President Bola Tinubu has approved a request by the Nigerian National Petroleum Company (NNPC) Ltd to utilise the 2023 final dividends due the federation to pay for petrol subsidy, TheCable can report.

The president also approved the suspension of the payment of 2024 interim dividends to the federation in order to augment NNPC’s cash flow, according to presidency sources.

In addition, the national oil company told the president it will be unable to remit taxes and royalties to the federation account for now because of the subsidy payments, which it termed “subsidy shortfall/FX differential”.

An NNPC forecast seen by the newspaper showed that the cumulative petrol subsidy bill from August 2023 will hit N6.884 trillion by December 2024 — leaving the national oil company unable to remit N3.987 trillion in taxes and royalties to the federation account.

Advertisement

TheCable could not confirm the total amount of dividends to be withheld or suspended.

NNPC is expected to pause the payment of interim dividends for eight months this year — from May to December.

Interim dividends — based on inflow projections — are usually remitted monthly into the federation account and shared by the three tiers of government while the final dividends are paid at the end of the year after reconciliation.

Advertisement

Under the Petroleum Industry Act (PIA), the NNPC is obligated to pay taxes and royalties as well as dividends to the federation, its sole shareholder.

‘SAVE OUR SOUL’

In June 2024, NNPC had cried out to Tinubu that the subsidy payments were negatively impacting its cash flow and it was struggling to remain a “going concern”.

The company said it might not be able to sustain petrol imports because of the ballooning subsidy bill, which it blamed on “forex pressure”.

Advertisement

TheCable understands that Mele Kyari, the group CEO of NNPC, informed the president that when subsidy was removed in June 2023, it led to monthly savings of N400 billion to the federation.

This, he said, enabled the company to remit its taxes and royalties totalling N2.032 trillion into a sequestered account at the Central Bank of Nigeria (CBN) as at January 2024.

Kyari said the development was short-lived with the devaluation of the naira which led to month-on-month escalation in the NAFEX exchange rate.

Advertisement

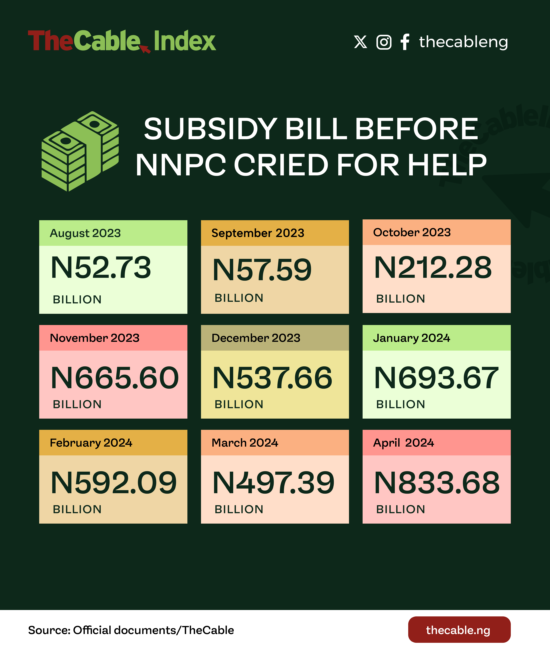

In August 2023, NNPC moved from surplus to negative in fuel importation costs, incurring a subsidy bill of N52.73 billion.

This increased to N57.59 billion in September and N212.28 billion in October before ballooning to N665.60 billion in November, when exchange rate had more than doubled from the time subsidy was removed.

Advertisement

The bill fell slightly to N537.66 billion in December before hitting a new high of N693.67 billion in January 2024.

The bill dropped to N592.09 billion the following month and N497.39 billion in March before rising again to N833.68 billion in April, forcing Kyari to send an SOS to the president.

Advertisement

He said the situation had continued to exert “undue pressure” on the NNPC, leading to its inability to remit royalties and taxes into the federation account.

Kyari further said national energy security was being threatened as the NNPC might not be able to sustain petrol imports “beyond July 2024”.

Advertisement

ALL EFFORTS NOT WORKING

In making his case to the president, Kyari said NNPC had implemented a number of strategies between August 2023 and April 2024 but the situation was getting out of hand.

The strategies included improving oil production by fighting theft and vandalism, debt rescheduling/forward sales, payment deferrals to suppliers and contractors, deferrals of non-critical projects, and debt recovery.

However, the situation was still not looking good as projections showed a consistent increase in cash flow deficit mainly because of the exchange rate.

Whereas an estimated N3.987 trillion in taxes and royalties will be due the federation account by December 2024, NNPC said it will still be owed N2.897 trillion after reconciliation of its obligations and subsidy shortfall.

Kyari requested that Tinubu should approve the utilisation of the final dividends due the federation for 2023 and deferment of the remaining interim dividends for 2024 to defray the subsidy costs.

The president approved Kyari’s request on June 6, 2024, TheCable understands.

FINALLY, AN ADMISSION OF ‘SUBSIDY’

When TheCable reported in August 2023 that Tinubu was mulling the return of subsidy, Ajuri Ngelale, his spokesman, immediately issued statement to deny the story, saying there was no going back on the new policy.

However, in official communication between NNPC and the president, the word “subsidy” is now liberally used.

It is thought that the government of the All Progressives Congress (APC) seeks to distance itself from the use of the term because “subsidy scam” was one of the campaign weapons it used to dislodge the Peoples Democratic Party (PDP) from power in 2015.

The Muhammadu Buhari administration used “under recovery” in place of “subsidy”, although it started using “subsidy” liberally years later.

The official position of the Tinubu administration remains that “subsidy is gone” — although NNPC projects that it will gulp at least over N5 trillion this year alone.

Petrol subsidy was removed in June 2023 when the exchange rate was N463/$ but it is now about N1,500/$, while crude oil prices have also been high, thereby making it a “doubly whammy” for NNPC.

To keep petrol price within the N600-N700 per litre range, NNPC uses a “derived FX rate” .

The gap between that rate and the official rate is the subsidy/FX differential.

Add a comment