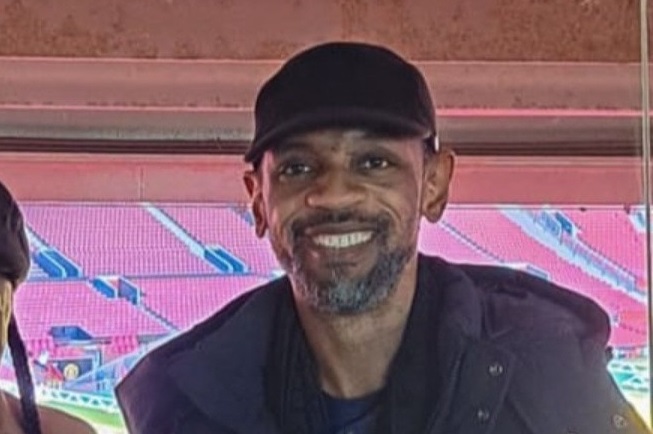

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says the steady increase in the country’s inflation rate is consistent with global trends.

Emefiele said this on Friday in Lagos at the 57th annual bankers’ dinner, organised by the Chartered Institute of Bankers of Nigeria (CIBN).

Emefiele said inflation soared to 20.77 percent in September, indicating eight consecutive months of uptick.

He explained that the upward momentum was after a successive period of decline in 2021 due to balanced monetary policy actions.

Advertisement

The CBN governor said the upside pressure on consumer inflation re-emerged during the year as global conditions complicated existing local imbalances to undermine price stability.

“Food remains the major component of domestic consumer price basket. The annualised uptick in headline inflation mirrors the 6.21 percentage points upsurge in food inflation to 23.34 percent in September,” NAN quoted Emefiele as saying.

“During this period, core inflation also resumed an upward movement from 13.87 per cent in January to 17.60 percent.

Advertisement

“In addition to harsh global spill overs, exchange rate adjustments and imported inflation; inflation was also driven by local factors such as farmer herder clashes in parts of the food belt region.”

Emefiele said during the early part of 2020, the world economy experienced the most significant downturn last witnessed since the ‘great depression’ following the outbreak of the COVID-19 pandemic.

He said the effect contracted global gross domestic product (GDP) by about 3.1 percent in 2020, and commodity prices went into a state of turmoil as the price of crude oil plunged by over 70 percent.

Emefiele added that as the world struggled to recover to pre-pandemic conditions, the global economy was yet again hit by another adverse occurrence with the eruption of the Russian-Ukraine war.

Advertisement

He said the war, along with the sanctions placed on Russia by the United States and its allies, led to a spike in crude oil prices.

The CBN governor said in the attempt to contain rising inflation, advanced markets such as the US began to increase their policy rates which led to a tightening of global financial market conditions along with a significant outflow of funds from emerging markets.

“The subsequent strengthening of the US dollar further aggravated inflationary pressures, along with a weakening of currencies, and depletion of external reserves in many emerging market countries,” he said.

“Today, close to 80 percent of countries have reported heightened inflationary pressures due to a confluence of some of the factors mentioned above.”

Advertisement

According to Emefiele, central banks in emerging markets and developing economies, in a bid to contain rising inflation were also compelled to raise rates, which was expected to lead to a tapering of global growth over the next year.

“In fact, the short-term global growth projections by the IMF have been downgraded three times in 2022 and is likely to be below the 3.2 percent and 2.7 percent estimates for 2022 and 2023, respectively,” Emefiele said.

Advertisement

“Average growth among advanced economies is projected to plunge from 5.2 percent in 2021 to 2.4 percent in 2022 and 1.1 percent in 2023.

“Estimated output growth in emerging markets is expected to slow from 6.6 percent in 2021 to 3.7 percent apiece in 2022 and 2023.”

Advertisement

Emefiele said in view of the food, energy, and cost-of-living crises in many countries, there were growing restrictions on food exports from many countries.

“As at the last count, about 23 countries, mainly in advanced economies, according to the World Bank have banned the export of 33 food items,” he added.

Advertisement

“Seven other countries have additionally implemented various measures to limit food exports.”

However, Emefiele said the redesigned notes would help curtail currency outside the banking system, and as the monetary policy becomes more effective, it would help rein in inflation.

Add a comment