Here are the seven top business stories you need to track this week — October 7 to October 11.

FG COMMENCES CRUDE OIL SALE IN NAIRA

The federal government says it has officially commenced the sale of crude oil and refined petroleum products in naira.

Wale Edun, minister of finance and coordinating minister of the economy, in a statement on Saturday, said the sale of the products in naira commenced on October 1, in line with the federal executive council (FEC) directive.

Advertisement

The development had followed FEC’s approval of a proposal by Tinubu directing the NNPC to sell crude oil to Dangote Petroleum Refinery and other refineries in naira.

On August 19, the federal government said the sale of crude oil to the Dangote refinery and other refineries in naira would commence on October 1.

CBN INTRODUCES ELECTRONIC FX MATCHING SYSTEM TO CURB SPECULATION

Advertisement

The Central Bank of Nigeria (CBN) has announced the introduction of an electronic foreign exchange (FX) matching system (EFEMS).

In a circular on October 3, Omolara Duke, CBN’s director of financial markets department, said the system is for FX transactions and would be implemented no later than December 1.

The CBN said there would be a 2-week test run in November.

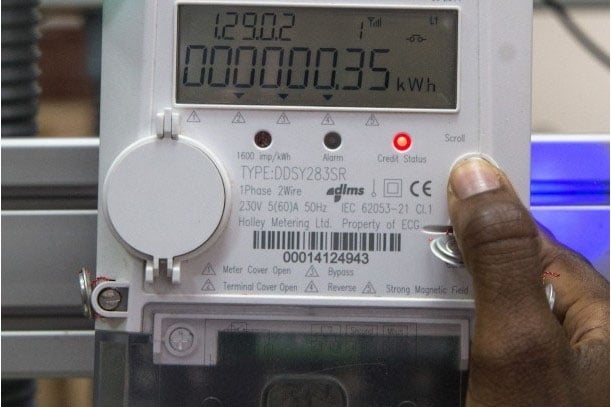

‘OVER 40% OF NIGERIANS NOW ENJOY 20 HOURS OF DAILY ELECTRICITY SUPPLY’

Advertisement

Adebayo Adelabu, minister of power, says more than 40 percent of Nigerian electricity consumers now enjoy over 20 hours of regular supply daily.

The milestone was disclosed during a review of the ministry’s achievements over the past year as part of the country’s Independence Day celebrations.

Adelabu attributed the progress to several “revolutionary measures” implemented with the support of President Bola Tinubu’s administration.

He said the ministry’s initiatives are aligned with the president’s ‘renewed hope’ agenda, which aims to enhance industrialisation through consistent power supply.

Advertisement

NIGERIA AGREES TO 1.5MBPD PRODUCTION QUOTA SET BY OPEC

Heineken Lokpobiri, the minister of state for petroleum resources (oil), says Nigeria will conform with the production quota set by the Organisation of Petroleum Exporting Countries (OPEC).

Advertisement

OPEC had, on June 2, extended Nigeria’s production quota of 1.5 million barrels of crude per day (bpd) to 2025.

The group said Nigeria should maintain the production level till December 31, 2025.

Advertisement

The oil cartel had increased Nigeria’s production level to 1.5 million bpd for 2024 at its ministerial meeting on November 30, 2023.

FG PUBLISHES NEW WITHHOLDING TAX REGULATIONS, TO TAKE EFFECT FROM JANUARY 2025

Advertisement

The federal government has officially published the gazetted withholding tax regulations.

Taiwo Oyedele, chairman of the presidential committee on fiscal policy and tax reforms, spoke in a post on X on October 2.

He said the commencement date of the new regulations is September 30, while implementation begins on January 1, 2025, to allow for a minimum of 90 days notice required for tax changes in line with the 2017 National Tax Policy.

TINUBU ASKS N’ASSEMBLY TO REPEAL FIRS

President Bola Tinubu has asked the national assembly to consider repealing the act that establishes the Federal Inland Revenue Service (FIRS) and replace it with the Nigeria Revenue Service (NRS).

Tinubu’s request was contained in letters read on the floor of the house of representatives and senate on October 3.

“The third bill is our (sic) respect of the Nigerian Revenue Service which seeks to repeal the Federal Inland Revenue Service Establishment Act number 13 of 2007 and establishes the Nigerian Revenue Service to assess, collect and account for revenue accruable to the government of the federation,” he said.

FG REMOVES VAT ON COOKING GAS, DIESEL, CNG

The federal government has introduced concessions aimed at revitalising the oil and gas industry to boost Nigeria’s upstream and downstream sectors.

Wale Edun, the minister of finance and coordinating minister of the economy, unveiled two major fiscal incentives on October 2.

The federal government recently announced the exemption of 63 items from value-added tax (VAT).

Add a comment