Throughout 2021, the Central Bank of Nigeria (CBN) implemented various reforms and policies to ensure economic and financial stability.

While it received kudos for some of its policies, the apex bank also received knocks from Nigerians.

TheCable looks at five major policies of the CBN that had impacts on Nigerians in the year 2021.

NAIRA 4 DOLLAR SCHEME

Advertisement

In March 2021, the apex bank introduced the ‘Naira 4 Dollar Scheme’ as an incentive to boost inflows of diaspora remittances into the country.

With the initiative, all recipients of diaspora remittances through CBN’s licensed international money transfer operators (IMTOs) are paid N5 for every $1 received as remittance inflow.

The scheme was applauded by many market analysts as a great approach to drive foreign exchange inflow into the country.

Advertisement

BAN OF FOREX SALE TO BDCs

In July 2021, the CBN banned the sale of foreign exchange (forex) to Bureaux De Change (BDC) operators. It also stopped the issuance of new licenses to BDCs.

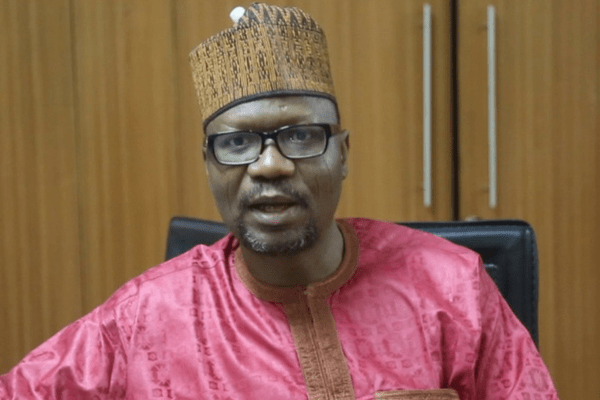

Godwin Emefiele, CBN governor, accused BDC operators of turning away from their objectives — to process FX demands of $5,000 or less — to becoming a conduit for illegal financial flows working with corrupt people to conduct money laundering in Nigeria.

Since then, the apex bank had been channelling FX to commercial banks to meet customers’ legitimate demands.

Advertisement

A day after the move, the naira suffered an abysmal fall from 505 to 525 per dollar at the parallel market, better known as the black market.

Emefiele has consistently argued that it is not a true reflection of Nigeria’s exchange rate.

Today, the naira is trading at a record-high between N565 and 570 at the black market.

CLAMPDOWN ON FINTECH COMPANIES OVER “ILLEGAL” FOREX, CRYPTO TRADING

Advertisement

In February 2021, the CBN directed deposit money banks (DMBs), non-bank financial institutions (NBFIs), and other financial institutions (OFIs) to identify persons or entities involved in cryptocurrency transactions within their systems and ensure that such accounts are closed immediately.

It also directed banks from transacting in and with entities dealing in cryptocurrencies.

Advertisement

The apex bank claimed that cryptocurrencies were being used to facilitate scams, money laundering, terrorism financing, illicit fund flows, and other criminal activities.

The directive sparked controversies among experts, operators, and speculators alike.

Advertisement

Many were concerned about the potential negative effect it could have on the country’s growing cryptocurrency market and innovation in financial technology (fintech).

In August 2021, a federal high court in Abuja granted the request of the Central Bank of Nigeria (CBN) to freeze accounts belonging to some technology trading platforms offering local and foreign stocks.

Advertisement

The apex bank said it was investigating “illegal foreign exchange trading” by the fintech companies and sought the court injunction to freeze their accounts for 180 days pending the completion of investigations.

The companies include Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Bamboo Systems Technology Limited OPNS, Chaka Technologies Limited, CTL/Business Expenses, and Trove Technologies Limited.

The CBN alleged that Rise Vest Technologies Limited, Bamboo Systems Technology Limited, Chaka Technologies Limited, and Trove Technologies Limited were complicit in operating without license as asset management companies “and utilizing FX sourced from the Nigerian FX market for purchasing foreign bonds/shares in contravention of the CBN circular referenced TED/FEM/FPC/GEN/01/012, dated July 01, 2015.

Assuring customers that their funds were safe, the companies affirmed their willingness to work with the apex bank to address the concerns of illegitimacy.

Some analysts believe that the apex bank’s freezing order spells doom for Nigeria’s ease of doing business reputation and hampers the growth of fintech startups in the country.

The court also ruled CBN can not use a mere circular as law.

eNAIRA, NIGERIA’S FIRST DIGITAL CURRENCY

100 FOR 100 POLICY

On October 25, 2021, the CBN announced the introduction of its new financial instrument tagged, ‘The 100 for 100 PPP — Policy on Production and Productivity’

The 100 for 100 PPP is a scheme designed to financially support 100 targeted private sector companies every 100 days, beginning from November 1. Companies can apply for as much as N5 billion under this scheme. Any amount above N5 billion would require special approval from CBN’s management.

However, the selection criteria for the scheme limits the instrument to only new projects and would not cover any refinance of existing facilities.

According to the CBN, the initiative is a long-term loan for the acquisition of plant and machinery, as well as working capital.

Add a comment