The Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) has attributed the recent hike in the pump price of petrol to the difficulty in landing the premium motor spirit (PMS).

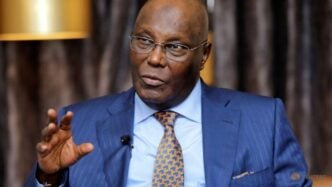

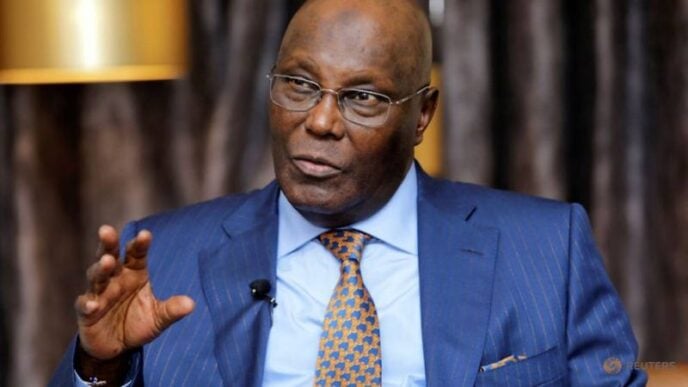

Billy Gillis-Harry, PETROAN president, spoke during an interview on Channels Television’s ‘Morning Brief’ programme on Thursday.

“What I can tell you is once there is difficulty in landing products by NNPC and the size of shock absorbing that they can do becomes overwhelming, they will certainly shed some of the loads,” he said.

“I think that’s what would have happened.”

Advertisement

Gillis-Harry said the Nigerian National Petroleum Company (NNPC) Limited has acknowledged its significant debts, adding that these financial obligations must be addressed through some business decisions.

The PETROAN president said other factors in landing petroleum products must also be considered, such as the costs involved in transporting products from various depots to retail outlets and the additional charges that arise without clearly defined regulations.

“Don’t forget NNPC came out to say we are owing and the size of debt is humongous and that has to be paid with some method of business decisions,” he said.

Advertisement

“You could land products at that N998, what happens to the inward movement of products to the various depots and what happens to cost of logistics from those depots to the retailer outlets and the few other charges that keep coming up without any clearly defined rules. These things must always be considered whether it is NNPC or not.

“The only thing I want to hold NNPC responsible for is to ensure that we have enough petrol, enough diesel to guarantee our energy resource to make Nigerians active and contribute to the growth of our economy.”

On Wednesday, the NNPC increased the price of petrol across its retail outlets.

In Lagos, petrol prices jumped to N998 per litre while in Abuja, the price rose to N1,003.

Advertisement

The price development comes weeks after the NNPC commenced petrol lifting at the Dangote Petroleum Refinery’s gantry after an extended period of price negotiations.

On September 15, the NNPC said petrol was bought from Dangote refinery at N898 per litre.

The Dangote refinery countered NNPC’s claim, describing it as “both misleading and mischievous”.

A day after, the national oil company announced estimated pump prices based on prices set by the Dangote refinery for its petroleum products, saying petrol will sell for N950 in Lagos and N999 in Abuja.

Advertisement

‘SUPPLY AND DEMAND DETERMINE PRICES’

Gillis-Harry said the petrol prices are largely driven by market forces, particularly the dynamics of supply and demand.

Advertisement

He stressed that the exchange rate between the naira and the dollar plays a major role in the cost of petroleum products, as Nigeria operates a “dollarised” petrol business.

“The truth right now is that petrol prices are going to be determined by the forces of demand and supply,” he said.

Advertisement

“This does not mean that the prices will always be high. We must remember that our dollar exchange value is going to impact very highly on the cost of PMS because we are operating a dollarised business in naira.”

‘DANGOTE REFINERY COULD ALLEVIATE PETROL PRICE PRESSURE’

Advertisement

Despite the current price increases, Gillis-Harry expressed optimism about the role the Dangote refinery as well as other refineries in Nigeria could play in alleviating the pressure on petrol prices.

“The Dangote refinery should come to the rescue, as well as other refineries in Nigeria,” he said.

Gillis-Harry added that PETROAN is hoping to engage in formal and clear business discussions with the Dangote refinery to explore potential benefits for the industry.

Add a comment