Nigeria is seriously considering entering into another $30 million a month “take or pay” deal with Qua Iboe Power Plant (QIPP), a private generating company, TheCable can report.

The current deal with Azura-Edo Power obligates Nigeria to pay at least $30 million a month whether or not the country takes the power generated by the plant.

Azura is the only private power company given a sovereign guarantee by the federal government following the World Bank partial risk guarantee (PRG) signed by Nigeria in August 2015.

Nigeria is also tied to a $10 million a month “take or pay” deal with Accugas Ltd to supply gas to the Calabar Generation Company Ltd, owned by the Niger Delta Power Holding Company Ltd.

Advertisement

Critics have questioned the wisdom of the Azura and Accugas deals because of the limited capacity of the Transmission Company of Nigeria (TCN) to take the power generated.

Many analysts have concluded that Nigeria’s priority now should be transmission and distribution — as the country has considerably high generation capacity lying idle.

However, Nigeria is considering a similar pull/call option agreement (PCOA) and power purchase agreement (PPA) with investors in the 540mw QIPP.

Advertisement

Ibrahim Gambari, chief of staff to President Muhammadu Buhari, has written to Zainab Ahmed, minister of finance, asking her to provide an “indicative timeline” to close the deal.

THE QUA IBOE POWER PROJECT

The project was initiated by Mobil Producing Nigeria Unlimited but its ownership was later transferred to new investors, led by the Black Rhino.

In 2017, the federal government approved the power purchase agreement (PPA) negotiated by the Nigerian Bulk Electricity Trading Plc (NBET) with the new investors of QIPP located in Ibeno, Akwa Ibom state.

Advertisement

NBET is the body that buys power from the generating companies (GenCos) through PPAs and sells to the distribution companies (DisCos) through vesting contracts.

The gas-fired power project is estimated to cost about $1.1 billion, with a proposed 58-kilometre transmission line that will link the plant to the national grid.

QIPP has entered into a 20-year gas supply agreement with Exxon Mobil to get 400 million standard cubic feet per day of gas through its deep offshore facility.

Also, the project will benefit from a World Bank PRG covering $150 million loans, TheCable learnt.

Advertisement

The project, which was estimated to begin commercial operations in 2021, is facing a huge setback owing to NBET’s reluctance to bear the financial risks associated with the operations of the plant.

Advertisement

GAMBARI WADES IN

In a letter dated July 27, 2020 and addressed to Gambari, Brian Herlihy, QIPP’s director, raised the issue of the financial burden arising from lower capacity utilisation of the turbines.

Advertisement

“Two commercial issues were raised by NBET that impact on the tariff price: The number of free startups that QIPP provides (this relates to restarting the power plant if tripped by the Grid) and the impact of the system operator asking the power plant to run at a lower rate of output (this impacts the cost of gas as the turbines are run at a less efficient rate),” Herlily said.

“In both cases the agree-to-positions ultimately impact the tariff price as such risks are always calculated into the overall investment analysis.”

Advertisement

Herlily said NBET maintained that it is beyond their mandate to take the risks and, therefore, should not be provided for in the PPA but in some other agreement.

According to him, the bankability of the PPA lies in the backing of the ministry of finance through the PCOA; hence, QIPP is “confused” why NBET was proposing to carve out risks related to the grid and forex.

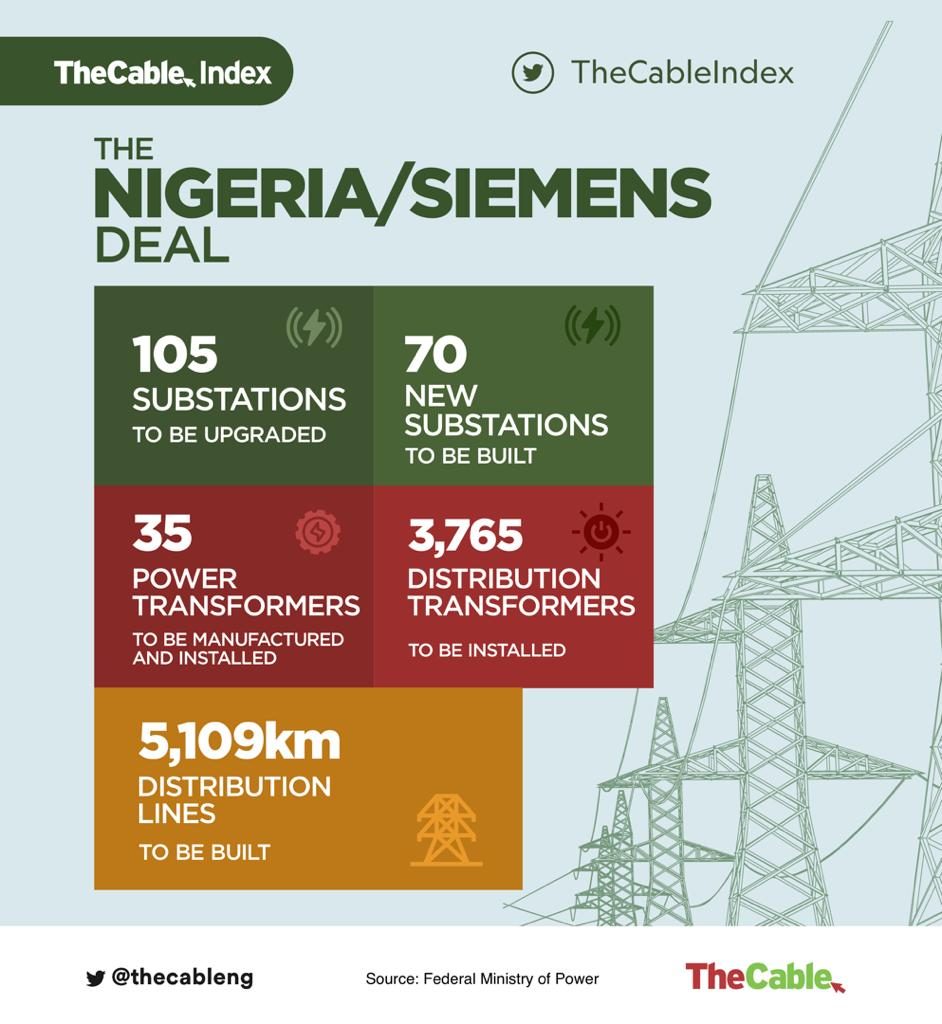

“QIPP has worked on a schedule that would focus on building the missing transmission lines now (in coordination with Siemens under the PPI), then initiate construction of the power plant in 2022 and achieve commercial operations by 2025,” he wrote.

“Furthermore, QIPP has proposed conditions to the PPA that permit FGN to delay the start of construction if necessary, so not to force the liability onto FGN before it is ready.

“To this end, QIPP has sought to execute the PPA and PCOA (including the above-discussed conditions) to ensure both sides are committed to a bankable structure. Over the course of the past five years, there has been much discussion of alternative PPA structures (such as only paying for energy when the energy is required – which would not enable an investment such as QIPP’s $1 billion to know when it would or would not get paid) or requiring investors to take on F(x) risk where there is a gap in the official rate vs the rate at which the investor could export dollars (as proposed by NBET the investor would only receive 85 cents for every $1 dollar invested).

“To this end, QIPP has been firm that it maintains a bankable structure for both sides to ensure the longevity of the relations (as set out in the initialed PPA from October 2017). From QIPP’s perspective, its investors must have the right to make a return on their investment to the extent that QIPP delivers on its obligations.”

While the PCOA could not be executed at the deadline of April 10 as a result of the COVID-19 pandemic, Herlily urged the federal government to finalise the deal by the end of the first week of August.

On July 28, the day after Herlily’s letter, Gambari wrote the minister of finance review to the agreement and propose remedial action.

“Sequel to the enclosed letter dated 27 July 2020, and the concessions proposed by QIPP on the above subject matter, kindly provide an update on the status of the conclusion of the PPA and PCOA, with proposed remedial actions for the existing bottlenecks and recommendations for Mr President’s consideration. Also, provide an indicative timeline for closure,” Gambari said.

OBSTACLES BEFORE QIPP

If Nigeria finalises the QIPP agreement, the government will pay a minimum take-or-pay sum of about $30 million per month in the event that the plant is available and ready to generate but the power cannot be evacuated or consumed for reasons that are not the fault of the investors.

The energy generated by QIPP is expected to be transmitted to the national grid through the Ikot-Abasi- Ikot Ekpene transmission line, which is still under construction by NDPHC and also facing huge challenges over the right of way.

In a letter dated March 28, 2018, addressed to Chiedu Ugbo, the managing director of NDPHC, Louis Edozien, then permanent secretary of the ministry of power, had lamented the paucity of fund, high cost of the right of way and then raised concerns about the capacity of the two contractors handling the project.

“QIPP is in negotiation with the Nigerian Bulk Electricity Trading (NBET) for the Power Purchase Agreement (PPA). Under the PPA, NBET an agency of government, is to procure a Put Call Option Agreement that obligates the government to reimburse part of the investment in the power station in the event the power station is unable to operate commercially as intended under the PPA for reasons of default by government entities, like NDPHC,” Edozien wrote.

“Failure to complete the Ikot Abasi-Ikot Ekpene line would be a trigger of these default risks on NBET and government. The project participants have expressed concern that the risk of failure to complete the project is unacceptably high.

“The construction of the line cannot continue unless the acquisition of the line route right of way is fully acquired. The information provided by NDPHC is that N3 billion has already been expended as compensation to project affected persons to acquire the 80km by 50m right of way. Complications arising from the lapse in time since the last enumeration and compensation efforts led NDPHC to re-enumerate the entire line route.

“From the re-enumeration exercise, an additional N2.7 billion is needed to complete the compensation payments. The first concern is that NDPHC does not have the fund. The second concern is the high cost of the right of way – roughly N7.1 million to every 100m x 50m parcel of land along the line of route.”

TheCable understands that the transmission project is currently stagnant, while there are talks to transfer it to Siemens AG, the German firm.

In 2019, the president had signed a power project deal with Siemens AG to invest in substations, transmission lines and deliver 7,000mw of electricity to the national grid by 2021 under the presidential power initiative (PPI).