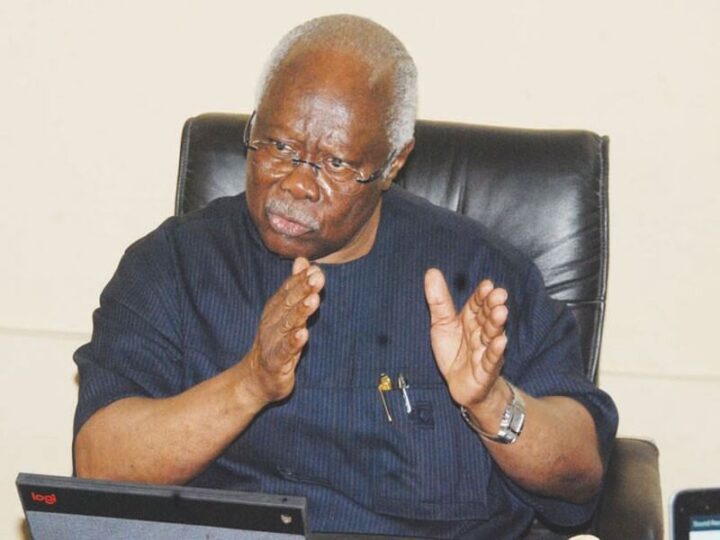

Dauda Lawal

Dauda Lawal, governor of Zamfara state, says some states may find it difficult to survive if the proposed tax reform bills are enacted into law.

The governor spoke on Tuesday during his appearance on Politics Today, a Channels Television programme.

Since their introduction by President Bola Tinubu in early October, the four bills have sparked significant debate across the country, with strong opposition coming from northern stakeholders.

Critics, particularly in the northern region, have raised concerns over the economic impact of proposed changes to the value added tax (VAT) distribution system, arguing that it could disproportionately affect their states.

Advertisement

One of the key issues is the proposed shift to a VAT distribution model that factors in derivation, a system critics say could disadvantage northern states.

Some have argued that such move could be unconstitutional, given that the current VAT distribution is based on principles of equity, equality, and population.

However, Lawal said that it would be difficult for many states to pay the minimum wage if the tax reforms are implemented.

Advertisement

“Well, the tax issue has a lot of components – there is the good aspect and there is the bad aspect. So, we are studying the situation so as also to advise our people on the way forward. It’s an ongoing process and we will continue with the engagement,” he said.

“Reform in a system is inevitable and we should always expect reforms. However, in trying to do that, we also need to be careful not to be in a hurry to do something that will later hurt us.

“So, I believe we should carefully study the situation, and have a clear understanding and take a common stand.

“There is a component of it that talks about derivation and definitely, if we are to go by it, it is going to affect some of the states in terms of what kind of inflows they have and invariably it may make it difficult for some states to be able to pay their salaries.

Advertisement

“Honestly, if we were to go by it, it would be difficult for some states to pay salaries especially with the issue of minimum wage.

“Some states may not be able to survive so it is something that must be carefully studied so that we don’t hurt ourselves in the long run.”

BACKGROUND

On October 3, Tinubu asked the national assembly to consider and pass the Nigeria tax bill, Nigeria tax administration bill, Nigeria Revenue Service establishment bill, and the Joint Revenue Board establishment bill.

Advertisement

Tinubu is also seeking to repeal the law establishing the Federal Inland Revenue Service (FIRS) and replace it with the Nigeria Revenue Service.

However, the Northern States Governors Forum (NSGF) has kicked against the bills after a joint meeting with the northern traditional rulers’ council at the Kaduna government house on October 28.

Advertisement

The governors asked the national assembly to reject any legislation and called for equitable and fair implementation of policies and programmes to prevent marginalisation of any geopolitical zone.

On October 31, the presidency assured the northern governors that the bills were not recommended by Tinubu to shortchange any part of the country.

Advertisement

On December 3, Yakubu Dogara, a former speaker of the house of representatives, asked northerners not to condemn Tinubu over the bills.

Dogara advised that they should view the reforms as an opportunity rather than a disadvantage, noting that the north can survive on its own without VAT.

Advertisement