Obi Nwanodozie is a little less than four years and is born into a farming family with tremendous landed assets in a rural community near the commercial heart land of Abia State known as Ntigha in Isiala Ngwa Local government Area.

Obi’s father, Mr. Eze is a big time farmer but had made up his mind to go into the business of importation from one of the core Western European nations just as he had the limitations of not been blessed with enough cash to back up his dream line of business.

The quick thinking rural farmer who planned to diversify his trade then approached a big man in a nearby community of Aba. The man who was approached to raise Mr. Eze a working capital in form of a loan, has the challenge of not having enough land in his family due to the extended size of that family which meant that land he inherited was so small.

The lender then demanded that Obi should tender his huge landed assets as collateral for the loan which he must pay back with less than five percent interest after seven years. The deal was sealed but not without reaching a legal agreement that should there be a default in payment the ownership of these massive family land will change hands to the lender in place of his N100 million loan he gave to the lendee.

Advertisement

Walking away resplendently, Eze then proceeded to embark on his new business trip and made success out of the first few trips but the sixth trip became a huge problem.

Mr. Eze fell into wrong hands of professional dupes who took all his money and left him in penury.

This tragedy happened incidentally in the sixth year into his loan agreement but he made frantic effort to reschedule the repayment without success because the big man was actually eyeing those lands.

Advertisement

The bigger tragedy happened when the time for repayment arrived but Mr. Eze has no money to repay but had to surrender the ownership of his land. This was exactly when his son was almost getting ready to enroll into college. Mr. Eze became so poor that he could not meet basic financial obligations to his family.

Ironically, the man who was rich in landed assets now became homeless and impoverished because of wrong investment choice and his encounter with the wrong business partners who were dubious.

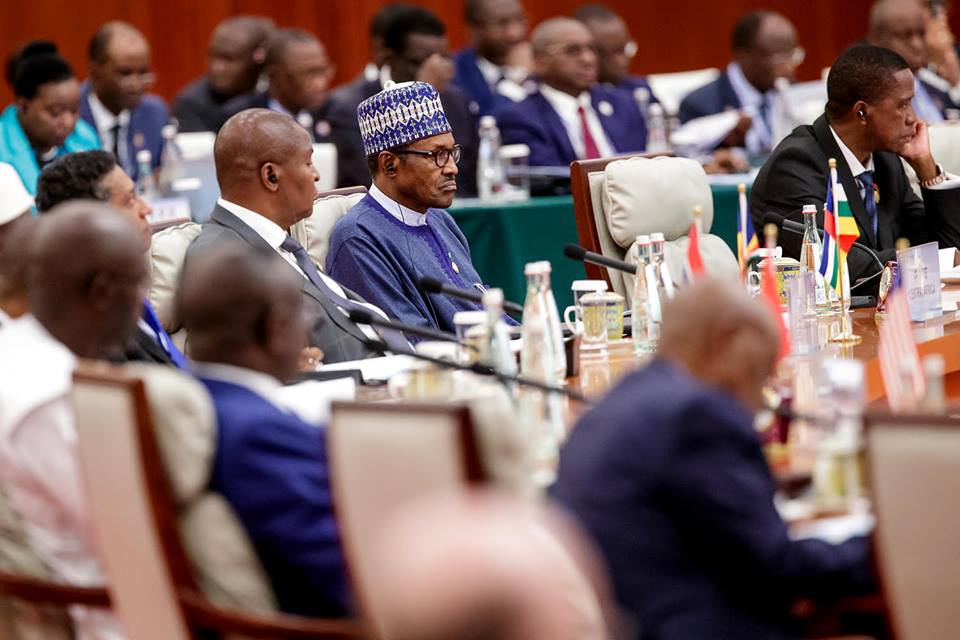

The above story is the likeliest situation that Nigeria could face in the near future if the nation due to current high level of corruption cannot repay the massive loans the Muhammadu Buhari’s administration has continued to generate in the guise of building strategic infrastructures but which ended up been stolen by his thieving officials. Recall that few years back the United Nations Office on Drugs And crime (UNODC) estimated that Nigeria has lost to government thieves over $400 billion revenue generated from exports if crude oil in the last four decades.

The signal Nigerians are now getting even from official quarters is scary and shows a nation whose leaders have gone a borrowing with little or no plan on how to repay these loans.

Advertisement

Ironically, just before 2015 when Buhari came on board, the nation had exited the bad club of heavily indebted poor countries by virtue of the fact that the Finance Minister during the then Chief Olusegun Obasanjo’s administration Mrs. Ngozi Okonjo Iweala (Professor) successfully negotiated with Nigeria’s multilateral creditors for soft landing.

A development policy review published on September 5th2013, edited by Geske Dijkstra of the Erasmus University Rotterderm had celebrated the so-called exiting from this inglorious club of debtors by Nigeria.

The researcher had asked what did 18 billion dollars achieved? That is the 2005 debt relief to Nigeria. The researcher said the aim of this paper is to assess the contribution of the 2005 debt relief agreement to Nigeria to this higher growth. This agreement eliminated Nigeria’s US$ 30 billion to Paris Club creditors; the creditors cancelled an unprecedented US$ 18 billion, while Nigeria paid US$ 12 billion.

The agreement he argued was concluded in the midst of intensive international campaigns for more aid and more debt relief.

Advertisement

He recalled that the G8 summit had just decided to eliminate all multilateral debts for countries that had fully complied with conditions for the Initiative for the Heavily Indebted Poor Countries (HIPC initiative).

He recalled too that together with the HIPC initiative itself, this new Multilateral Debt Relief Initiative (MDRI) hugely reduced the external debts for the involved low income countries.

Advertisement

But there was a big snag. Nigeria’s case was different. It was not a HIPC country, mainly because of its huge oil income, and most of its debt was with bilateral creditors. Debt cancellation for Nigeria was heavily disputed at the time, the researcher noted.

The researcher told us vividly that an important argument against it was precisely that Nigeria was oil-rich and that the country could easily pay its debts.

Advertisement

Another objection, he said was Nigeria’s bad reputation in terms of policies and governance, which made it highly unlikely that the country would use the debt relief savings well.

On the other hand, he noted, it was argued that Nigeria was a low income country (in 2003, GDI per capita was US$ 320) with 54% of its about 150 million people living in poverty, and that the debt cancellation was necessary in order to help the country achieve the Millennium Development Goals (Moss et al., 2004; Okonjo-Iweala, 2008; World Bank, 2005).

Advertisement

Not done. This financial historian recalled that some analysts also claimed that the creditors should have cancelled the debt a long time ago, since most debt was arrears (Rieffel, 2005).

Again, the writer said given the conflicting views on debt cancellation to Nigeria, it is the more relevant and interesting to assess what it has meant for economic growth and poverty reduction in the country.

“This paper traces the three possible impact channels of debt relief, namely the flow channel (reduced debt service), the stock channel (removal of debt overhang) and the conditionality channel (Dijkstra, 2008).”

The researcher reminded us that by carefully establishing the most likely counterfactual scenario for each of these channels, the paper concludes that the debt relief agreement played a key role in the country’s improved economic performance.

“The conditionality channel was in fact most influential. It was the anticipation of possible debt cancellation the broke the political deadlock that had prevented policy reforms for a long time.”

Mrs. Ngozi Okonjo got lots of plaudits from this brilliant move that saved Nigeria the much sought after $18 billion debt relief.

Although this writer then forcefully opposed the decision of Nigeria to pay off that huge chunk of foreign reserves to service the then $30 Billion credits which was reduced to just $12 Billion, the decision earned the government praises for at least saving the face of Nigeria and pulling us away from the enslavement of being a debtor.

Few years down the line, the current government has literally gone back to accumulate heavy debts.

By its own mouth, government of Muhammadu Buhari told us that Nigeria’s external debt commitment rose by $11.77bn in the last three years.

According to debt statistics obtained by the media from the Debt Management Office, the country’s external debt rose from $10.32bn in June 30, 2015 to $22.08bn as of June 30 this year.

This means that the country’s external debt commitment has grown by 114.05 per cent in the last three years.

Although multilateral debt made up $10.88bn or 49.28 per cent of the country’s external debt profile, most of the increases in the last three years occurred in the area of commercial loans, the newspaper reported.

According to the DMO, commercial foreign loans, which stood at $1.5bn as of June 30, 2015, had risen to $8.8bn as of June 30 2018.

This according to the newspaper means that in the last three years, the country’s exposure to commercial foreign loans has risen by $7.3bn or 486.67 per cent.

With a commitment of $8.47bn, the World Bank is responsible for 38.36 per cent of the country’s foreign portfolio, it asserted.

The media uncovered that apart from the World Bank Group, Nigeria is also exposed to some other multilateral organizations such as the African Development Bank with a portfolio of $1.32bn and the African Development Fund with a portfolio of $843.47m.

Others are the International Fund for Agricultural Development with a portfolio of $159.44m; the Arab Bank for Economic Development with a portfolio of $5.88m; the EDF Energy (France) with a portfolio of $64.96m and the Islamic Development Bank with a portfolio of $16.92m.

On the other hand, the newspaper affirmed, bilateral debts make up $2.39bn or 10.87 per cent of the country’s external debt exposure.

The bilateral agencies to which the country is indebted are the Export-Import Bank of China with a portfolio of $1.91bn; the Agence Francaise de Development with a portfolio of $274.98m; the Japan International Cooperation Agency with a portfolio of $74.69m; the EXIM Bank of India with a portfolio of $4.76m; and Germany (KFW) with a portfolio of $132.24m.

However, the media stated that unlike the foreign debt, the domestic component of the country’s total public debt decreased marginally recently as a result of moves to rebalance the local/foreign debt ratio.

According to the DMO, a major highlight in the latest public debt data was the decrease in the Federal Government’s domestic debt, which declined from N12.59tn in December 2017 to N12.58tn in March 2017 and N12.15tn in June 2018.

The DMO said the reduction in the FGN’s Domestic Debt Stock arose from the redemption of N198bn Nigerian Treasury Bills in December 2017 and another N639bn between January and June 2018.

A total of $3bn was raised through Eurobonds to refinance maturing domestic debt as part of the implementation of the debt management strategy for the purpose of substituting high cost domestic debt with lower cost external debt to reduce debt service costs for the government, the DMO said.

It also explained that the implementation of the Public Debt Management Strategy, whose overall objective was to ensure that Nigeria’s debt is sustainable, was already yielding positive results.

The ill-advised decision of Buhari to lead Nigeria blindly into another debts trap is dangerous because apart from massive corruption by the officials, the government has yet to plug the gaps in the crude oil sector which makes it possible for multinational companies to continue to milk Nigeria dry off the revenues from our crude oil resources and other sectors such as Maritimes even as the current administration continue to pile up foreign debts that will inevitably return us to second slavery.

Specifically, the Nigerian Maritime Administration and Safety Agency (NIMASA) had expressed worry on foreign dominance in the nation’s shipping subsector, saying that 95 percent of income goes to foreigners.

The Director General of the agency, Dr. Peterside Dakuku, said this at a one day seminar with the theme: Local Content Development in Shipping, Oil and Gas Logistics Operations in Nigeria, organized by Maritime Reporters Association of Nigeria (MARAN) in Lagos.

Dakuku who was represented at the event by Assistant Director, Shipping Development, Mrs. Hannah Akpan said, 95 percent of the income from the annual throughput of 150 million metric tons transactions, goes to foreigners.

He said, “Industry statistics shows that the country generates an estimated annual cargo throughput of 150 million metric tons with freight earnings in excess of $50billion in her international trade transactions.

“95 percent of this income is earned by foreigners, with the job deprivation to the country that goes with it.

“The same dominance by foreigners, is also extended to the domestic shipping market where the estimated $3 billion annual marine related spending in the oil and gas production activities are virtually earned by foreigners.”

Let it be recorded that Human Rights Writers Association of Nigeria (HURIWA) has warned against this enslavement that Muhammadu Buhari’s administration is leading us into especially the components of these loans from China which will mortgage our crude oil resources and further impoverish the citizenry. We must halt these maddening rush for foreign loans that end up being stolen by government officials in the current dispensation.

Onwubiko heads the Human Rights Writers Association of Nigeria (HURIWA) and blogs @ www.huriwanigeria.com; www.emmanuelonwubiko.com.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment