The Central Bank of Nigeria (CBN) has since the last quarter of the last fiscal year been doing its best at managing the crisis in the foreign currency market following the near-collapse of the Nigerian economy occasioned by the fall in the price of crude oil, and dark clouds on the 2015 presidential election. It was indeed a gloomy period for the nation’s economy losing half the value of its earnings from its priced crude oil and managing the lack of confidence by institutional investors in the market on the back of the keenly-contested national elections.

As of the third quarter of the year 2014, Nigeria’s external reserve, according to the CBN, stood at US$38.29billion. It’s no news that crude oil exports accounts for over 90% of Nigeria foreign exchange (fx) earnings, thereby making the economy highly vulnerable to fluctuations in the oil market. Though, over the last five years to 2013, the crude oil price has averaged $100/bbl, it’s ‘understandable’ the laxity of the nation’s economic managers to foresee the slump despite early warnings by global players.

The reaction of the CBN to the ‘slump’ no doubt has been very calm, calculated and effective so far. It’s to their credit that the US$/naira market has been stable for some time now against the free fall experienced between September 2014 and January 2015 when it lost about 27% of its official value against the US$. Many analysts opine that the pressure on the naira during this period would not have been significant but for the fears on the likely outcome of the 2015 presidential election. The doomsayers had predicted the worst. It was indeed a scary situation.

Advertisement

In November 2014, the CBN issued a circular announcing the exclusion of some transactions from the RDAS window. The implication of this was that the importation of certain excluded items such as finished products, electronics, IT, generators, telecommunication equipments and invisible transactions would no longer be funded from the official market. This was considered the first major step of the CBN in managing the fx crisis beyond the dollar-sale intervention. The impact of this sudden change was in no small measure on the real sector, especially the pharmaceutical and manufacturing industries which had significant input materials among the excluded list.

The ambiguity on the definition of ‘finished’ products was not helpful as the CBN reserved the right to approve or otherwise, items deemed not ‘eligible’. The effect of this currency exchange exposure could not easily be passed to the consumers due to the already cash-crunch in the economy. And for those that had running contracts with huge import components, the options of contract re-negotiation, default or outright cancellation abound. The success of this policy change would then need to be measured vis-à-vis the impact on the real sector.

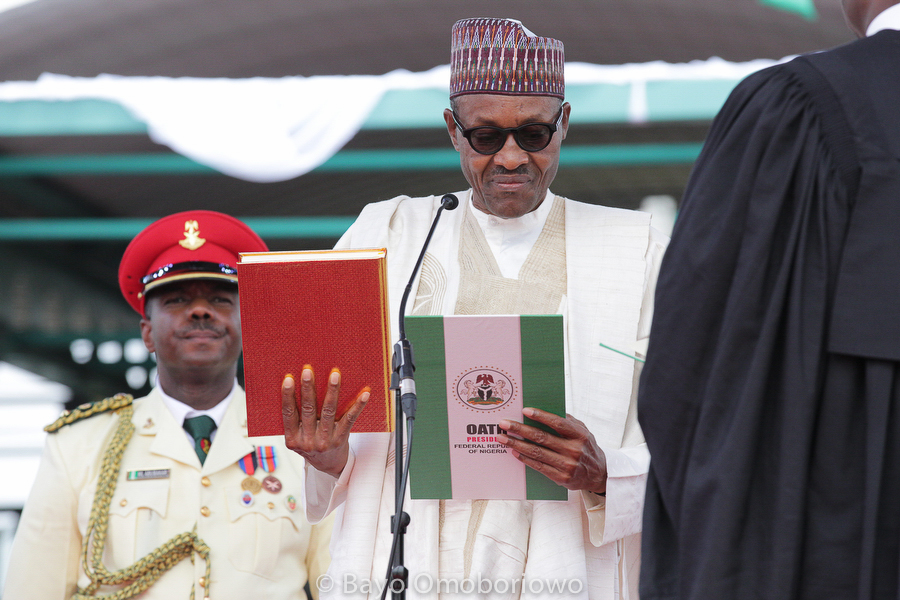

It’s noteworthy, however, to state that in the long run, the exclusion of those transactions should afford the local manufacturers an inward search for alternative locally available input materials; or witness a rise in new factories to support such requirements. It would be a win-win for the economy; only in the long run. The eventual closure of the RDAS window in Q1 2015 leaving only the Inter-bank window, was an un-official way of devaluing the naira. It was a tough but consistent policy from the CBN to sustain the survival race on the naira. Not a few analysts had commended the CBN for taking such a bold step at that time. The immediate attendant effect was the increase in the subsidy regime of the downstream petroleum sector as the importation of white products such as the PMS was hitherto based on the CBN official rate. The government therefore had an obligation to make up the fx differential. It is hoped that the question of ‘when’, not ‘if’, the subsidy regime would be completely phased out would be laid to rest by President Muhammadu Buhari.

Advertisement

The latest move by the CBN is the attempt at enforcing the provisions of the CBN Act of 2007 on currency substitution and dollarization of the economy. In its circular of April 17, 2015, the CBN reminded the Banks of the provisions of Section 15 of the CBN Act 2007 which states the unit of currency as the Naira and only legal tender for the payment of any amount. The CBN warned that it is illegal to price or denominate the cost of any product or service (visible or invisible) in any foreign currency in Nigeria. It thereby advised banks from the collection of foreign currencies for payment of domestic transactions on behalf of customers and the use of the customers’ domiciliary accounts for making payments for visible and invisible transactions.

As usual, there was panic in the system, especially among the big players in the Oil and Gas and Energy sector on the applicability of this directive in view of the near- total reliance of the Nigerian economy on imports. In order to avoid unnecessary penalties from the CBN, the Banks quickly informed their customers of the latest development and of course, several on-going and pending contracts were halted to appraise the latest ‘shock’. Thankfully, the CBN has issued subsequent circulars to clarify the ambiguity on the initial directive and make room for some certain transactions. There has also been a specific circular on the utilization of export proceeds by Oil and Gas Companies; while the latest being on May 21 2015 in favour of operators in certain sectors that are exempted from the ‘obnoxious’ rule of the 2007 Act.

Given that this step by the CBN was another highly calculated and commendable step in the right direction, however, care must be taken that the loss to the economy does not outweigh the perceived gains on the currency market. When two Nigerian Companies engage in transactions that include importation of equipment or service from offshore, there’s immediately an fx exposure. But the question is on which party, the customer or supplier? When the customer pays for the service or products supplied wholly in Naira, not minding the current balance on its domiciliary account, the onus is then on the supplier to source fx to meet its obligations to its foreign partner.

Either through the interbank or the unofficial market, the foreign partner gets paid. This then opens the doors for several options by the customer to get its job done with less hassles. One of such option is for the customer to have a direct contract with the foreign entity. And if or when this happens, the revenue on such product or service is completely taken offshore and government stands the risk of losing both direct and indirect taxes thereon. Where there is no indication of the foreign company having a permanent establishment in Nigeria, there will be no Company Income tax (CIT), WHT or VAT that would normally accrue to the Government if such services were contracted locally. A ripple effect of such scenario will impact on other macro-economic indices such as unemployment and reduction in National output.

Advertisement

According to the Economics Resource Centre of the South Western College, USA, advocates of the dollarisation policy often suggest that developing economies that replace their less stable domestic currency with the US$ experience a lower and more stable inflation rate. A lower and more stable inflation rate, in turn, is expected to lead to a higher level of investment and a faster rate of economic growth. This benefit is larger when the domestic monetary authorities have established a poor track record in maintaining a stable domestic money supply. On the other hand, dollarization can also make the domestic monetary authorities not to have control over the domestic money supply. The government of a dollarized economy will not be able to use discretionary monetary policy to deal with domestic macroeconomic problems.

For economies that are significantly dollarised, it is expected that commercial banks or the central bank need to hold a significant volume of international reserves, or to arrange external lines of credit to be able to withstand significant exchange rate adjustments, as well as possibly larger-than-normal swings in capital flows. With an external reserve that currently stands below US$30billion, the latest moves by the CBN are quite understandable, only that, sufficient consideration must be given to operators in very key and sensitive segments of the economy so that the benefits thereon can be fully maximized.

Orolu, a finance expert, is head of accounting, finance & controlling at Siemens Limited, Nigeria

Advertisement