Dollar bullish investors stole the show during trading on Monday with the Dollar Index surging to eleven-month highs at 100.00 as expectations intensified over the Federal Reserve raising US interest rates in December.

The Dollar’s appreciation was complimented with optimism towards Trump’s administration bolstering spending and reviving inflation, a move seen as supporting economic growth in the States.

With recent comments from Vice Chair Fischer, Lacker and Williams adding to the hawkish chorus of Fed officials signaling a December rate hike, the Dollar could be a buyers dream moving forward. Sentiment is heavily bullish towards the Greenback and the 81% probability of a rate hike before year-end could keep the currency buoyed. Much attention may be directed towards Tuesday’s retail sales figures which if exceeds expectations may add to the pool of economic data that continue to display signs of economic stability in the States.

The Dollar Index is bullish on the daily timeframe as prices are trading above the daily 20 SMA while the MACD has crossed to the upside. A decisive breakout and daily close above 100.00 could open the doors towards 100.50 and potentially higher.

Advertisement

Japan’s Q3 GDP a pleasant surprise

Optimism towards Japan’s economic recovery received a boost during early trading on Monday following the nation’s impressive third quarter GDP figure of 0.5% which quelled some fears over faltering economic growth. The unexpected expansion eased anxieties over the ineffectiveness of Abenomics while also providing some support to Japanese Prime minister Shinzo Abe as he faces a potential economic repercussion from the shocking U.S presidential victory.

With Japan’s third quarter economic growth heavily driven by exports rather than consumption, concerns still remain elevated over the sustainability of the current recovery. It should be kept in mind that consumption in the world’s third-largest economy remains weak while fears of Donald Trump’s protectionist views on trade have kept Japanese government officials on edge. The overall outlook for Japan continues to look fragile with risk aversion amid the ongoing uncertainty pressuring the nation further as the Yen appreciates.

Advertisement

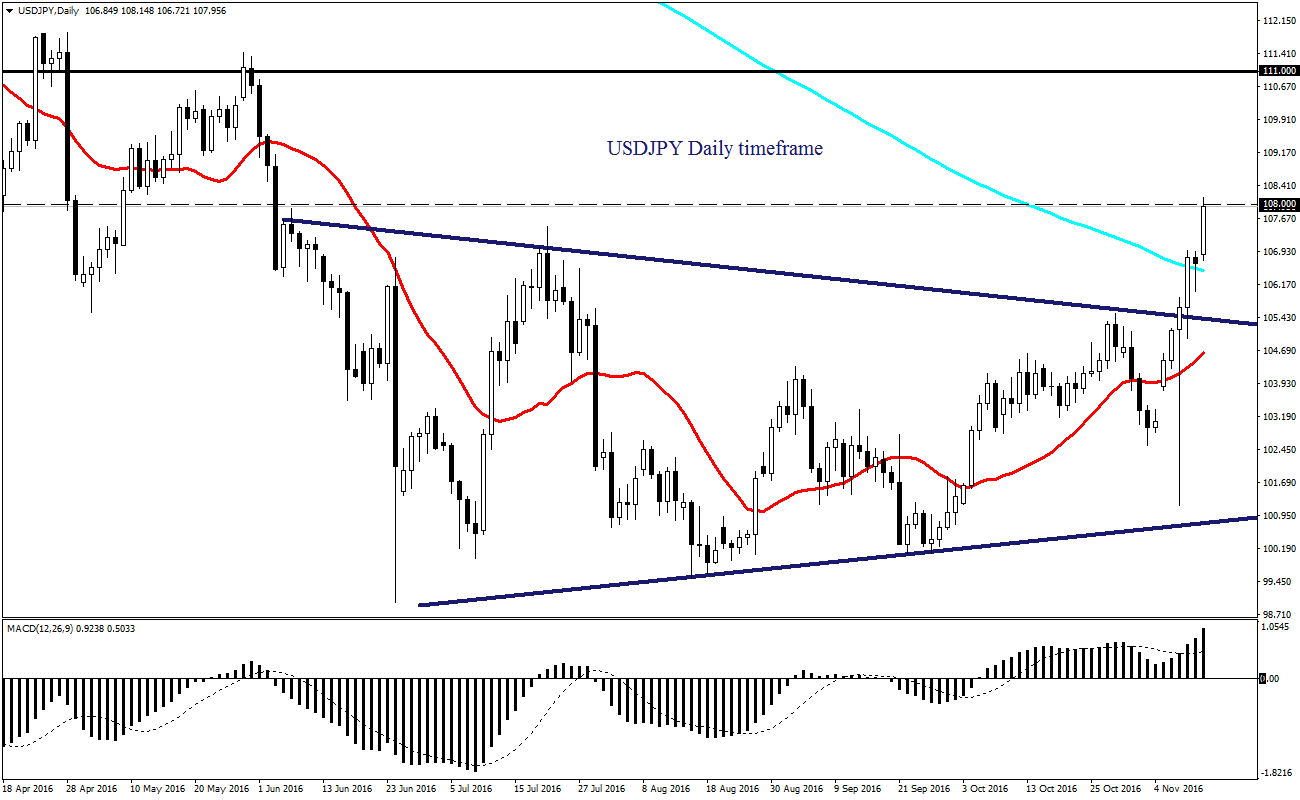

The USDJPY is heavily bullish on the Daily timeframe as the combination of Dollars strength and temporary Yen weakness amid the risk-on trading environment encourages bullish investors to attack. Prices are trading above the daily 20 SMA while the MACD has also crossed to the upside. A breakout above 108.00 could trigger a further incline towards 111.00.

WTI bears on the offense

WTI oil was shaky on Monday as the heightened fears over the persistent oversupply of oil in the global markets haunted investor attraction. Recent reports of Iran pumping incessantly in a self-fulfilling quest to reclaiming lost market share continues to attract sellers while optimism has faded over November’s pending OPEC meeting concluding with an effective freeze deal. The Dollar resurgence amid rising US rate hike expectations simply pressured oil prices further with concerns that demand may be waning from slowing global growth capping oils upside gains. The bearish combination of Dollar strength, oversupply concerns, and fears of slowing demand have made WTI Oil fundamental bearish. Steeper depreciations could be expected in the medium term once bears conquer the $43 support.

Advertisement

Currency spotlight – EURUSD

The EURUSD commenced the week under tremendous pressure with prices cutting below 1.0800 as a resurgent Dollar enticed bears to install heavy rounds of selling. Donald Trump’s shock victory swiftly sparked speculations of the European Central Bank extending its QE program at December’s meeting, consequently leaving the Euro vulnerable to losses. The mixture of Euro weakness and Dollar strength has made this pair attractive to sellers with further declines expected as expectations heighten over the Fed raising US rates before year end. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has also crossed to the downside. Previous support around 1.0800 could transform into a dynamic resistance which may open a path lower towards 1.0600.

Add a comment