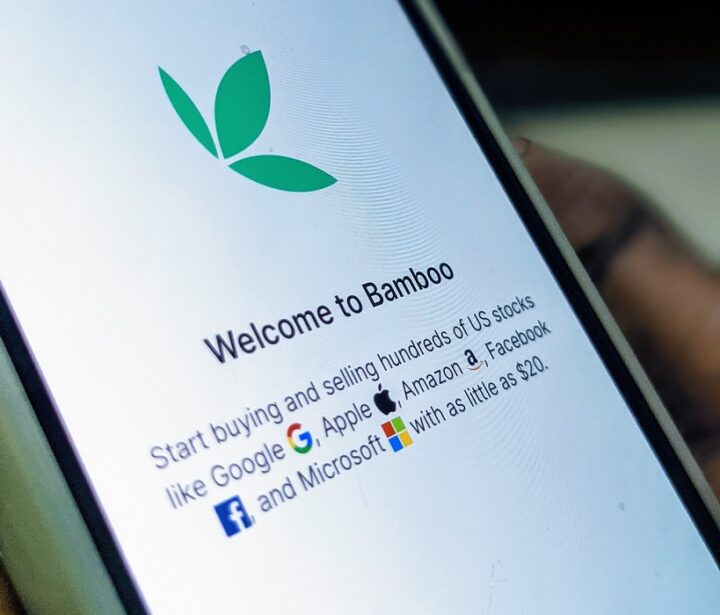

A federal high court in Abuja has ordered that the accounts of Bamboo Systems Technology Limited and Bamboo Systems Tech. Ltd be temporarily unfrozen to enable them pay salaries.

The companies had filed an application praying for a variation on the grounds that they needed funds to pay rent and workers’ salaries.

Chiezohu Okpoko, counsel to the two firms, told the court on Tuesday that his clients were also seeking an amicable resolution of the matter.

Michael Aondoakaa, counsel to the Central Bank of Nigeria (CBN), who had filed the ex-parte motion to freeze the companies’ accounts, did not oppose the application for variation.

Advertisement

“They want a partial variation to allow them access funds to pay rent and workers’ salaries; they also want an amicable settlement,” he said.

“We are not opposed to this, and we are open to an amicable settlement, all we want is that they should operate within the guidelines of the law.

“So we agree to a partial variation to the extent of what they have asked for with regard to paying rent, salaries and an amicable settlement.”

Advertisement

Ruling on the application, Ahmed Mohammed, the presiding judge, granted the prayer for partial variation of the order and ordered the accounts of the two companies to be unfrozen.

“An order is hereby made varying the freezing order of this court made on August 17, as it affects the 2nd and 3rd respondents,” he said.

“This is to allow the companies to pay rent on the property they are occupying, pay salaries of workers and allow for amicable settlement.”

The court adjourned the matter to February 17, 2022.

Advertisement

The Central Bank of Nigeria (CBN) had on August 17, secured the order of the court to freeze accounts of fintech companies for 180 days pending the conclusion of investigations.

The accounts include that Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Bamboo Systems Technology Limited OPNS, Chaka Technologies Limited, CTL/Business Expenses, and Trove Technologies Limited.

The apex bank had said it is investigating ‘illegal’ foreign exchange transactions by the fintech companies.

Advertisement

Add a comment