PRESIDENT BUHARI ATTENDS 2018 APC CONVENTION 000. President Muhammadu Buhari Chats with the Vice President Yemi Osinbajo others during the 2018 National Convention of the Party at the Eagle Square in Abuja. PHOTO; SUNDAY AGHAEZE. JUNE 23 2018

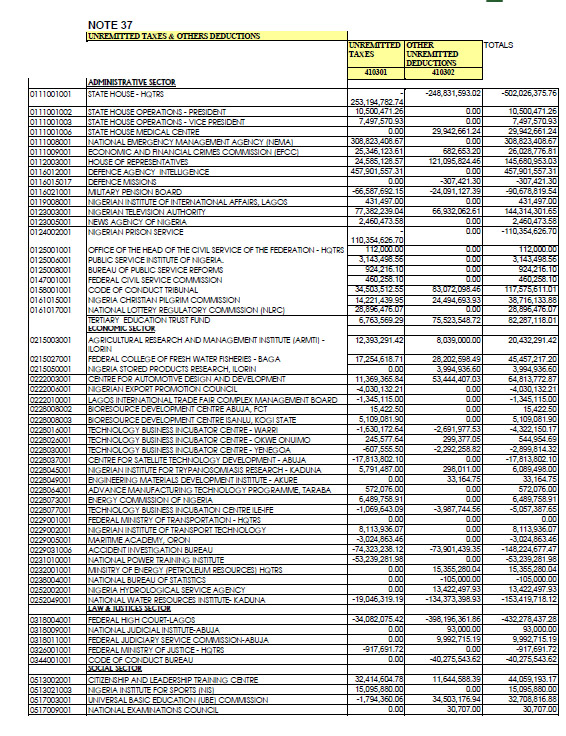

Aso Rock, Nigeria’s seat of executive power, failed to remit taxes, such as pay as you earn (PAYE), value added tax (VAT) and withholding tax (WHT), to the Federal Inland Revenue Service (FIRS) in 2016 — despite deducting at source.

The two chambers of the national assembly also failed to remit these taxes same year.

These revelations are contained in the just-released 2016 annual report of the auditor-general of the federation obtained by TheCable.

The auditor-general said State House headquarters did not remit N253,194,782.74 in taxes, while State House operations (president) withheld N10,500,471.26 and State House operations (vice president) N7,497,570.93.

Advertisement

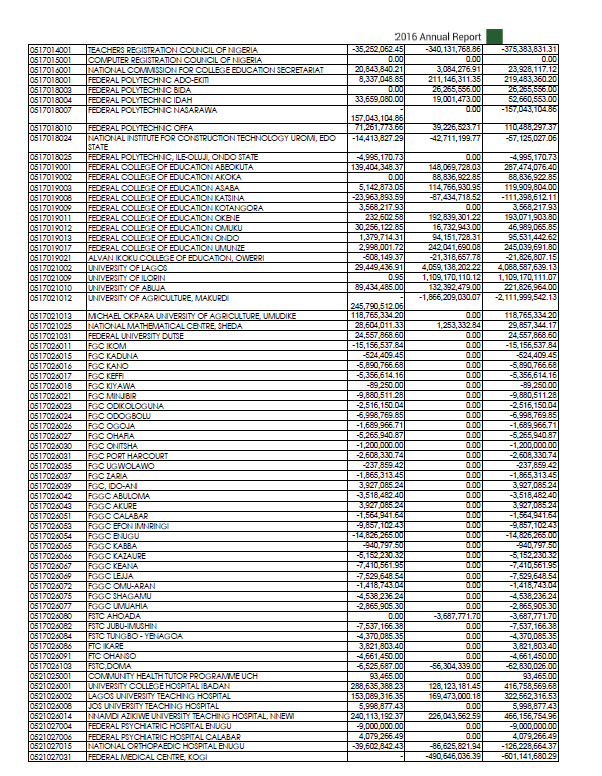

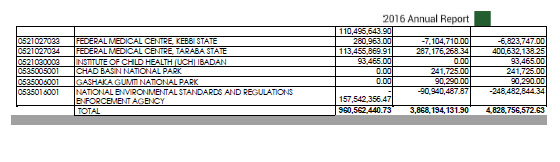

A total of 109 ministries, departments and agencies (MDAs) — including the Economic and Financial Crimes Commission (EFCC) — failed to remit taxes to the appropriate agencies during the audited period, according to the report signed by AM Ayine, the auditor-general of the federation.

Also named as defaulters are teaching hospitals, national parks, federal government colleges, polytechnics, universities, federal ministry of justice, office of the head of civil service of the federation, Nigerian Prison Service, Nigerian Television Authority and National Emergency Management Agency.

NATIONAL ASSEMBLY TOO

Advertisement

On the house of representatives, the auditor-general wrote: “Pay As You Earn (PAYE) deductions from staff salaries totalling N821,564,296.48 (Eight hundred and twenty-one million, five hundred and sixty-four thousand, two hundred and ninety-six naira, forty-eight kobo), were claimed to have been remitted to the tax authorities, but receipts for the remittances were not produced for audit verification in contravention of Financial Regulation 235 which states that “Deductions for WHT, VAT and PAYE shall be remitted to the Federal Inland Revenue Service at the same time the payee who is the subject of the deduction is paid.

“The Clerk to the National Assembly should produce the receipts confirming the remittance of the sum of N821,564,296.48 to the Federal Inland Revenue Service for verification. (b) Contrary to the provisions of Financial Regulations 1404(i) and 1405 which require Accounting Officers to provide adequate Advances records and to ensure that officers granted advances retire them promptly, advances granted to officers of the House of Representatives totalling N254,059,513.70 (Two hundred and fifty-four million, fifty-nine thousand, five hundred and thirteen naira, seventy kobo) for procurement of goods and services between January and December, 2016 remained unretired as at the time of examination in June 2017.

“The Clerk to the National Assembly should recover the whole sum of N254,059,513.70 from the defaulting officers and forward recovery particulars for Verification.”

On the senate, he wrote: “Withholding and Value Added Taxes totalling N118,625,057.48 (One hundred and eighteen million, six hundred and twenty-five thousand, fifty-seven naira, forty-eight kobo), which were purportedly remitted to the Federal Inland Revenue Service, were not acknowledged with revenue receipts.

Advertisement

“The Clerk to the National Assembly was requested to recover the whole sum from the defaulting officers and furnish recovery particulars for verification. (b) Withholding and Value Added Taxes totalling N118,625,057.48 (One hundred and eighteen million, six hundred and twenty-five thousand, fifty-seven naira, forty-eight kobo), which were purportedly remitted to the Federal Inland Revenue Service, were not acknowledged with revenue receipts. The Clerk to the National Assembly should produce the receipts from the Tax Authorities for verification.”

The federal government has been cracking down on tax defaulters recently 2015 but recently declared limited amnesty through VAIDS.

The auditor-general is required by Section 85 (5) of the constitution to submit the report on the audit of the accountant-general’s financial statements to the national assembly within 90 days of receipt of the statements from the accountant-general.

In the executive summary, Ayine wrote: “The Financial Statements of the Federal Government for the year ended 31st December, 2016 were first submitted to me by the Accountant-General of the Federation on 30th June, 2017. Following my preliminary observations, the Statements were significantly amended and resubmitted on 29th September, 2017. Further amendments to the Financial Statements led to another re-submission on 29th December, 2017 and 16th January, 2018 before the final version was eventually submitted on 20th March, 2018,” he said.

Advertisement

UNREMITTED TAXES AND OTHER DEDUCTIONS

Advertisement

Advertisement

Add a comment