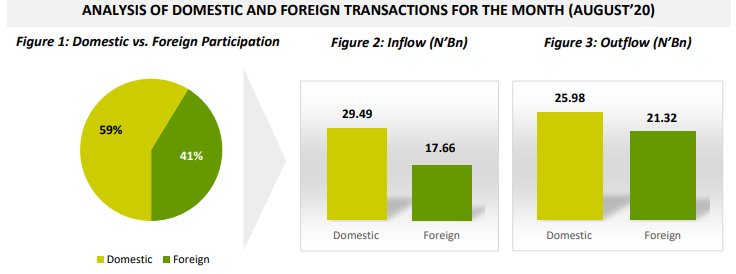

According to NSE’s domestic and offshore investors’ participation data for August, the total value of transactions executed by domestic investors outperformed transactions executed by foreign investors by 18 percent. Foreign inflow for the month stood at N17.66 billion compared to a foreign outflow of N21.32 billion.

Advertisement

Source: NSE

Also equity analysts at United Capital opined that despite sustained uncertainties in the horizon, the recent decision by the monetary policy committee, alongside the expected sizable inflows into the financial system in Q4-2020, the equities market would likely see a continuous flow of funds-especially from local investors, while the low yield environment in the fixed income market will persist.

Advertisement

Advertisement

Add a comment