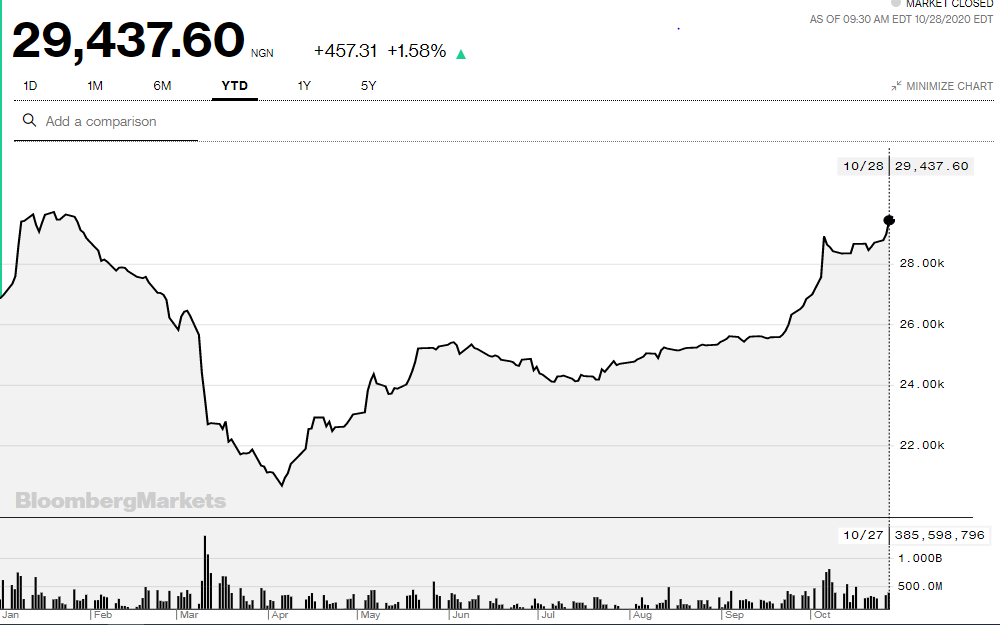

The Nigerian stock market started year 2020 on a good note, jumping 10.69 percent in the first three weeks, to emerge as the global best performer.

Issues such as lack of clarity in Nigeria’s exchange rate windows, and biting dollar scarcity, dragged the performance of the equities market during the year.

The Nigerian Stock Exchange (NSE) has gained 41.17 per cent year-to-date as at December 22 — on track to outperform 42.3 percent recorded in full year 2017.

Notwithstanding these challenges, the stock market capitalisation opened at N12.97 trillion in January 2020, and rallied to a record high of N20.28 trillion at the close of trading on December 22, 2020.

Advertisement

This means that investors booked N7.31 trillion in gains, despite the headwinds that battered major financial markets during the year.

This year’s performance makes it one of the best performing stock markets in the world, contrasting sharply with the 2019 performance when the market closed on a negative note at 14 percent.

The early rally in January rode on the back of higher oil prices and crashing rates on Treasury Bills. Oil prices opened higher in January following Iran’s strikes on United States-Iraq bases.

Advertisement

Source: Bloomberg Terminal

As the reality of the COVID-19 pandemic hit the crude oil market from late February, and was exacerbated by a breakdown of the agreement between Saudi Arabia and Russia in March, the Nigerian stock market joined the rest of the world in a global financial market crash, tumbling more than 20 percent by the end of the first quarter (Q1-2020).

The spread of the coronavirus across the world triggered unanticipated global financial market volatility, and Nigeria was not left out. Foreign Portfolio Investors (FPIs) and local investors flew to safety amid the collapse in oil prices and currency adjustments.

Advertisement

With Brent price falling to a low of $19.3 per barrel, this weakened the naira and Nigeria’s fiscal buffers substantially. As a result, sentiment towards the equities weakened to record level, with the NSE ASI touching a low of 20,669.4 pts.

In addition to the decline in oil prices, the period was also associated with lockdown and restrictions in Nigeria, as well as globally, hampering the operations of multiple sectors.

However, after tumbling by over 20.0% in March 2020, the stock market recovered by more than half the initial downturn in the month of May amid increased demand by local investors.

The recovery was driven by the rebalancing in the oil market after OPEC+ members implemented output cut; increasing indications that governments around the world would reopen their economies regardless of the anxiety around COVID-19; cheap market valuation of high-quality stocks; attractive dividend yield and sizable market liquidity.

Advertisement

Source: Bloomberg.

Advertisement

The rally was also supported by the dovish stand of the Central Bank of Nigeria (CBN). The apex bank cut the base monetary policy rate by 200 basis points to 11. 5 percent, in order to boost lending, discourage savings and drive growth to counter the pandemic effect on the economy, while also keeping rates low in the fixed income market.

In terms of market participation, the year was primarily dominated by domestic players, as excess liquidity (created by CBN’s OMO restriction), the hunt for double-digit yields and depressed pricing, rekindled local interests.

Advertisement

Source: NSE

Advertisement

The year also saw the adoption of virtual closing of closing bell, fact behind the figures by companies and other activities on the stock exchange following COVID-19 pandemic.

Some stocks that have rewarded investors with impressive returns year-to-date are Airtel Africa (184.98%); Livestock Feeds (150%); Dangote Cement (72.94%); MTNN (52.38%); BUA Cement (46.34%); Zenith Bank (31.72 %), among others.

Add a comment