The Federal Inland Revenue Service (FIRS) said it generated N6.4 trillion revenue in 2021, representing over a hundred percent of its collection target.

Was this the true value of its collection in 2021?

In a report released titled “FIRS 2021 Performance Update,” the agency said the total revenue of N6.405 trillion in both oil (N2.008 trillion) and non-oil (N4.396 trillion) revenues surpassed its target of N6.401 trillion for the year.

“Upon the coming into office of the current management, the Federal Inland Revenue Service (FIRS) began strategic administrative and operational reforms; and the implementation of new policies that would improve its capacity towards the fulfilment of its mandate,” a statement from FIRS quoted Muhammad Nami, its chairman, as saying.

Advertisement

“The deployment of a new automated tax administration system, the “TaxPro Max” in June 2021 was a game-changer.

“With the solution, taxpayers experienced the ease of registration, reporting, payment and issuance of Tax Clearance Certificates while the Service experienced greater efficiency in the deployment of resources thereby leading to improved revenue collection.”

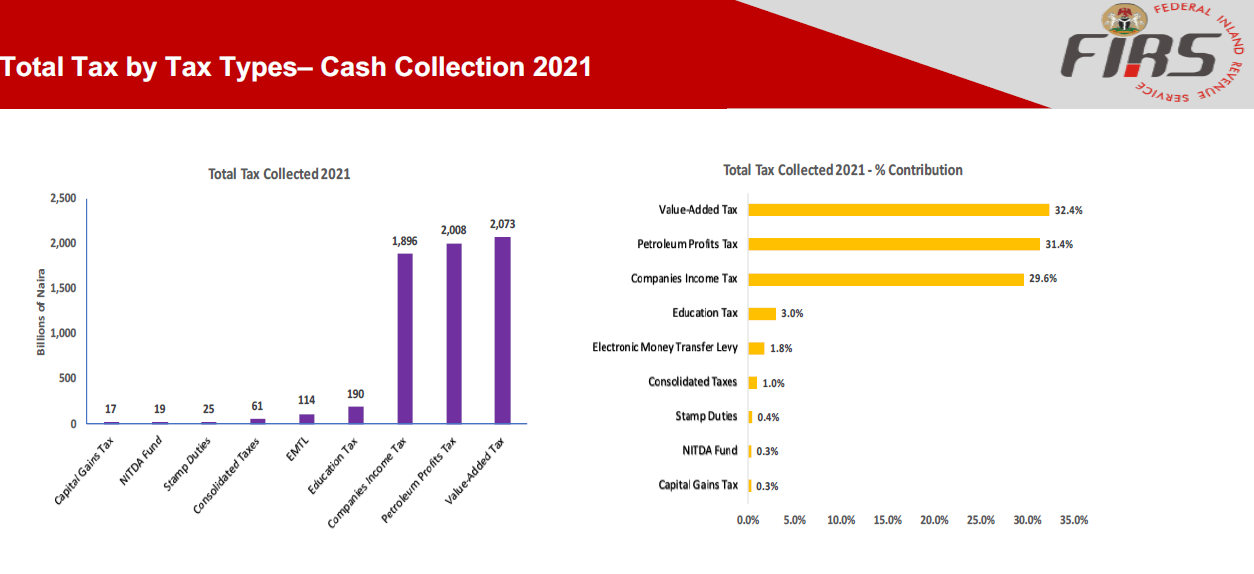

In the report, FIRS said it collected N1.896 trillion as companies income tax, petroleum profit tax (N2.008 trillion) and value-added tax (VAT) at N2.07 trillion in 2021.

Advertisement

The report added that the agency raked in N114 billion from electronic money transfer levy and earmarked taxes amounted to N208.8 billion.

“Non-oil sector contributed 69 percent of the total collection in the year, while oil sector’s contribution was 31 percent of the total collection,” the report added.

“The Service issued certificates for the sum of N147.8 billion tax credit to private investors and NNPC for road infrastructure under the Road Infrastructure Development Refurbishment Investment Tax Credit Scheme created by Executive Order No. 007 of 2019.”

With the figures, the agency arrived at N6.4 trillion for the year, supposedly surpassing its last record at N5.3 trillion in 2019.

Advertisement

ARE THESE FIGURES CORRECT?

Checks by TheCable showed that the figures stated in the report are correct except the input for petroleum profit tax (PPT) fixed at N2.008 trillion for the year.

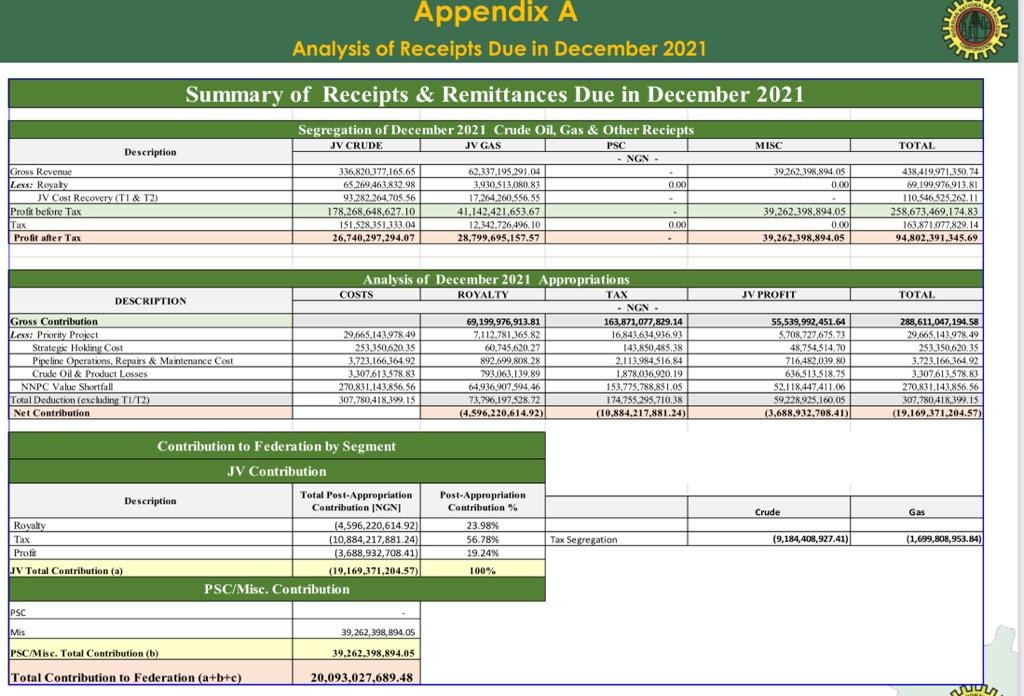

Data from the federation accounts allocation committee (FAAC) showed that FIRS declared N1.2 trillion as PPT in 2021 instead of N2 trillion, as stated in its report. This shows a discrepancy of N800 billion in the FIRS’ data.

By implication, this means that FIRS only collected a total of N5.6 trillion as revenue instead of N6.4 trillion.

Advertisement

WHAT IS FIRS POSITION

An official at FIRS confirmed that FAAC received N1.2 trillion as revenue generated from the total PPT for the year. The agency, however, said the sum is not the total PPT the federation received for the year.

Advertisement

“Recall that the NEC had approved certain expenditures to be incurred by the NNPC from the PPT, among others — the totalling of the sum of those expenditures should give you the balance that amounts to a total of 2 trillion received for the FG in the year under review,” the official said.

In this instance, FIRS said the questionable N800 billion was used by the Nigerian National Petroleum Company (NNPC) Limited for some expenditures approved by the national economic council (NEC).

Advertisement

With this clarification, it means the N800 billion was not captured in FAAC report as revenue that hit the ‘account’ of FIRS.

Based on details of the FAAC, N800 billion was not added to FIRS’ total collection in 2021 — and the agency may not be able to sum up fund that did not hit as part of its revenue for last year.

Advertisement

FURTHER CLARIFICATION FROM FIRS

Johannes Oluwatobi Wojuola, special assistant on media and communication to the chairman of FIRS, said the agency acts as revenue collection for the federal government and the funds are remitted into the federation (sub) accounts maintained in the central bank.

“First, and critically, the FIRS does not have a so-called account: The FIRS collects revenue into the Federation (sub-)Accounts maintained in the CBN,” he said.

“There is no account that taxpayers put their moneys to called “FIRS Account”.

“Flowing from this, the FIRS, collects revenue that is paid into the Federation (sub-) Accounts; how these funds are drawn by the government, and expended is not within the statutory powers of the FIRS To dictate.

“So where N2.008 trillion was received by the Service as PPT — both cash, as disbursed at FAAC, or non cash as expended by the Government, it is the amount collected as Revenue—moneys received by the Federal Government.”

Editor’s Note: This story has been updated to reflect the official position of the FIRS and clarity on the N800 billion that was not included in the FAAC report for FIRS.

Add a comment