With food inflation at over 22 percent and national debt of about N78 trillion, the topic of discussion everywhere you go is the Nigerian economy. How are we going to survive as individuals and as a country? What will the incoming administration do differently and what needs to change? How will the economy bounce back? How can we create wealth for all Nigerians?

Asiwaju Bola Ahmed Tinubu, the president-elect, is gifted as a thinker, talent management expert, master strategist and problem-solver but there are no easy answers to questions on the economy with the International Monetary Fund (IMF) projecting GDP growth rate of 3.2 percent this year and 3.0 percent next year.

The average GDP growth rate between 2015 and 2022 was only 1.35 percent and it was during this period that we also suffered two economic recessions. The first recession in 2016 was due to the sudden slump in the price of oil in the international market and low production levels at home due to the activities of non-oil actors. The second recession in 2020 was caused by the devastating impact of Covid-19 pandemic on the global economy.

But we have also made poor economic choices. For example, why did we not remove fuel subsidy when it was no longer sustainable? Lack of FDIs and oil theft are putting pressures on our local currency, yet we pretend not to know where the shoe pinches us.

Advertisement

With the official exchange rate at N465, dollar scarcity will continue and you would be lucky to buy dollars at N800 in the parallel market.

When Patience Oniha, Director General of the Debt Management Office (DMO), spoke to the News Agency of Nigeria (NAN) recently, she did not tell us anything new. She also did not propose any solution.

Oniha said that the rising debt was caused by budget deficits and low revenue. Most of these deficits, she repeated probably for the umpteenth time, were funded through local and external borrowing, resulting in the rapid growth of our debt stock and increases in debt service.

Advertisement

There is nothing wrong in borrowing when you have the capacity to pay back. But when we use 96.3 percent of our revenue to service our debt, according to the World Bank, then we have a problem. Nothing will be left for recurrent expenditure and investment. The solution is to continue to borrow. In 2021, our debt service to revenue ratio was 83.2 percent.

We now borrow to pay salaries!

According to Oniha, deficits in the annual budgets, including supplementary budgets, rose to N10.78 trillion in 2023 from N1.62 trillion in 2015. Between 82 percent and 99 percent of these deficits were funded by new borrowing which ranged from N1.46 trillion in 2015 to N8.80 trillion in 2023.

It is evident that our economy is in bad shape but what is Angola’s magic wand? The second largest oil producer in Africa – behind Nigeria – also has its own problems. According to a World Bank report, Angola’s economic fortunes have been tied to global oil demand – just like Nigeria.

Advertisement

With a population of less than 34 million but also rapidly growing like ours, inequality and poverty levels are high. Urban and youth unemployment, says the report, exceed 38 percent and 50 percent respectively.

However, reforms over the last five years have improved macroeconomic management and public sector governance. With higher oil prices, their currency (Kwanza) – which is being rated as the best performing currency against the dollar in Africa – appreciated by 26.2 percent in 2022. The current account surplus stood at about 11 percent of GDP driven by high growth demand in oil exports (51 percent year-on-year).

Angola’s international reserves stood at $14.5 billion at the end of 2022, or about six months of imports. Inflation has also fallen rapidly, allowing the Central Bank to moderately loosen monetary policy. The year-over-year rate fell from 27 percent in December 2021 to 13.9 percent in December 2022 – the lowest rate since 2015.

What is their growth strategy?

Advertisement

Angola has what it calls Country Partnership Framework (CPF) planned for FY23-28 – for the next five years – which concentrates on the promotion of more inclusive development consisting of two strategic pillars that revolve around building human and institutional capacity.

The first pillar focuses on strengthening the non-oil economy through national economic diversification by revitalising rural economies to create greater competitiveness and employment.

Advertisement

The second pillar is designed to enhance the quality of service delivery and instituting a strong social protection programme to improve the quality of life of the population and equip individuals to take a greater role in the development of the country.

It must be noted that we have never had a shortage of ideas or policy directions. Our biggest challenge has always been poor implementation and the lack of political will to act on the right decisions. The two growth pillars of the Angolan economy are contained in our ERGP (economic recovery and growth plan) – a medium all-round development initiative that was designed to restore economic growth and build a globally competitive economy.

Advertisement

Speaking at the Governors’ Forum in Abuja recently, Dr Ngozi Okonjo-Iweala, Director General of The World Trade Organisation (WTO), said we have “challenges on the fiscal, debt and monetary policy fronts.” Nigeria’s gross debt level, she told the governors, climbed from N19.3 trillion in 2015 to N91.6 trillion in 2023.

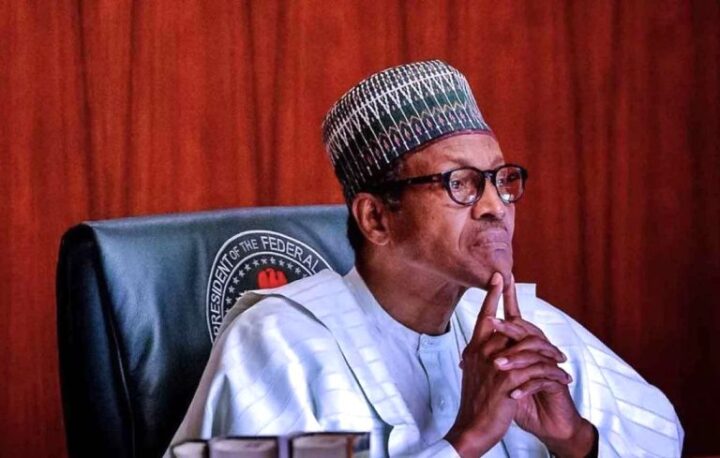

Isn’t that a frightening jump? The debt-to-GDP ratio has almost doubled within the same period from 20 percent to 39 percent. These are sobering statistics under the Buhari administration that embarked on a borrowing spree.

Advertisement

Although global growth slowed down largely due to Covid-19 pandemic and the Russia-Ukraine war, what Dr Okonjo-Iweala said in plain language was that we have been suffering from fiscal indiscipline and on top of that, we do not borrow wisely.

“In this gloomy and global context,” she said, “Nigeria has to work much harder to avoid falling even further behind.” With food insecurity and youth unemployment becoming an albatross, over 130 million Nigerians have been pushed below the poverty line.

But there has to be a silver lining in the dark and ominous clouds to give us renewed hope. It was against this backdrop that foremost economist, Dr Ayo Teriba, shared useful insights and broad perspectives on our economic challenges and possible solutions.

Teriba was a guest speaker at the District Conference of Rotary International District 9110 which held at the June 12 Cultural Centre, Kuto, Abeokuta on May 13.

During his presentation, Teriba quoted Thomas Monson (1927 – 2018), the American religious leader and author. “When you can’t control the winds,” Monson noted, “adjust your sails.” However, Dolly Parton, Bertha Calloway, Jimmy Dean and several others have also been credited with the same quote.

We are being told that there are still opportunities despite the economic challenges confronting us. If we ignore these opportunities, we would have ourselves to blame. Even when we cannot control or direct the winds, at some point, maybe through divine intervention, the winds could become favourable.

At that moment, what do you do? Adjust your sails in the direction of the favourable wind. Teriba said we are at that point and we must act thoughtfully. He explained that falling revenues, rising debts, multiple exchange rates, galloping inflation and dwindling reserves are the flash points but we can still navigate our way out of the stormy weather.

Having made similar PowerPoint presentations countless number of times in the past to organisations, governments, bilateral and multi-lateral agencies, Teriba was on familiar grounds.

In making his recommendations, he x-rayed the global economic context and explained what the national and subnational governments as well as the private sector can do to unlock the opportunities that are available in the next four years – a period where hard decisions must be made by the incoming administration for the economy to bounce back.

The private sector is already creating wealth for the economy. Whereas the federal government can optimise our economic potential better, attention must be paid more to state governments because, ultimately, they have the primary responsibility to grow our national wealth through their economic activities.

According to Teriba, Balance sheets will continue to be bigger sources of wealth than income statements. What does this mean? In its simplest from as we were taught in Economics, your balance sheet has assets and liabilities.

He cited China as a good example to buttress his point. We should also begin to focus on growing the balance sheet size of Nigeria because that’s where the action is.

Assets and equity investment inflows into them will put money in our pockets while debt liabilities will take money away from us, especially when such debts are IOUs or promissory notes issued in anticipation of future income.

Equity inflows unlock idle assets, especially foreign direct investment, while debt issues encroach on revenue, especially IOUs issued against income without links to assets.

What is the point of having an asset that wastes away without even knowing its value? Assets appreciate in value and they provide future economic benefits. Think of your landed property but get the experts to give you the economic value and see how it appreciates over time.

Other examples include cash, account receivables, marketable securities, distribution rights, trademarks and so on.

Dubai used the power of destination marketing to brand the city that literally grew out of a desert as one of the best tourist locations in the world. Dubai is the most popular emirate in UAE and it attracts visitors in droves, creating significant commercial value.

The city has eye-popping architecture, man-made islands, giant shopping malls and some of the best entertainment venues in the world.

Marrakech in Morocco has also been branded as a tourist destination. Our states and cities can do the same by promoting specific locations and their benefits.

“The outlook of the global asset prices over the next half decade remains mixed,” Teriba told his attentive audience for proper context in order to get a sense of what’s happening globally.

“The IMF projects in its economic outlook online database that commodity prices that are currently elevated by geo-political tensions will fall steadily back to 2021 levels from 2023 to 2027, while equity prices are widely expected to continue the strongly upward trajectory they have been following since 2018 through 2027.

“The outlook of global exports and FDI stocks will similarly remain mixed over the next half decade. Exports could rise up to 50 percent from US$22.4 trillion in 2020 to US$33.1 trillion by 2027, while FDI stocks could continue their stellar growth trajectory to surge nearly two-fold from US$41 trillion in 2020 to US$79 trillion by 2027.

“While both export flows and equity stocks are expected to expand, they will do so at different speeds; the gains in equity stocks on the global balance sheet would still be thrice the size of the gains of the export flows on the global income statement, with positive overall consequences for global economic growth.”

The global economic outlook suggests that exports will grow but FDI stocks will perform better as they will double in size by 2027. Smart investors will always put their money where their mouth is. Why are we unable to attract FDIs? Isn’t that better than collecting IOUs?

We complain of having a revenue challenge but how do we justify our rising debt profile? If we didn’t take IOUs from China, for example, our debt stock would have reduced. Instead of borrowing cash from China, why didn’t we consider the option of asset-linked debt as Teriba explained?

He said we should rely more on equity investments and FDIs rather than any type of debt. It is better to borrow against assets instead of income that may never come. Issuing IOUs or promissory notes is taking the path of least resistance.

The value of an asset will eventually go up and have a knock-on effect on the money you have borrowed. When we tie our debts to assets, such investments can be converted into equity or we can even issue equity outright at the onset of the transaction.

Teriba also said we pay too much attention to GDP while ignoring what our national assets can do to revive the economy. How do we get Nigeria to be liquid again? We can sell some of our national assets that are idle. India and Brazil are receiving close to $100 billion annual inflows of foreign direct investment into local assets in a bid to unlock liquidity from, or financialise, under-utilised assets.

When we entered the mobile telephone business in 2001, we auctioned licenses and raked in significant revenue while the mobile networks invested in the infrastructure required locally. After more than 20 years, MTN, Glo, Airtel and 9mobile are still in business and growing strong, paying taxes every year. Nigeria remains their biggest market in Africa.

We can also borrow a leaf from Saudi Aramco, the world’s largest oil producer. The company is owned by the Saudi Arabian government and it is the world’s most profitable company – richer than tech giants such as Apple and Google.

In 2022, Saudi Aramco made a profit of $161.1 billion, more than Google, Amazon, Microsoft and Tesla combined. Why can’t NNPC Limited use the same business model? Oil revenue will not last forever; so, oil producing countries are thinking of investment in the non-oil sector.

Amid high oil prices, Saudi Arabia transferred nearly $80 billion of Aramco shares into a Wealth Fund with more than $620 billion in assets to plan for the rainy day and expand investment opportunities. It would be the second of such transfers.

It appears we forget that Facebook is the biggest media company in the world but it produces no content. Facebook’s gross annual revenues are over $80 billion annually.

What of Air BnB and Uber? They neither own properties nor vehicles but they are minting raw cash providing accommodation and taxi services around the world. It is called innovation which can also grow the size of our balance sheet if we think outside the box.

For state governments that are struggling financially and cannot pay salaries and pensions, they can borrow this business model instead of rushing to Abuja every month begging for handouts. More importantly, Dr Okonjo-Iweala advised them to build trust with their people.

The United Arab Emirates (UAE), just like the Western region of old, is a good example of how states can unlock their potential in real estate investment. It explains why Lagos State, the economic and financial hub of Nigeria, thrives and is currently ranked as the fifth largest economy in Africa.

Lagos State with a GDP of over N45 trillion has a massive retail market that encourages manufacturing sector activities. According to the World Economic Forum, about 24 million people live in Lagos, and close to 2,000 people from across Nigeria arrive in Lagos every day in search of economic opportunities.

As the value of the real estate market goes up, investors also reap phenomenal profits.

Lagos has its own hail-a-cab service – similar to Uber and Bolt. It is called Lagride. Other states can do the same thing because it is no rocket science. If economic migrants travel to places such as Lagos, Port Harcourt, Kano or Abuja, it is for their survival.

Every state in Nigeria can invest in real estate, create and leverage premium skills, brand products and services and regularly upgrade the value chain of those brands to attract investment. Delta is thinking in that direction by positioning the state as the destination for national sports events and the preferred Nollywood location for shooting movies in Nigeria.

Akwa Ibom State also plays host to most Super Eagles matches in Uyo using the ultra-modern Nest of Champions stadium which is also a form of destination branding. Imagine for a moment the impact on the value chain of the local economy: airline and taxi cab operators, hotels, restaurants and bars, merchandising and so on.

If you bought the stocks of a company and the share price doubles down the road, it means you have earned twice the value of your investment. This is a good example of how to make your money work for you without lifting a finger. State governments should also have this type of creative and investment mindset.

State governments can generate rental income per square metre from assets that they host such as city centres, rail and bus stations, airports, cinemas, stadiums, as well as entertainment, tourist and event centres, shopping malls, etc.

Yaba in Lagos has been branded as our own “Silicon Valley.” With the growth of the Fintech industry, states have incredible opportunities to build ICT hubs and tech-ecosystems with our vibrant youth population.

In the agro-allied sector, food brands can be created and exported by working with the Nigerian Export Promotion Council (NEPC). Lagos and Kebbi states once worked together to produce LAKE rice – a remarkable partnership indeed.

In Cross River state, the Calabar Carnival was another excellent example of destination marketing and city branding. The fiesta held every December. Whatever happened to the beautiful idea where all the hotels and even private homes were fully booked for one month?

Braimah, public relations strategist and publisher/editor-in-chief of Naija Times (https://ntm.ng), can be reached via [email protected]

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment