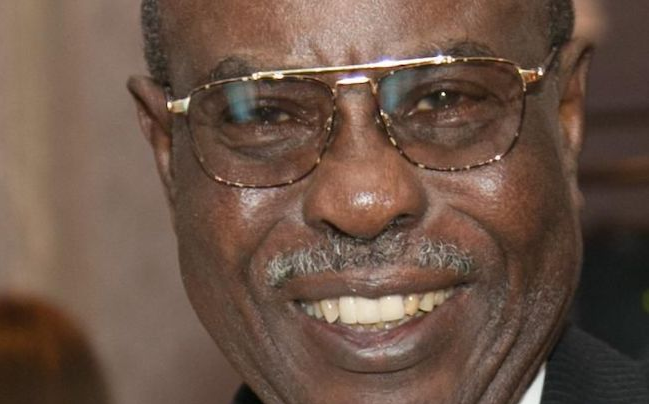

Taiwo Oyedele, Africa tax leader at PricewaterhouseCoopers (PWC), says the new value-added tax direct initiative (VDI) would need proper awareness and safeguards to avoid abuse.

On Monday, the Federal Inland Revenue Service (FIRS) announced its partnership with the Market Traders Association of Nigeria (MATAN) to ease the collection of tax from its members in the informal sector.

Reacting to the development in a Tweet on Tuesday, Oyedele commended the federal government for the initiative.

He, however, stressed that there is a need for proper education to ensure that the traders know their rights and are not exploited by tax officers.

Advertisement

“This VAT initiative should be commended but it needs some safeguards to prevent abuse,” he said.

The tax expert further made some recommendations to enable the government effectively implement the initiative.

‘SOLVE LOW COMPLIANCE, REDUCE EXTORTION’

Advertisement

He said the country has a problem of low morale for tax payments due to a ‘lack of trust in government, lack of commensurate fiscal exchange for taxes paid, and corruption in tax administration”.

Low tax morale, he explained, is the willingness to voluntarily comply with your tax obligations.

“Government needs to address these issues for the initiative to truly work,” Oyedele said.

“The social contract between the government and the people requires that every taxable person pays their taxes while the government must apply the revenue collected for the benefit of the people.

Advertisement

The tax expert said the FIRS initiative is commendable as it seeks to bring the mostly informal sector traders under the MATAN umbrella into the formal tax net.

He noted that it would also help the traders “ward off the menace of multiple taxes and extortions often by non-state actors”.

‘PROVIDE RECORDS, ACCESS TO FINANCE TO SCALE UP BUSINESS’

On the implementation of the VDI, Oyedele traders should be considerate in their calculations of the percentage increases in the value of goods or services.

Advertisement

“The VAT should not apply to over 90 percent of the traders and for those who need to charge the VAT, the impact should be about 1 percent to 2 percent of the sales value if not less,” he added.

“In fact, the traders should pay less “tax” overall if the government can stop the illegal taxes the traders currently pay as a sweetener for the VAT pact.

Advertisement

“Ultimately, the biggest win for the government from this arrangement may not be the VAT to be collected by the FIRS but the tax awareness, data about the traders and their trades which can be used for economic planning and possible interventions to support the informal sector businesses.

“This should include simplified record keeping to help them to access finance and scale their business.”

Advertisement

Oyedele also asked FIRS to work with various states similar to their arrangements with Lagos to ensure that the traders who are not in the tax net for personal income tax purposes do so “subject to the income tax exemption of N360,000 per annum as provided under the law”.

‘CUSTOMERS SHOULD NOT BE EXPLOITED’

Advertisement

In the same vein, he urged the traders involved in the VDI not to use the platform to exploit customers.

“Based on the VAT act, businesses making an annual turnover of N25 million or less are exempted from charging VAT on their sales regardless of the goods or services involved,” Oyedwle said.

“This is expected to cover the majority of the traders going by available data indicating that over 90 percent of these businesses are micro and small enterprises.

“Most basic items are exempted from VAT regardless of turnover threshold including basic food items, medical products, baby products, and educational materials. I expect this to cover many of the traders not exempted by the turnover threshold.

“There is also an exemption by design where the manufacturer, usually a large firm, prescribes the retail price and has accounted for the VAT upfront taking the burden off the traders. Examples include mobile airtime, many beverages etc.

“For those who are not covered by any of the above exemptions, they will be liable to charge and remit VAT at 7.5 percent on their sales.

“However, they are eligible to claim input VAT on their purchases such that the 7.5 percent VAT is effectively charged only to their margins. For instance, if a trader buys an item for N1,000 and sells it for N1,200. The incremental VAT cost to charge to the customers is N15 i.e. 7.5 percent of N200 margin.

“The combined effect of the above means that the public should not be exploited either by the traders who may use this VAT arrangement as an excuse to hike their prices.”

Add a comment