In 2019, MTN Nigeria became the first of the big telecommunication players to list on the Nigerian Stock Exchange, setting the bar high for others planning to go public. Since listing in May 2019, MTN share price has at least doubled, trading at over N191 in November 2021, from N90 on the day it went live two years earlier.

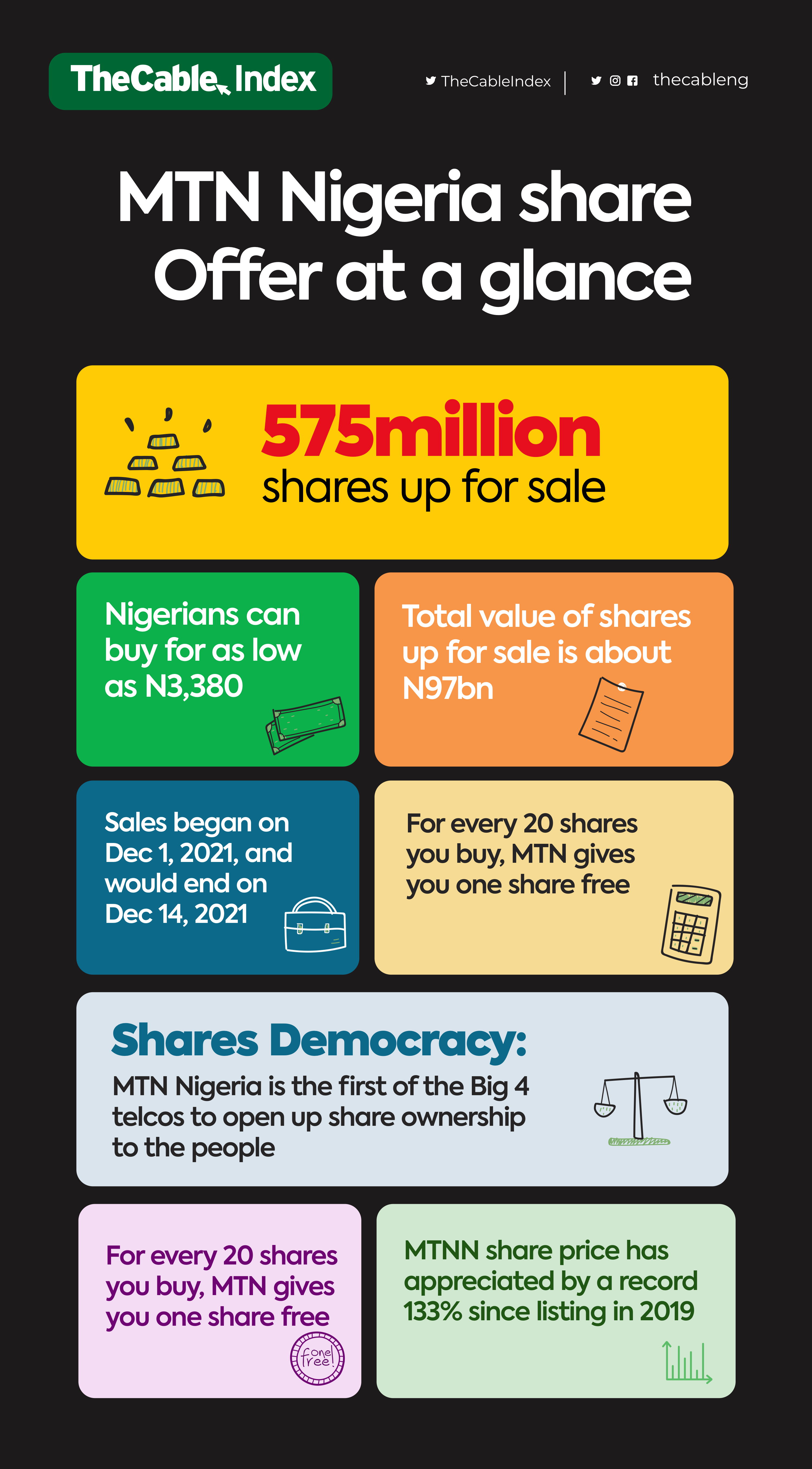

In the course of the last 52 weeks, MTN Nigeria shares went as high as 209.9 per unit, posting a 133 percent increase in share since it got listed, beating both inflation and naira devaluation by a mile.

MTN is used to many firsts in Nigeria — also in 2019, it became the first telco to test 5G network in Nigeria, and in a few months would be deploying the same in major cities across Nigeria.

Beyond its many first, MTN’s latest first has the potential to change the stock market in Nigeria. From December 1 to December 14, MTN will be trading its shares to every Nigerian interested.

Advertisement

MTN is generally regarded as the second most valuable company in Nigeria, only behind Dangote Cement. Of the entire MTN Nigeria share, approximately 79 percent is held by MTN Group.

However, the group is currently letting go of 14 percent of its holding to as many Nigerians who are interested — making it the biggest member of the bourse to make such an offer. As Karl Toriola, MTN Nigeria CEO, said repeatedly, MTN Nigeria is not in need of quick funds, hence, the share offer is not a fundraiser to support MTN’s bottomline.

According to Toriola, the share offer is to get more Nigerians on board at MTN.

Advertisement

“This is a Naija company, proud to be Naija, and we want it to be even more Naija, so that every Nigerian that is eligible can own a share,” he said at a roadshow.

His words have been proven, as we confirmed that any Nigerian with a bank verification number (BVN) can buy MTN shares, and for as low as N3,380 on a mobile phone. TheCable explained how this can be done here.

HOW MTNN COULD CHANGE THE MARKET

In May 2019, just after MTN Nigeria (MTNN) was listed on the Nigeria Stock Exchange (NSE), which has now become the Nigerian Exchange Group (NGX), the bourse automatically added over N1.8 trillion, which was the valuation of MTN at the time.

Advertisement

This marked one of the biggest leaps forward for the stock market in Nigeria in over a decade. MTN share price has doubled in about two years since then.

The implication of this is that MTN Nigeria in the space of two years added as high as another N1.8 trillion to the market, pushing the Nigerian bourse a lot further on the global scene and across the continent.

As a testament to this influence, Bloomberg named Nigeria the best performing stock exchange in the world, posting a 50 percent gain at the end of 2020. The Lagos bourse closed with the highest points since December 2007, beating 92 other stock exchanges around the world.

However, MTN is taking that influence forward by democratising access to premium shares on the Nigerian exchange. The use of a publicly available application — native to millennials and Gen Z — means more young Nigerians, who were previously averse to local shareholding are now coming into the market.

Advertisement

Compared to its peers, the NGX has a long way to go. For instance, Johannesburg Stock Exchange (JSE) is valued at over $1 trillion as of November 2021. NGX on the other hand has a market cap of less than $100 billion, leaving Nigeria with a large room for growth.

According to a Credit Suisse report, since the start of 2020, retail trading as a share of global market activity has nearly doubled to over 30 percent. This means a lot more retail trading is deepening financial activities across global markets. For Nigeria, a lot of that retail trading has gone into cryptocurrency trading and foreign stock purchases.

Advertisement

As Wall Street Journal reported, Nigerians using the Binance cryptocurrency app, are about 11 million. This is an immense market of tech-savvy Nigerians, who have the capacity to invest anywhere they are sure to make a profit.

MTN’s use of the Chapel Hill Denham PrimaryOffer app means more retail investment can flow into the market, increasing trade volume. If 10 percent of this number gets into the local stock market, that could translate to billions of dollars for the Nigeria exchange in the medium to long term. This is the change MTN is igniting with this public offer.

Advertisement

According to the NGX, MTN Nigeria is the “first fully digital public offer in the Nigerian capital market”. This means many more big and small players within the Nigerian capital markets can tap into the same model and allow more Nigerians, especially younger Nigerians get into the market.

With many more businesses following in MTN steps, Nigeria could reduce the gap between its stock market and its peers across the globe.

Advertisement

Add a comment