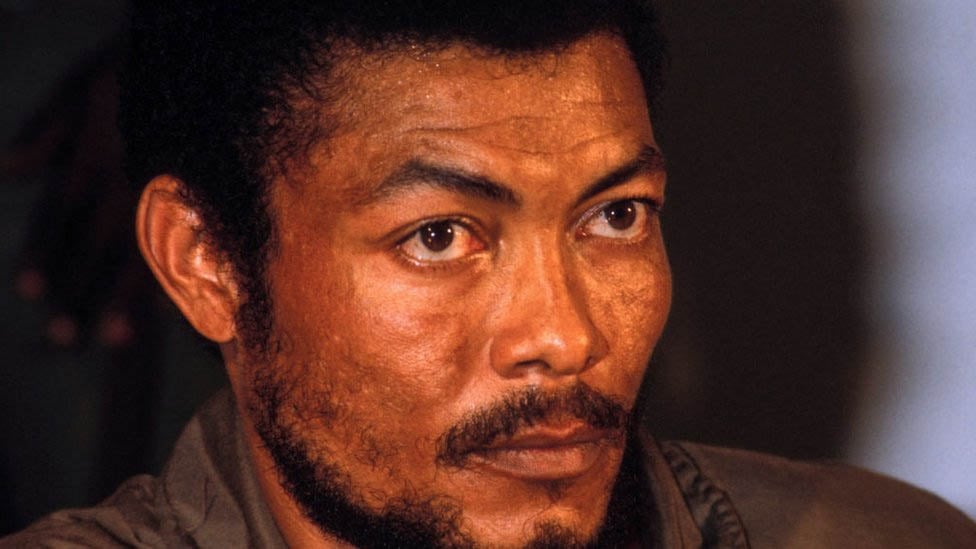

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says electronic transaction volumes increased by 67 percent during the COVID-19 lockdown with increased transactions at agent networks.

A statement signed by Nelson Olagundoye, head of corporate communication at the Chartered Institute of Bankers of Nigeria, quoted Emefiele as saying this during the 20th edition of the National Seminar on Banking and Allied Matters for Judges.

The seminar was organised by the CIBN, in collaboration with the National Judicial Institute (NJI), under the auspices of the Bankers Committee of CBN.

Emefiele was represented by Aishah Ahmad, the CBN deputy governor, financial services system.

Advertisement

The CBN governor said the banking and payments system was able to retain its operational resilience and accommodated the surge as more citizens moved to electronic channels.

Emefiele, who spoke on the role of technology, said the COVID-19 pandemic unraveled itself as a global health and economic crisis of seismic proportions.

“Individuals, families, businesses, industries, economies, countries – all have had to adapt to a new normal, even as global coronavirus cases continue to rise above 50 million,” he said.

Advertisement

“The effects of the pandemic, particularly the crash in international oil prices, disruption in trade value chains and muted business activities during the lockdowns have severely impacted economic output and heightened domestic macroeconomic vulnerabilities with GDP growth for Q2 2020 contracting by 6.10 percent compared to 1.87 percent growth in Q1, 2020, a decline of -7.9percent,” he said.

Emefiele said banks and other financial institutions sustained the credit growth momentum by channeling a significant amount of lending (over N3.7 trillion) to the real sector – manufacturing, consumer, agriculture, etc.

Emefiele advised that the justice administration process also leverage technology to facilitate mass communication and business processes in the country.

“Electronic trials should be used to complement traditional court hearings to clear the backlog and improve the speed of dispensation of justice,” he said.

Advertisement

“The judicial system must keep abreast of the transformations to be in a pole position to adjudicate cases presented by the financial sector.

“The sector should ramp up investments in critical infrastructure (hardware and software) needed to function in the new normal.

“Above all, continuous learning and capacity development in ICT skills is critical for the judiciary to maintain its support for the financial services industry in its intermediation role.”

The statement also quoted Bayo Olugbemi, the CIBN president, as saying the banking industry has embraced the innovations accompanying what is now known as the “new normal”.

Advertisement

“With the option of working from home now more of a reality than ever, banks and other financial institutions have further leveraged on technological advancements to improve the efficiency of services, operations, compliance, and regulations,” he said.

Advertisement

1 comments

E-commerce, like ordinary business, has its own market laws. You can find out all about this if you take training at forextime. I came to this not so long ago. My main job began to bring less money and I realized that changes were needed. I can use Forex exchanges even during isolation. This attracted me in the first place. I’m not ready to risk real money yet, but I already feel confident using a demo account. Have you tried this type of earnings?