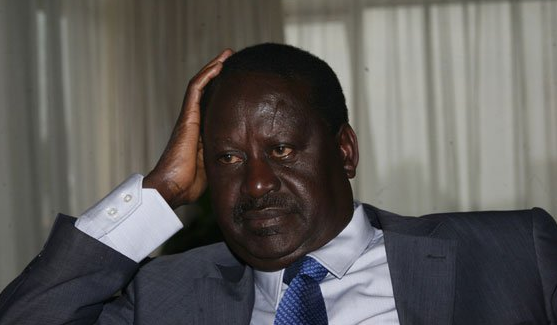

Anytime the Governor of Central Bank of Nigeria (CBN) retained benchmark interest rate at 14 per cent, and he has done it for many months, he received a mix of cheers and boos, some of them very harsh.

A popular economist who usually reviewed the decisions on television called the rates retention a “do-nothing” decision, which was taken by some people to mean cluelessness.

Opposition against Emefiele had, indeed, heightened in September last year to earn him the label of “stubborn Governor” when he ignored the advice of Finance Minister Kemi Adeosun to reduce monetary policy rates.

A day before the MPC meeting, Adeosun, apparently voicing the concern of manufacturers, urged the CBN to consider cutting the 14 per cent benchmark interest rate to support government’s stimulus plan to borrow cheap funds locally, and to bail out the economy.

Advertisement

For a man who was seen by some of his fierce critics as a wimp, Emefiele was expected by them to take the advice hook, line and sinker. They must have been disappointed. In a unanimous decision, MPC left the prevailing rates unchanged, signaling a lack of consensus in the government’s economic team on the best way to guide the economy out of recession.

The CBN governor said the MPC’s decision to ignore Adeosun’s proposal in favour of retaining the rates was informed by the bank’s resolve to continue to tighten liquidity in the monetary policy to limit the balance of risks weighing against one of its key functions of stabilising price.

“Both monetary and fiscal authorities have the same intention to achieve growth. But, the direction through which each wants to achieve it may differ, for as long as you still achieve the growth,” Emefiele had said.

Advertisement

But some people were not convinced. They saw it as an anticipatory defence mechanism for cluelessness.

“That is the stubbornness of a clueless man,” an economic commentator had said then. “The man is just stubborn. Don’t also forget the 41 items he has continued to restrict forex access to.”

In fact, some people had expected Emefiele to be fired after that time, forgetting that just as in good times; you don’t fire a central bank boss in times of general economic crisis if they didn’t cause it. Doing that sends out signals of hopelessness, causing loss of confidence, especially among investors.

Clueless or stubborn, Emefiele stayed on.

Advertisement

Managing interest rates and inflation requires delicate balancing because of their inverse, see-saw, relationship. In the United Sates, by moving interest rate targets up or down, the Federal Reserve attempts to achieve target employment rates, stable prices, and stable economic growth. It will raise interest rates to reduce inflation and ease (or decrease) rates to spur economic growth.

The “do-nothing” story was to change last September. With the economy out of recession and the rate of inflation dropping for the seventh consecutive month to 16.01 per cent in August, the comment of the highly respected economist was widely expected. “It is the same do-nothing decision, but it appears to be working,” he had confessed. The reward for focus and perseverance but there is more work to be done!

He acknowledged that at last month’s MPC meeting: “On the argument to hold, the Committee believes that the effects of fiscal policy actions towards stimulating the economy have begun to manifest as evident in the exit of the economy from the fifteen-month recession.

Although still fragile, the fragility of the growth makes it imperative to allow more time to make appropriate complementary policy decisions to strengthen the recovery.

Advertisement

Secondly, the most compelling argument for a hold was to achieve more clarity in the evolution of key macroeconomic indicators including budget implementation, economic recovery, exchange rate, inflation and employment generation.”

Subdued image?

Advertisement

Emefiele seems to be proving many people, including those who didn’t believe he was the right man for the job, wrong. Louder and more visible commendations for the CBN have come recently, but of course, his success will be judged ultimately by effects of his monetary policy on the health of the economy.

The current re-assuring image of Emefiele is a sharp contrast to the subdued version he took to Plot 33, Abubakar Tafawa Balewa Way, Abuja, on June 3, 2014 to start the plum job of Governor of the Central Bank of Nigeria.

Advertisement

Before the trip to Abuja, he served as chief executive officer and group managing director at Zenith Bank Plc, a very high profile job in one of Nigeria’s flagship private enterprise.

Despite the remarkable success of the bank, he served under the towering image of Jim Ovia, which somehow eclipsed Emefiele’s fine qualities. Ovia is the founder of the bank where he also worked as CEO until 2010, when he transferred into the chairman role.

Advertisement

In Abuja, where Emefiele replaced the current emir of Kano, Muhammadu Sanusi II (Sanusi Lamido Sanusi), he had walked into the shadows of another towering image of a bright and vocal economist and banker, who had left in controversial circumstances. And in a storm!

Emefiele is a relatively quiet person; this quality prompted oppositionists to hastily conclude that the Jonathan government had opted for a pliable governor, offered by his supporters. Although Emefiele had paid his dues, his handlers were quiet about it or in his characteristic reserved nature; he had chosen to focus on his work rather than flaunting his elite resume.

Who is Emefiele?

He is from Ika South Delta State, but a Lagos boy. He was born in Lagos, Nigeria’s commercial capital, where he began his primary school education at Government Primary School, Victoria Island, formerly Ansar-U-Deen Primary School, Igbosere, Lagos. He continued at Maryland Comprehensive Secondary School, Ikeja, Lagos. People raised in Lagos are noted for their street-smarts and so Emefiele couldn’t be a pushover. Observers say he is much tougher than he looks.

He proceeded to the University of Nigeria, Nsukka where he obtained his Bachelor of Science Finance & Banking (Second Class Upper). To that, he added an MBA as the best graduating student in Finance at the same university.

He went on to deepen his knowledge of Macroeconomics at Oxford University having obtained various qualifications and executive education studies in Negotiation, Strategy, Leadership, Critical Thinking, Delivering Value/Profit from Harvard University, Stanford University and University of Pennsylvania, Wharton Business School.

Before he became group managing director of Zenith Bank, he had served as the executive director in charge of Corporate Banking, Treasury, Financial Control and Strategic Planning of Zenith Bank Plc. The new Governor of the Central Bank of Nigeria has over eighteen years of banking experience.

He has some teaching experience as a lecturer at the University of Nigeria Nsukka, and University of Port Harcourt, respectively where he lectured Finance and Insurance before he finally decided to go full-time.

The CBN Governor

Emefiele, therefore, couldn’t have been a wrong choice for the top banking job, but barely a year after his appointment another storm made a landfall at the CBN headquarters. Questions were raised about the bank’s role in the movement of monies for the Goodluck Jonathan campaign. The storm has calmed down now, but while it raged Emefiele was calm, focusing rather on his work. He is said to be a workaholic.

Asked why he looked slightly emaciated at the recent IMF/World Bank meeting in the US, a source close to him explained jocularly: ”The Governor needs deliverance from two sources. One, the demon of work. Two, the demon of no rest. Your observation was correct.”

His family may be uncomfortable with those “demons of no rest” but although the economy is out of the intensive care Unit, it is still in the hospital and therefore in need of painstaking care.

Another Emefiele advantage is his devotion and patriotism, which he wears silently in his green ties. He wears no other colour these days. The source explained it more directly this time:”The green ties are a symbol of patriotism. It keys into his philosophy that the nation comes first and the welfare of the ordinary Nigerian should underpin public policy.”

The mix of all of those Emefiele qualities, including “stubbornness” is paying off now. As an immediate example, the restriction on 41 items has engendered domestic production and consumption reducing dependence on the imported items; employment generation improved domestic capacity and conservation of foreign exchange.

These achievements are better illustrated in Baton Nigeria, a company based in Ogun state, which commenced the production of toothpicks in August 2016 with 43 staff per shift to produce 60 million sticks of toothpicks per month.

It aims at producing about 4 billion per month by December 2018. This company’s toothpick is about 25 per cent cheaper than that of the main competitor.

Generally, the CBN’s forex policy has stabilized the exchange rate, even though the desired expectation has been to have one rate; increased forex liquidity; provided easy access to forex for capital and raw materials importation; availability of forex to MSMEs; ease of payment of tuition fees, medicals, BTA/PTA, etc; and boosting the capital market.

The effects of the policy show in the growth of many companies like Caverton, Dangote Cement, Chi Ltd, Nestle Nigeria and Larfarge Africa. Chi Ltd, which has between June 2015 and now created over 2,500 direct employments across Nigeria, more than twice the employment created in the 10 years before the policy.

Forbes Award

For his efforts, recognition came for Emefiele in the US during the last IMF/World Bank meeting where he was awarded the Forbes 2017 Best of Africa Innovative Banking Award.

President of Forbes Customs Emerging Markets, Mark Furlong, said the award was in recognition of Emefiele’s courage and determination in using monetary policy to ensure financial stability in Nigeria.

Furlong said the CBN under Emefiele had also shown transparency, which had helped to stabilise the economy through interventions in the real sector of the economy.

He cited the CBN’s Anchor Borrowers’ Programme, as a major boost to the development of the agricultural sector in Nigeria.

Before receiving the award, the CBN governor highlighted efforts since 2014 to stabilize the financial system and maintain the international value of the naira.

He attributed the award to the efforts of the CBN management and staff, the cooperation of government to check the negative impact of global shocks on the Nigeria economy between 2014 and 2016.

The monetary authorities, he noted were glad that its policies contributed in forcing inflation down from about 18 to 16 per cent, adding he was optimistic inflation would further be lowered with other policies in place.

On CBN policy to restrict access to foreign exchange from the Nigerian foreign exchange market to some 41 items, Emefiele said the decision was to stop the country’s foreign reserves due to huge import bills, among other things.

There are all manner of awards the world over, but the Forbes award is a reputable one; the same company that ranks the world’s richest people including Aliko Dangote, Mike Adenuga, and Folorunsho Alakija.

The Buhari “award”

However, for all his green ties, the commendation that may excite Emefiele most is the veiled one from President Muhammadu Buhari. It came in the President’s October 1st address to the nation: “With respect to the economy, the Government has remained pro-active in its diversification policy. The Federal Government’s agricultural Anchor Borrowers Programme, which I launched in November 2015, has been an outstanding success with:

- 92 billion released through the CBN and 13 participating institutions,

- 200,000 smallholder farmers from 29 states of the federation benefitting,

- 233,000 hectares of farmland cultivating eight commodities, namely Rice, Wheat, Maize, Cotton, soya-beans, Poultry, Cassava, and Groundnuts, in addition to fish farming.

The Anchor Borrowers Programme is one of the CBN’s key intervention programmes

It was launched by the President on November 17, 2015, at Birnin Kebbi, Kebbi state and as at August 2017, a total sum of N44.18 billion has been released through 13 Participating Financial Institutions (PFIs) in respect of 199, 692 smallholder farmers across 29 states cultivating over 234. 581 hectares of farmland.

While the programme has supported nine commodities, the focal crop still remains rice. According to the bank, this overarching strategy of the programme is in line with the federal government’s agenda to ramp up local rice production and stop the importation of parboiled rice in the foreseeable future. The CBN has made similar intervention in power and other sectors.

A job done well attracts more work. The President again disclosed that: “A new presidential initiative is starting with each state of the Federation creating a minimum of 10,000 jobs for unemployed youths, again with the aid of CBN’s development finance initiatives.”

More work

Before he left for the US, Emefiele, who is devoted to programmes that affect the common man was already holding stakeholder meetings to develop a framework for the new initiative. More work!

With the fragility of the economy, the fear that it might slip back into recession if appropriate measures are not taken for sustainable economic growth, and the need to further strengthen the banking sector to engender greater confidence in the health of all banks, there must be more concerns to usher in a legion of the “demons of work” to put on hold a celebration of the harvests at CBN.

So, this may be harvest time for the CBN but the celebration has to wait as Emefiele deploys more of his trademark stability, courage and perseverance!

Add a comment