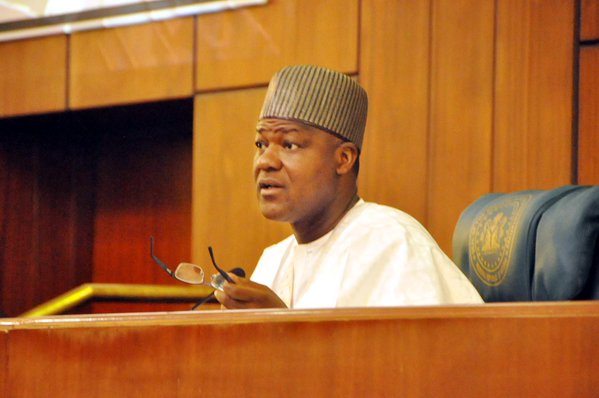

Yakubu Dogara, speaker of the house of representatives, says the Central Bank of Nigeria (CBN) cannot subvert the laws of the land under the pretext of promoting “sound financial system”.

Speaking at the public hearing organised by the house committee on commerce on ‘A Bill for an Act to Provide For

Secured Transactions’, Dogara said the CBN made regulations for a collateral register, which may have overreached its powers.

Speaking on the secured transaction bill, Dogara said: “The bill, if passed into law, will align Nigeria’s secured transactions regime with international best practices since the existence of a modern collateral registry for movables is one of the indices indicated for better doing business ranking.

“It is however important to point out that the Central Bank of Nigeria in September 2014 issued the COLLATERAL REGISTRY REGULATIONS, 2014. The CBN founded its authority for making the Regulations on Section 1 (2) of the Central Bank of Nigeria Act No. 7 of 2007 which details the principal objectives of the Bank and The Banks and Other Financial Institutions Act, Cap B3 – LFN 2004 (BOFIA) (as amended).

Advertisement

“It claimed that S.57 of the BOFIA authorizes the Governor of the Central Bank of Nigeria to ‘make regulations to give full effect to the objects and objectives of the Act’ as well as those for the operation and control of all institutions under the supervision of the Central Bank.

“In May 2016, the Central Bank of Nigeria launched a modern online Collateral Registry with the support of the World Bank. The registry allows low-income people and small-scale entrepreneurs to secure loans against movable assets such as machinery, livestock, and inventory.”

Dogara said the 2014 regulations, according to the CBN, were intended to “provide a regulatory framework for accessing credit secured with movable property, creation and perfection of security interests, and realization of security interests in movables”.

Advertisement

“The main challenge however which the Committee should examine critically with its legal consultants is to determine the need for legislation in this area when the Central Bank of Nigeria seems to have covered the field by way of the 2014 Regulation.

“The CBN has also established the Registry online as already indicated above. Most of the provisions sought to be enacted in the Bill are already operational by way of CBN Regulations.

“The real possibility of conflict exists if the CBN Regulations and the current Bill, if passed, are allowed to exist side by side. The Committee needs to determine whether the CBN overreached itself in proceeding by way of Regulations instead of by legislation on this subject.

He questioned CBN’s capacity to do all it did as regards the registry.

Advertisement

“Is the CBN authorized to introduce all manner of laws under the broad pretext of promoting ‘a sound financial system’ in Nigeria and giving effect to the ‘objects and objectives’ of BOFIA? Is the CBN a legislative body or merely a regulatory body in the financial sector?

“We need to examine these issues constructively in such a manner that will ensure fidelity to law and ease of operations in the financial system.”

He said no matter how difficult the legislative process may be, “it does not give any agency of government the authority to subvert the law by proceeding to legislate directly by questionable and unauthorized Regulations that go way beyond the enabling laws”.

Advertisement

Add a comment