Despite volatility in the Nigeria’s foreign exchange market, Nigeria recorded a daily foreign exchange turnover of $100.06million in the Nigerian Foreign Exchange Market (NAFEM).

The daily forex turnover rose by 32 percent from $75.82million, on Friday, November, 24, 2023 to $100.06million on Monday, November, 27, 2023.

According to the data from NAFEM, the country’s official foreign exchange market, the rise in the daily forex turnover reflected increased FX inflow into the economy on Monday, November 27, 2023.

According to data from FMDQ Securities Exchange, the local currency hit an intra-day trading high of N1,130 and a low of N700.

Advertisement

Meanwhile, financial experts have attributed the increase in the daily turnover, on Monday, 27, November, 2023 to increase in investors confidence in the foreign exchange market.

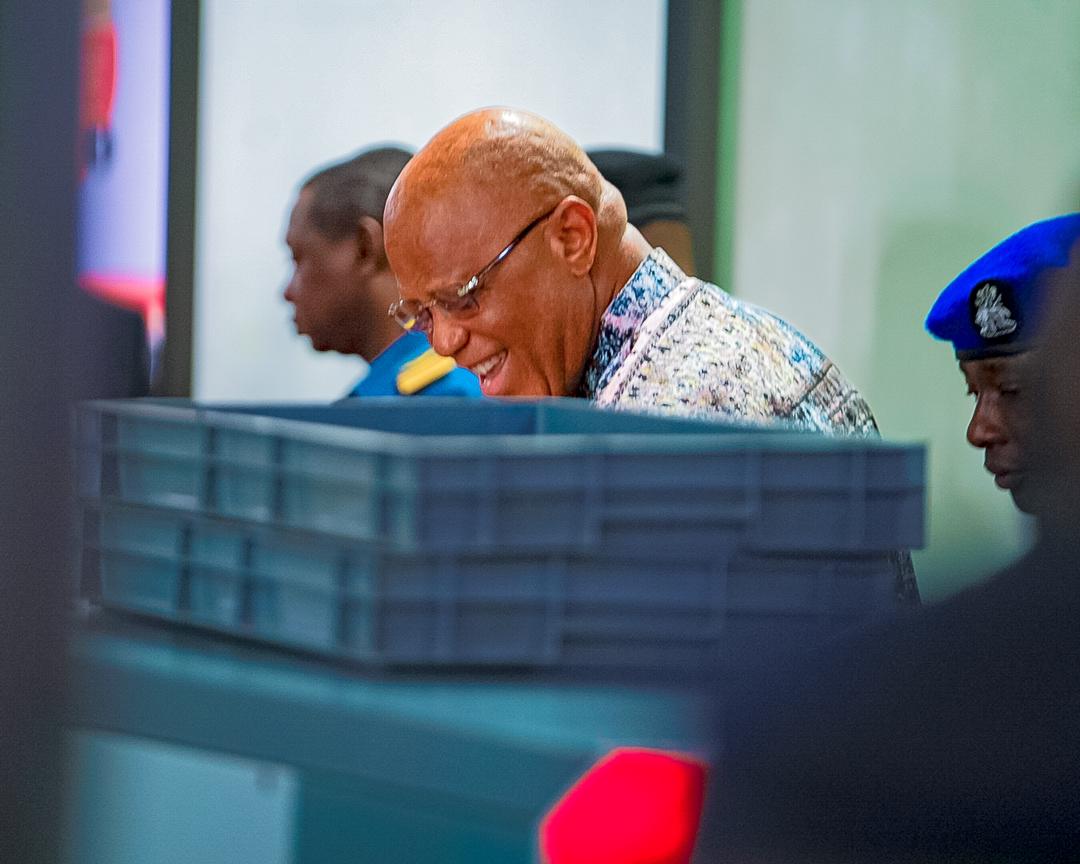

This was due to the assurance given by the CBN governor, Olayemi Cardoso, over the weekend, as he disclosed that the apex bank would continue the payment of unsettled forward foreign exchange obligations till they are all cleared.

Speaking at the Chartered Institute of Bankers (CIBN), dinner in Lagos, the CBN governor said the clearance of the forwards will ensure stability, curb speculation, and restore confidence in the foreign exchange market.

Advertisement

According to Cardoso, the intervention already had a positive impact on liquidity and has led to a significant appreciation of the exchange rate at certain points.

It could be recalled that last week, the naira appreciated both at the parallel and official markets significantly.

The naira recovered to N794.89/$1, on Friday, after a two day slump in the official market.

According to Data from FMDQ Securities Exchange, the rate represents a recovery of 16.88% from the N956.33 it recorded on Thursday.

Advertisement

Consequently, at the parallel market, the naira sustained its appreciation against the dollar as it appreciated on Friday, from N1,160 to N1,155.

This represents 0.43 percent (N5) gain than N1,160 exchanged on Thursday at the parallel market.

Speaking on the appreciation of the naira, the CBN governor said, “As the monetary authority, we are taking measures and deliberate steps to send the right signals to the market and achieve our mandate. To ensure stability, curb speculation, and restore confidence in the foreign exchange market, we have initiated the payment of unsettled forward foreign exchange obligations, and these payments will continue until all obligations are cleared.

“This intervention has already had a positive impact on liquidity and has led to a significant appreciation of the exchange rate at certain points. We have already witnessed improvements in FX market liquidity in recent weeks, as the market responded positively to tranche payments which have been made to 31 banks to clear the backlog of FX forward obligations.

Advertisement

“We have been subjecting these payments to detailed verification to ensure only valid transactions are honoured. In a properly functioning market, it is reasonable to expect significant FX liquidity, with daily trade potentially exceeding $1.0 billion. We envision that, with discipline and focused commitment, foreign exchange reserves can be rebuilt to comparable levels with similar economies.”

Advertisement

Add a comment