Devaluation of the naira will not feature on the agenda of the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) holding on May 23-24, TheCable can report.

This will come as a surprise to many analysts who were expecting adjustment in the official exchange rate following the decision of the federal government to increase petrol price from N86.50 to N145 per litre in “partial deregulation”.

Official devaluation was thought to be next on the card to create some stability in the forex market and narrow the gap between the CBN and secondary rates.

There are also proposals that the CBN should open a second window — called the autonomous foreign exchange market (AFEM) — to encourage independent forex inflows at a rate closer to market realities.

Advertisement

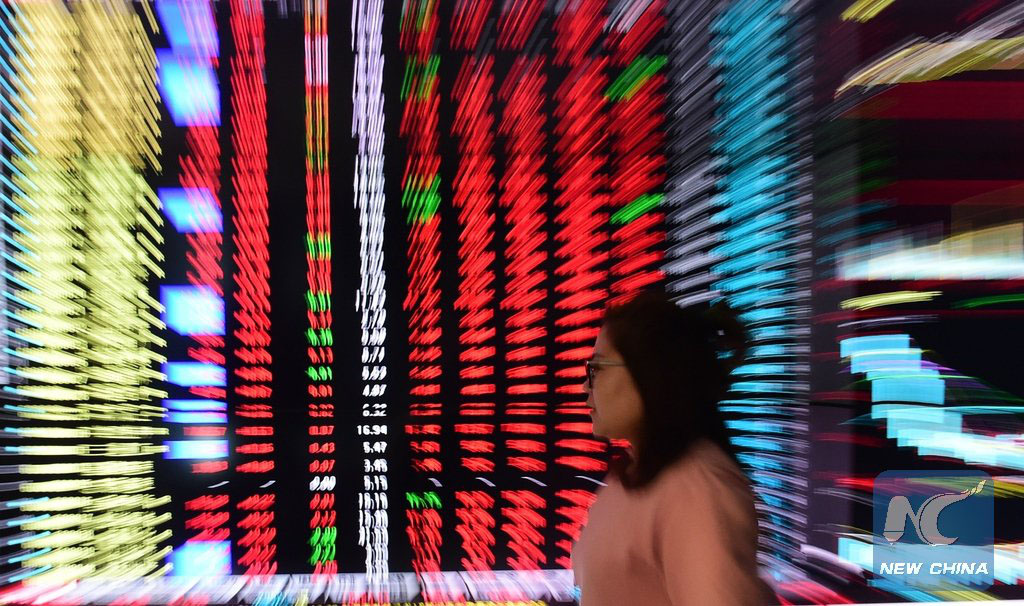

While the CBN officially fixes the dollar at N197, the interbank sells at N285 and the black market goes for N346.

The federal government had asked oil marketers to resume fuel importation to ease the burden on NNPC and end persistent queues at the filling stations.

As part of the agreement, the marketers were asked to source forex from the secondary market and price imported products accordingly.

Advertisement

This had sent the parallel market into a frenzy, with the naira selling for as high as N360 as currency speculators took position ahead of an expected official devaluation.

“It is not going to happen. There will be no devaluation,” a senior CBN official told TheCable.

“However, with inflation on the rise, expect an increase in the MPR (monetary policy rate).”

The MPR is the rate at which CBN lends to the banks, which then determines the rate the banks lend to their customers.

Advertisement

It was increased from 11% to 12% in March, and there are indications it may go as high as 14% this week, effectively making loans more expensive for businesses as part of efforts to check excessive liquidity in the system.

On the proposed AFEM, the CBN official told TheCable that it was a “good option” but said there are yet no safeguards in place in case the expected forex inflow does not materialise.

“The thinking behind AFEX is that if this window opens, there will be inflow of forex through Diaspora remittances, foreign portfolio investment and export proceeds. The rate will not be determined by the CBN but by the forces operating within AFEX,” he explained.

“However, there are no guarantees that these funds will come in, or if inflows will be significant enough. The foreign investor will be asking himself: if I bring my money into Nigeria through AFEX, if I want to get out, will I be able to get my money back at AFEX?

Advertisement

“They will still look up to the CBN to offer guarantees, so we cannot just jump into the autonomous arrangement for now. There must be safeguards in place.”

Advertisement