The Central Bank of Nigeria (CBN), on February 14, announced it has placed limits on the transfer of proceeds from crude exports by international oil companies (IOCs) to offshore parent company accounts.

According to a circular dated February 14, 2024, and signed by Hassan Mahmud, CBN’s director of trade and exchange department, the transfer of funds by the IOCs has an impact on liquidity in the domestic foreign exchange (FX) market.

The new policy meant that banks could only transfer 50 percent of repatriated export proceeds, on behalf of the IOCs, to their parent company’s offshore accounts — with the remaining 50 percent repatriated after 90 days.

The financial regulator said the transfer is subject to the approval of the CBN and the existence of a “cash pooling” agreement with the IOC’s parent entity.

Advertisement

‘ECONOMIC BENEFITS ARE SHORT-TERM’

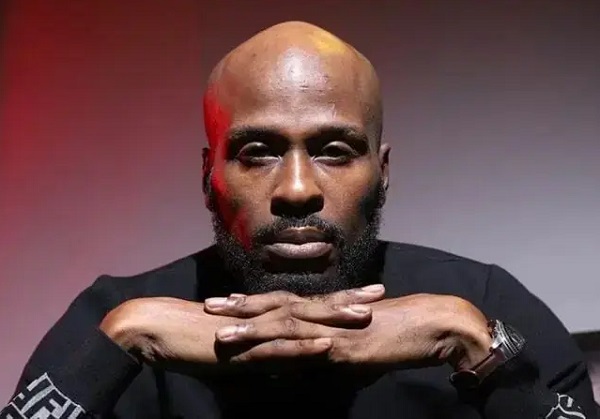

Commenting on the policy, Oyeyemi Oke, a partner at AO2LAW, said the policy, which has now put restrictions on foreign companies’ export repatriation, aims to ensure stability in the supply of FX within the country.

He said the economic benefits of the policy will be short-term and if not properly managed, it could be counterproductive.

Advertisement

According to the AO2LAW partner, the decision may guarantee FX supply, but the CBN still needs to curb the ‘excessive demand’ for dollars by restoring confidence in the naira.

This, he said, can be achieved when the local currency is stable.

“This 50 percent that have not been repatriated should perhaps have some short-term obligations,” he said.

“I hope we do not go the airlines’ route. The major fear is that would the dollars be available when the IOCs call for it?

Advertisement

“If the IOCs are not sure of the availability of foreign currency when they want to repatriate, then it may cause other problems in terms of our FX obligations.

“In as much as the CBN is trying to enhance supply, it is important for the bank to ensure the banks are able to meet their obligations when the IOCs need it.”

Oke said if the IOCs are repatriating based on cash pooling, there is the likelihood that it will also affect their operations internationally.

As such, they may need to change their operational model in order to adapt to the new CBN policy, he said.

Advertisement

“If those obligations are being met at the right time in terms of availability to transfer and the government lives up to its expectations or obligations after 90 days, there will be no cause for alarm,” the lawyer said.

“If they don’t, they will be reconsidering their options and perhaps not putting more money into the oil and gas sector.”

Advertisement

‘IT’LL INCREASE COST OF DOING BUSINESS FOR IOCS’

Also speaking on the issue, Jide Pratt, an oil and gas expert, said the policy is a major drawback to cash flow for the IOCs as it could also stifle projects’ completion timelines and, thereby escalate cost.

Advertisement

“We have a supply issue as regards FX. N126 million of 700 million for airlines alone is outstanding,” he said.

“This just adds another layer to this (repartition issues) for IOCs and is not the way to go in my opinion.

Advertisement

“This will definitely increase the cost of doing business in the oil sector. It will push investment to other countries where return is better and there is a guaranteed cash flow/payment environment.

“At a time where we should be pushing 1.8 million barrels per day (bpd), we seem to implement policies that stifle growth in the oil industry.”

‘IT’LL UNDERMINE NIGERIA’S INVESTMENT-FRIENDLY POSTURE’

On his part, Joe Nwakwue, former president of the Society of Petroleum Engineers (SPE), said although the country is in dire need of forex, it must not send conflicting signals to the investor community.

“One key representation is unconstrained repatriation of proceeds, this CBN circular undermines that and would most certainly undermine our investor-friendly posturing,” he said.

“This is especially so given the recent uptick in upstream activities.”

Nwakwue added that nothing should be done to reverse the “salutary” trend.

Add a comment