The Dollar has drifted lower against a basket of major currencies, ahead of the Federal Reserve decision later today, which is largely expected to conclude with an unchanged monetary policy.

With it being considered aprevious conclusionthat US interest rates will be left unchanged in September, much attention will likely be directed towards the Fed’s forward guidance, for clues on future monetary policy. While the central bank is also expected to announce the unwinding of its mammoth balance sheet today, the real action will be in the Fed’s economic projections and Yellen’s Press Conference. With concerns over low inflation in the U.S raising questions over when the next rate hike will come, it will be interesting to hear Yellen’s thoughts on this topic. This could be a very lively session for the Dollar, especially when considering how the FOMC will be updating its economic projections and providing its forecast for growth, inflation and interest rates.

Dollar bulls could be offered a rare opportunity to bounce back, if Yellen adopts a hawkish tone during her press conference. A situation where the Fed is cautious and expresses concern over low inflation, is likely to weigh on rate hike expectations, consequently punishing the Dollar.

The Dollar Index remains bearish on the daily charts, with sustained weakness below 91.50, encouraging a further decline towards 91.00.

Advertisement

Commodity spotlight – WTI

WTI Crude found comfort above $50 on Wednesday, after Iraq’s Oil Minister said OPEC and other oil producers were considering extending or even deepening supply cuts, to rebalance the markets.

As the OPEC meeting looms, an extension of the current production deal beyond March is a possibility, especially when considering how OPEC’s crude oil production fell last month, for the first time since April. With oil prices steadily appreciating, as investors become increasingly optimistic over OPEC’s effort to stabilize the saturated markets, the cartel should be encouraged to extend the current deal, which may fuel the upside.

Advertisement

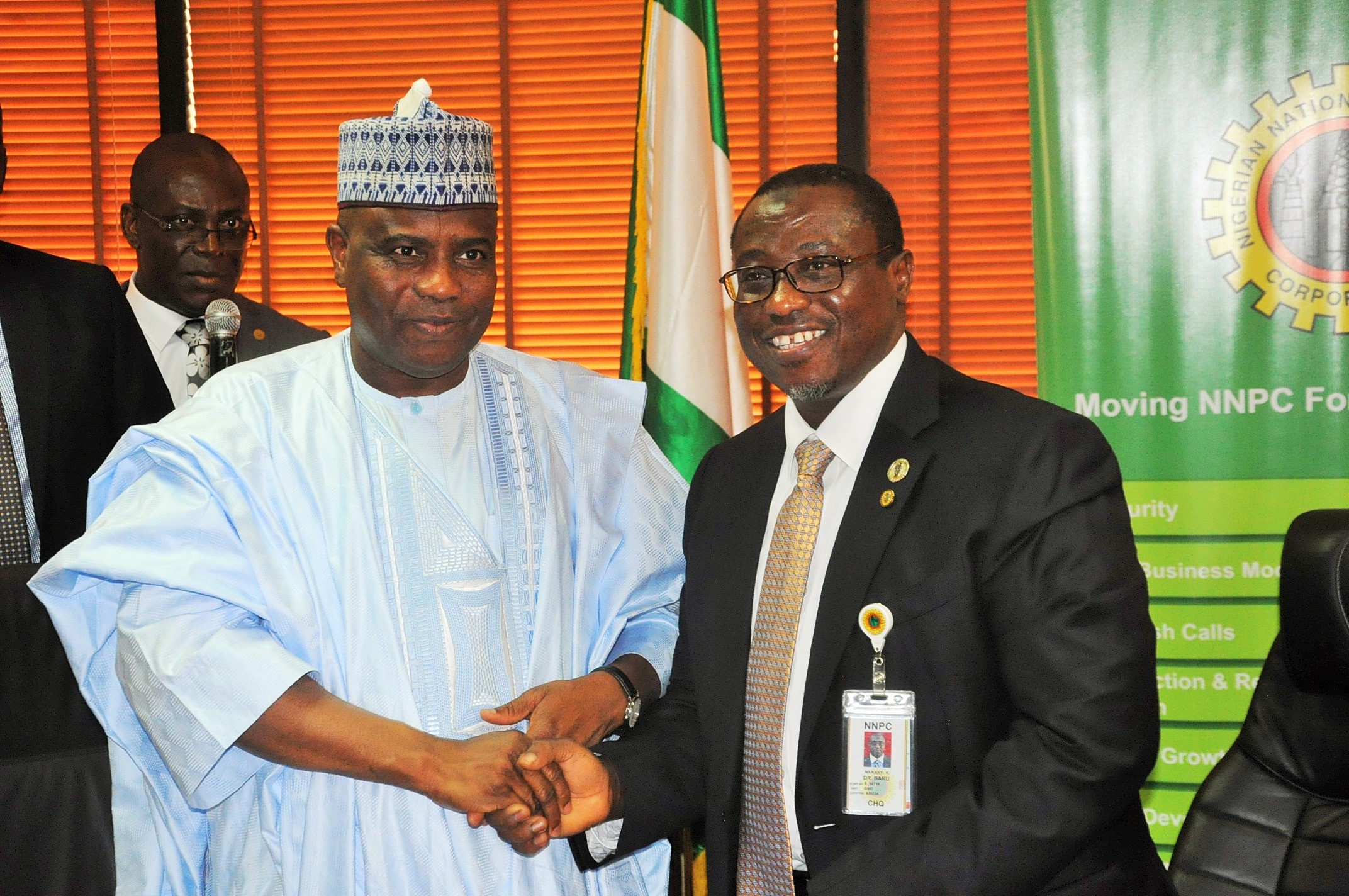

Nigeria and Libya are likely to be in the spotlight during Friday’s OPEC meeting, with discussions centered on the progress of their deal to limit output. With both countries currently exempt from the OPEC led deal to cut production, it will be interesting to see if the two nations agree to limit their output and how this will impact oil prices.

Technical traders will continue to observe how WTI Crude behaves above $50. A solid daily close above this level should encourage a further appreciation towards $51.50.

Add a comment