Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says the redesigned naira notes cannot be counterfeited due to its “security features”.

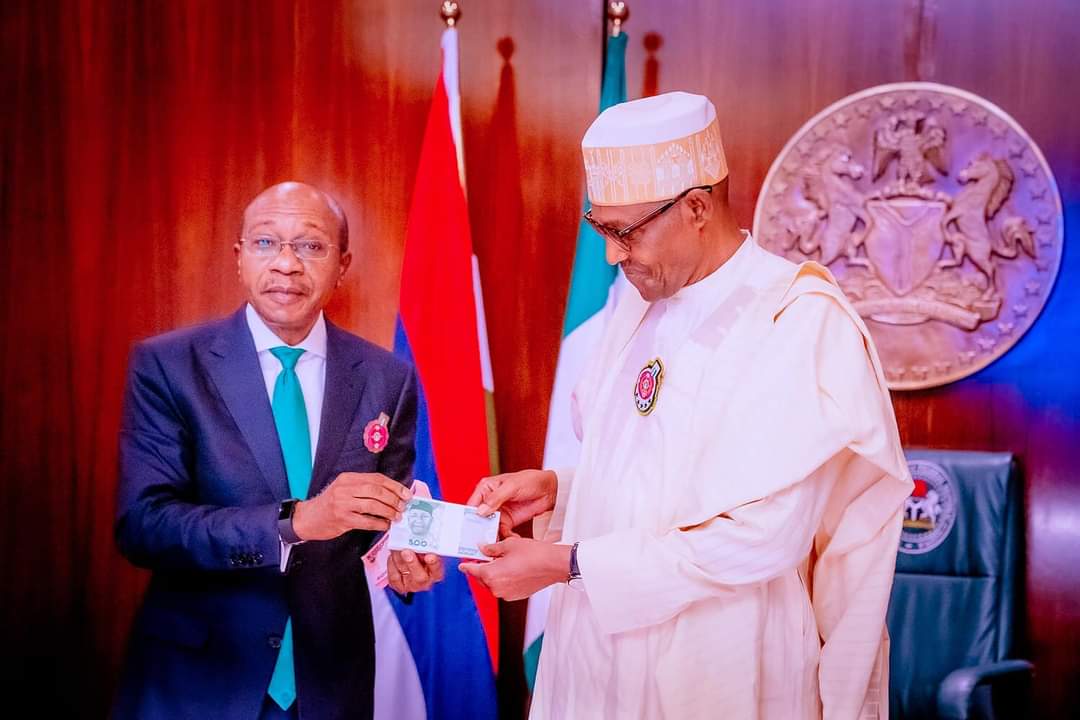

Emefiele said this while interacting with journalists on Wednesday in Abuja after the unveiling of redesigned N200, N500 and N1,000 naira notes by President Muhammadu Buhari.

The CBN boss explained that the authenticity of the new notes can be checked with an ultraviolet (UV) light.

According to him, it’s now “game over” for those involved in currency counterfeiting.

Advertisement

“Let me tell you this, these notes cannot be counterfeited because of the security features in them; nobody can counterfeit them,” Emefiele said.

“What you could only find will be people making photocopies of these notes. If you follow due process to check the authenticity of a currency and take them through the UV (ultraviolet) light, you will find that this currency cannot be counterfeited. The best you will find is photocopies.

“What I am trying to say is that to reduce that incidence of counterfeiting or photocopying, that is why we are saying that the CBN must now, without waiting every five to eight years, redesign and reissue these notes.

Advertisement

“So that those who think they can take advantage of the system by counterfeiting will know that the game is over for them.”

Emefiele said the apex bank will also place restrictions on the volume of cash that people can withdraw over the counter in banks.

This, he explained, is part of efforts to ensure that Nigeria operates a cashless economy.

“The world has moved away from predominantly cash to a cashless economy,” he said.

Advertisement

“And I think Nigeria and the Central Bank of Nigeria are prepared at this time to move towards a cashless economy. And that is the reason why with the reissue of these notes, we will insist that cashless would be nationwide. We will restrict the volume of cash that people can withdraw over the counter.

“If you need to withdraw a large volume of cash, you will fill out uncountable forms. We will take your data, whether it is your BVN, or your NIN so that enforcement agencies like EFCC (Economic and Financial Crimes Commission) or ICPC (Independent Corrupt Practices and Other Related Offences Commission) can follow you and be sure that you are taking that money for good purpose.”

He also debunked insinuations that the naira redesign policy was targeted at anyone, especially the political class.

The CBN governor, however, didn’t close the amount of money that has been mopped up from the circulation.

Advertisement

“Like I told you, those kinds of volumes, we don’t like to disclose. Like we told you, N3.23 trillion is in circulation and out of that N2.72 trillion is outside the bank vault,” he said.

“And we will insist that those N2.72 trillions must return to the bank vault by January 31st, 2023. If you choose to hold it after January 31st, 2023 it will become useless in your hand, that’s all.”

Advertisement

Add a comment