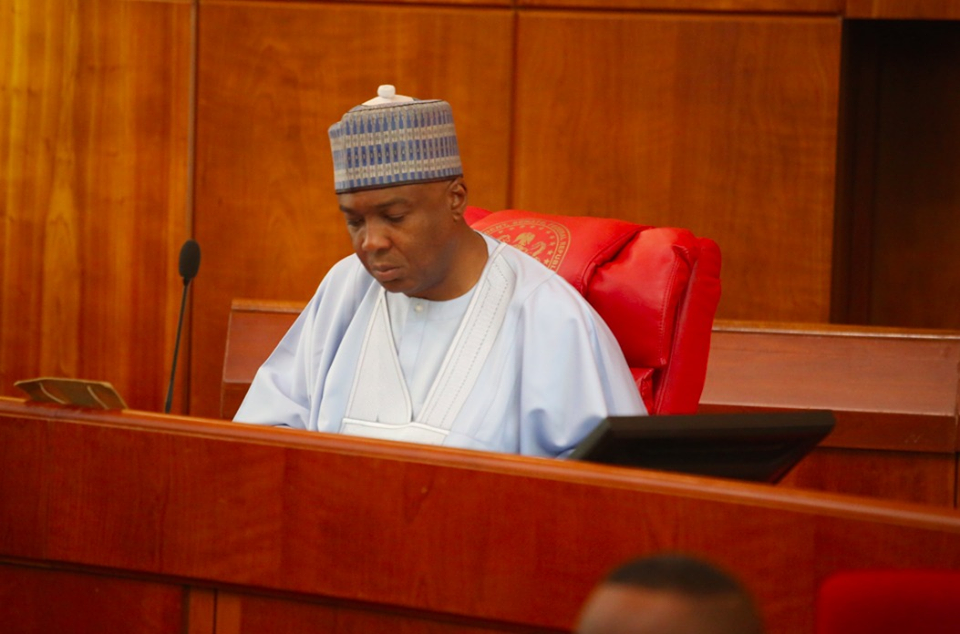

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), and Senate President Bukola Saraki, have expressed support for the sale of national assets, in a bid to get out of recession.

On Friday, Aliko Dangote, Africa’s richest man, had called on the federal government to sell its stake in the Nigeria Liquified Natural Gas Limited (NLNG) to beef up foreign reserves.

And speaking at an interview in Lagos, Emefiele said he had considered the option as early as April 2015, and he is favourably disposed to the idea.

“In the short run, we can sell assets. You will recall that as at April 2015, I had an interview with Financial Times of London during which even before the government came on board, I had opined that there was need for the government to scale down or sell off some of its investments in oil and gas, particularly in the NNPC and NLNG as at that time when the price of oil was around $50-$55 per barrel,” he said.

Advertisement

“We actually commissioned some consultants that conducted the study and at the end of that study we were told that if we sold 10% to 15% of our holding in the oil and gas sector, we could realize up to $40b,” he said.

“Unfortunately, the markets have become soft. Now if we choose to do that now, we could still get $10-$15b or maybe $20b.”

Emefiele stated that the sale should be done with “buy-back” clause, so that the government could recover the asset in a time of boom.

Advertisement

“I would imagine that that option is still on the table because more people, even in the cabinet, have made the same suggestion and if it happens, that will be fine, including the option to buy back the assets at some premium if we contemplate buying back when the crude prices move up and the assets value also move up.

“You know that in government, there are those against and those in favour. The argument in favour of selling the assets has gained a lot of credence recently.”

Saraki, on the other hand, was quoted by Financial Times as saying “asset sales could help avoid a worst-case scenario of entering an International Monetary Fund programme”.

“The singular strategy we are using of borrowing obviously is not working,” Saraki added, while calling on the executive to “look for alternative ways”.

Advertisement

Nigeria is in its worst economic recession in 29 years, and is currently facing challenges in plugging its budget deficit.

It has been finding it difficult to secure low-interest foreign loans due to its poor credit ratings, leaving asset sale and IMF loan as the likeliest way out of the current quagmire.

2 comments

It is a bad and idea please.what happens to the sell of bonds and treasury bills.pls do not mortgage our future.

It won’t be enough to sell only the NLNG and NNPC. I suggest we sell the FGN.