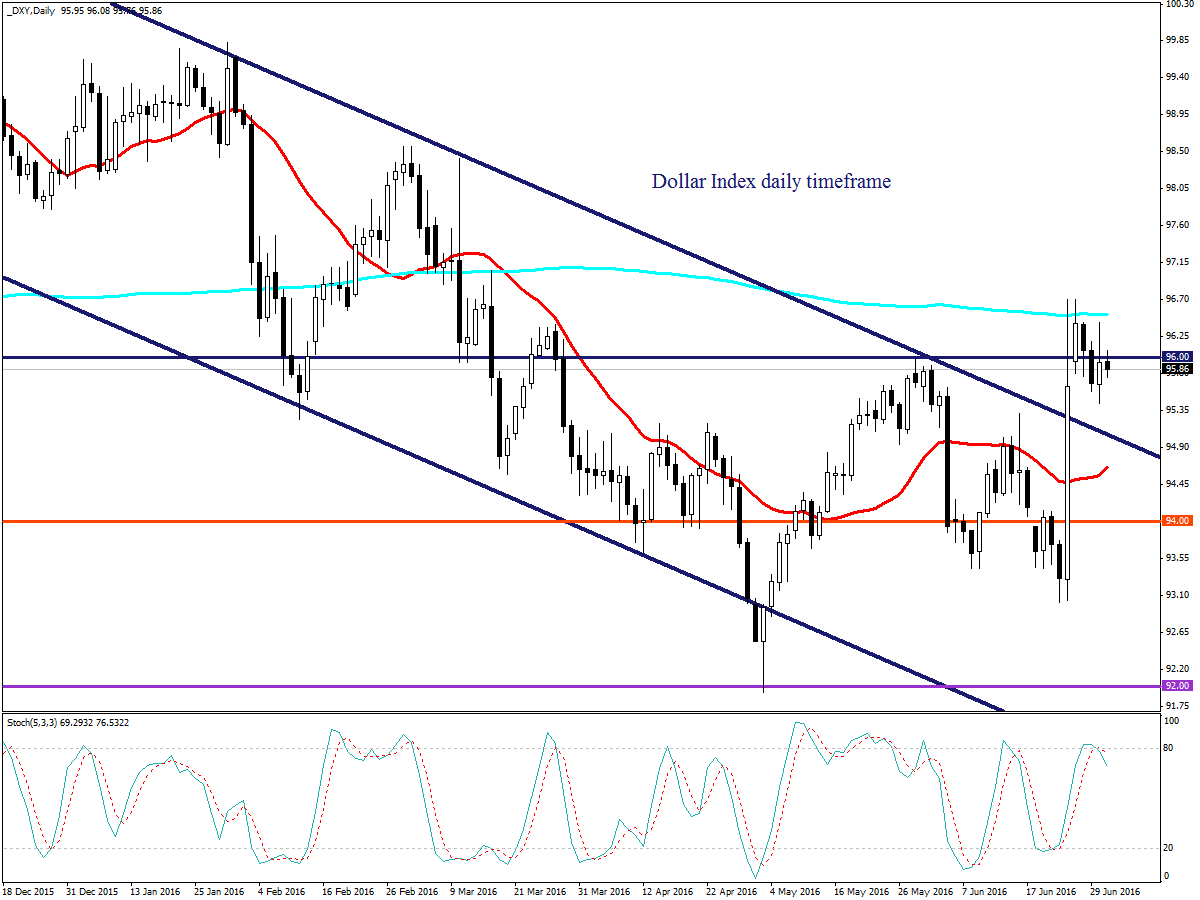

Dollar bears were on the offensive during trading on Friday as the lingering Brexit anxieties heightened concerns over the Federal Reserve failing to raise US rates in 2016.

US rate hike expectations have periodically declined, with the unexpected Brexit victory making it increasingly difficult for the central bank to take action. Although US data has displayed signs of improvement in the coming months, the persistent post Brexit uncertainty and ongoing concerns over the global economy could keep the Fed on standby.

The Dollar may be vulnerable, and with speculations already spiraling over a potential US rate cut amid the global instability, bears may exploit this opportunity to send the Dollar Index lower. US Manufacturing has displayed signs of stability and if today’s ISM exceeds expectations then bulls could be offered a slight breath of fresh air. It should be kept in mind the growing US rate hike hopes were one of the key factors that propelled the Dollar, and with this now almost reversed to a rate cut, the Dollar could be poised for a steep decline.

The Dollar Index Bull Run could be exhausted below 96.50. A solid weekly close below 96.0 could pave a path towards 94.00 and potentially lower.

Advertisement

WTI Oil cuts below $49

WTI Oil cut below $48 during trading on Friday amid the continued uncertainty over the impacts a Brexit would have on the global economy. Concerns remain elevated of a potential Brexit fueled recession which could have a negative impact on global demand while the oversupply woes have returned following the slow stabilization in global production. The over-extended correction may be running out of steam with prices set to decline lower when the lingering supply fears haunt investor attraction. From a technical standpoint, a solid weekly close below $48 could open a clean path back below $46.

Advertisement

Gold eyes $1350

Gold bulls maintained dominance on Friday as the combination of ongoing concerns over the global economy and risk aversion attracted investors to safe-haven assets. This yellow metal remains heavily bullish and could appreciate further as the Brexit anxieties trigger concerns over the Federal Reserve failing to raise US rates in 2016. With the Dollar potentially weakening from the fading US rate hike hopes, Gold could be propelled to fresh highs stretching towards $1350. From a technical standpoint, Gold bulls have already taken advantage of the $1308 support with the next target stretching towards $1350.

Advertisement

Add a comment