Before I delve into my piece this week, it is important to state that what set the tone as well as context for this discourse is the theme for this year’s AFDB meeting in India titled ‘Transforming agriculture for wealth creating in Africa’.

As you read this piece, I am in Incredible’ India Ahmedabad to be precise attending the 2017 Annual Africa Development Bank Meeting A meeting I have been involved in since my appointment as Chairman NACCIMA Export Advocacy Group (NEXAG). A responsibility I do not take lightly as I believe exports promotions and stimulation are the key ingredients to diversification from Oil and Fossil fuels

The Nigeria’s export sector as you know both oil and non-oil as you know, have recorded significant dips since 2014, affected by both international and domestic challenges. The decline in international prices of commodities was the international factor, while lack of adequate loanable funds and trade finance instruments were the domestic reasons the sector could not sustain its growth. After it peaked at $7.2billion in 2013, Nigeria’s total non-oil exports value slid from $6.1billion in 2014 to $3.4billion in 2015 and stood at $2.7billion by 2016. Mostly due to lower international commodity prices. However, the impact of the external factors on the local environment and especially, exporters could have been salvaged if we had a robust trade finance structure that accommodates a bouquet of long-term trade products, and securities.

Year in year out, export loans remain poor and inadequate to stimulate export-oriented industrialisation. Available data by the CBN shows that credit allocation to the export sector has consistently remained below 1% of deposit money banks’ total sectoral credit allocation since 2010. 2014, which was the last available data by the CBN, showed a woeful 0.09% of total allocations to the export sector. In absolute terms, the value of credit to the sector by DMBs fluctuated downward from N795 billion in 2009 to N121billion in 2014, while total banking sector credit allocations increased. It is expected to have gone lower between 2014 and 2016, as export sector funding by banks would expectedly remain a back-burner issue with lower global trade levels and cautious financial sector. Typically, international trade has always been championed and driven by governments, particularly because of the inherent risks. The activities of the Government in de-risking the sector typically sets the tone for the level of trade and investments abroad.

Advertisement

Recently, President Muhammadu Buhari filled the leadership positions in some government institutions. One of them, the Nigeria Export Import Bank (NEXIM), is the subject of this discussion, in view of its strategic role in the process of deepening trade, industrialisation and investments. Without financial lubrication provided by the Nigerian Export-Import Bank (NEXIM), the BOI and other financial institutions, for example, the wheels of export cannot move. NEXIM, or the idea, remains a key instrument for the attainment of the Nation’s objective of global competitiveness. It has a major role to play in the realisation of the objective of increasing the volume and value of Nigeria’s non-oil exports. I hereby advocate for an expansion in its activities and operations, in view of its role in activating finance, risk bearing and trade facilitation for local SMEs involved in international trade. Similarly, in the United States, President Donald Trump had named a new president for the US EXIM in April 2017 and announced a policy change on the EXIM.

NEXIM was essentially an instrument of economic recovery and diversification, established by Decree 38 of 1991 as an export credit agency (ECA). Like other EXIM Banks all over the world, it is fully owned by the federal government, 50% each by the CBN and the Finance Ministry. It remains West Africa’s only ECA and Nigeria’s main export financing institution by mandate and remains a strategic pillar in the made-in-Nigeria campaign across the borders.

Similar to the DMBs, the contribution of NEXIM, which is the government’s instrument to catalyse export growth financing, ranged between 0.98% and 6.96% of total non-oil export credits between 2010 and 2014, as reported by the management. The paltry contribution of the organization to total export funding capacity is primarily premised on its inadequate funding. Although the CBN, however, recently launched a N500billion export sector fund (non-oil export stimulation facility) to be managed by NEXIM. It is expected that the uncertainty created by the leadership gap in NEXIM must have affected the administration of the Fund.

Advertisement

Hence it was exciting to hear that the FG has finally appointed a substantive MD and executive directors to lead the hitherto moribund institution. The new MD, previously an ED in Unity Bank, I believe will make a difference. However, it is important to highlight two important challenges facing the organization. Number one is the inadequacy of capital. Number two are the products.

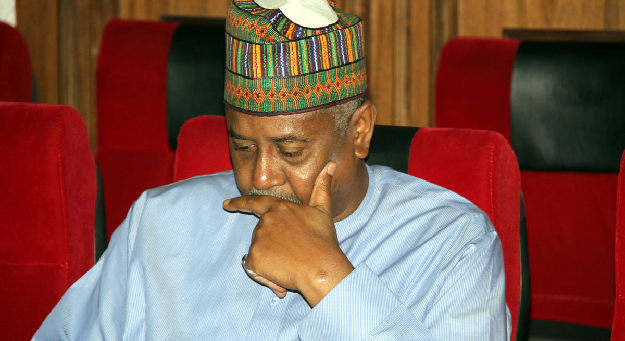

In order to help Abba Bello succeed, it is important for the government to review what EXIMS do, in order to give the institution the relevant recognition and support.

Recognition of the role of an ECA

EX-IMs, also known as export credit agencies (ECAs) are operated by 60 countries in the world and are typically each nation’s policy bank, used as the instrument of strategic cooperative partnerships between the EXIM nation and a foreign country. EXIMS provide financial services to facilitate a country’s major strategic plans towards global competitiveness. They form the channels used to grant concessionary loans and preferential export buyers’ credit to foreign countries so as to promote the purchase of locally-produced goods by liquidating its buyers to purchase them. EXIMs as a concept are channels of stabilising foreign trade, promoting cross-border investments, advancing the internationalization of a country’s currency, growing SMEs, facilitating greater economic openness and raising long-term capital (particularly through Bonds). ECAs primarily provide long and mid-term financing which can be in form of financial credit, credit insurance and guarantees. They also provide short-term financing for trade transactions.

Advertisement

Most industrialized nations have at least one ECA. Several countries, including China, India, Japan, South Korea, Germany and Brazil listed more than one agency as their official ECA or providing similar financing. Most of them have separated their insurance and guarantees business from their credit finance and international partnership functions. This usually helps them to classify their transactions, operations and focus. For instance, apart from the China EXIM which plays the policy bank role to promote foreign trade and investment as well as development assistance in concessional funding, there is also China Export and Credit Insurance Corporation (SINOSURE), which provides export credit insurance coverage against political risks, commercial and credit risks to exporting SMEs for high value-added goods to mitigate their exposures. India also has the India EXIM Bank and the Export Credit Guarantee Corporation of India (ECGC). There is however no one-size-fits-all model for a typical export credit agency as some operate from government departments, and others operate as private companies.

Products to help exporters

On commencement in 1991, NEXIM assumed CBN’s export credit services, particularly the rediscounting and refinancing facility (RRF) and the foreign input facility, before it introduced other products, like the raw materials stocking facility, rescue (repurchase) facility, exports advisory and exporters’ education services. Thus, the concept of NEXIM in Nigeria has mainly be seen till date, from the credit services perspective as against its other roles such as provision of guarantees, insurance, buyer credits and overseas investments. This was underscored by the fact that finance initially appeared to be the main problem of exporters as credit availability was limited and demand for risk bearing facilities was even low. Exporters had lower risk exposures in the early 90s, with limited buyer and country risks, given that 90% of their exports were mainly destined to Europe and the United States. A cursory look at the operations shows that the bulk of their operations still remain direct lending.

However, the world dynamics have changed since the 90s and exporters now require more export finance products, including credit insurance and guarantees. The risks in the export business has made it unattractive to many Nigerians. Time has shown that the impact of export promotion is not as much as the impact of the risk mitigating instruments. For instance, the significant decline in exports could have been arrested with such products as were first mooted by NEXIM in the 90s but never implemented.

Advertisement

- Price-guarantee contract (PGC)

Since price fluctuation is synonymous with the international commodity markets, the facility proposes to minimise the risks of Nigerian exporters against adverse price movements.

- Export Credit Guarantee Facility (ECGF)

A guarantee to a commercial bank to provide credit to an exporter of made-in Nigeria goods and services.

Advertisement

- Manufacture-In-Bond Guarantee Facility

A bond enabling exporters to access duty free raw materials and guaranteeing that the raw materials are used to produce goods for the singular purpose of exports.

- Mutual Export Guarantee Association (MEGA)

Small time exporters, usually with no track records, would be encouraged to form a mutual export guarantee association where a guarantee fund is managed by NEXIM and used to provide guarantees to banks to encourage lending to their individual members.

Advertisement

Capital base

Capital remains a key constraint to the outlook and operations of NEXIM. To be functional as an ECA, NEXIM requires more capital than it has ever had since inception. According to the consolidated balance sheet released by the CBN in q4 2016, NEXIM total assets stood at N66.5 billion or about $211 million. It is no wonder that NEXIM could not provide any meaningful support as non-oil exports earnings continued on a free decline to N2.6billion by the end of 2016. How can NEXIM de-risk the sector with as little as $211 million? How can it provide buyer credit and overseas investment loans to exporters and Nigerian companies abroad? Nexim cannot even significantly provide guarantees to Banks which now have trillions of Naira in assets nor insurance to projects and exporters with a shareholder fund lower than N50 billion. For instance, China Exim Bank had about $500 billion in total assets in 2016, separate from the assets owned by SINOSURE. The India Exim Bank also had about $15 billion in total assets.

Advertisement

According to the OECD, ECAs are now the world’s biggest class of public finance institutions operating internationally. Collectively they exceed the size of the entire World Bank Group and fund more private-sector projects in the developing world than any other class of finance institution. Rather than applying to other EXIMs for cash, it may be time for Nigeria to strengthen its own EXIM, as separate from the Development Bank, and position as a mechanism to propel the intra-regional trade objectives of the administration.

NEXIM will play a key role in developing strategic cooperation partnerships with other African trade partners, offering buyer credit to their companies to encourage the consumption of more made-in Nigeria products and even the internationalization of the Naira if they are encouraged to hold stock in Naira or as a means of deferred or electronic payments. NEXIM can champion the provision of overseas investments to Nigerian companies in trade partnering countries. It will also play the role of insuring local exporters against the various risks they face in their export transactions while also extending guarantees to Banks to lend to exporters to deepen the sector. Commercial risk include non-recovery of export proceeds, or the export itself being impossible, due to importer’s poor credit, bankruptcy, refusal to pay export proceeds, etc.

There is so much an EXIM can do, including capital raising through bond funds, to deepen the export sector. A robust EXIM would engender the introduction of more trade products, such as forfeiting factoring, export trading companies (ETCs), and so on. So, while I congratulate Abba on his new role, I wish to let him know that I sympathise with him in equal measure as he has a herculean task in explaining the importance of his role to the policy makers and getting down to putting together the necessary structures.

Views expressed by contributors are strictly personal and not of TheCable.

1 comments

The article is very articulate. The challenges highlighted are fundamental and the suggested way forward are equally good.

We hope those concern will find time to digest the article for better policy drafting.