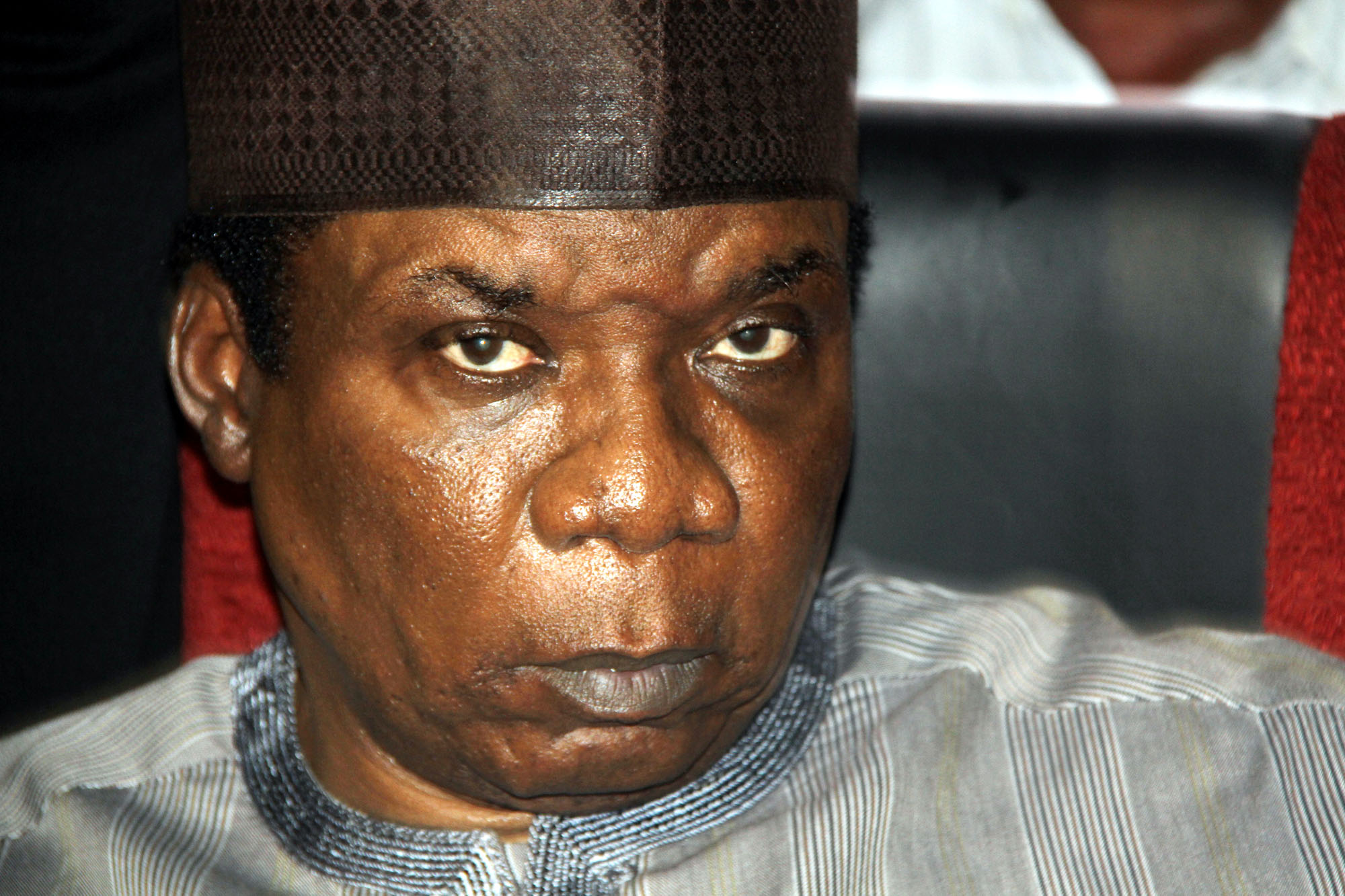

The management of Skye Bank Plc is seeking to take over some oil wells belonging to Jide Omokore, a businessman currently involved in some corruption cases within and outside Nigeria.

The bank said Omokore is indebted to it to the tune of about N110bn at an exchange rate of $1/N315.

The loans were said to have been obtained through three companies, namely: Atlantic Energy Drilling Concepts (N56 billion), Cedar Oil and Gas Ltd (N22.4 billion) and Real Bank Ltd (N31 billion).

In a series of letters and documents seen by TheCable, the management of the bank said the repayment of the first two obligations is tied to the controversial strategic alliance agreements (SAAs) with the Nigerian National Petroleum Corporation (NNPC).

Advertisement

Atlantic Energy was awarded SAAs by the Nigerian Petroleum Development Company (NPDC) Ltd, a subsidiary of NNPC, to develop and finance production from OMLs 26, 42, 30 and 34 — four oil blocks in all — in 2011.

NPDC valued its stake in the oil wells at $1.8 billion then.

BIGGEST OIL SCAM IN NIGERIA’S HISTORY

Industry experts have described the SAAs as the biggest organised scam in the history of Nigerian oil industry.

Advertisement

TheCable had published a report on how an agreement between NPDC and Omokore’s Atlantic Energy allegedly ripped off Nigeria by billions of dollars between 2011 and 2015.

The Economic and Financial Crimes Commission (EFCC) has frozen the assets of Omokore over suspicion of money laundering and procurement fraud.

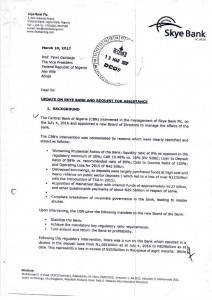

In a letter to Acting President Yemi Osinbajo, the bank appealed to the federal government to grant it access to the assets that were funded with loans from the bank.

Advertisement

SEIZING THE REAL ESTATE ASSETS

“We will require assistance for the extrication of the real estate assets that were fully funded with loans from the bank from the assets of Omokore presently under the forfeiture order from the court,” the letter read.

“This will enable us have access and rights over these assets and put the bank in a position to realise the assets that form the collateral for the loans granted to Real Bank limited.”

The bank also sought assistance to take control of the oil assets of Omokore.

“We will require some political intervention working with the NNPC to be able to bring this matter relating to Atlantic Energy to a quick resolution,” the letter read.

Advertisement

“The assets belong to the NNPC and we will require the NNPC to approve the transfer of the rights under the SAA’s to another company that can take over the obligations and repay the bank facilities.

“Our proposal is to work with the NNPC to take over these assets (since NNPC is a joint venture partner with 60% stake), and thereafter re-auction them to affirm that has the financial capability and credibility to take over and turn around the fortunes of these assets.

Advertisement

“This arrangement will also require strong political support at the highest levels. The positive outcome of this arrangement will enable the bank to repay NNPC’s TSA funds totalling USD$262.7m, and also part of CBN’s financial accommodation to the bank.”

TheCable could not reach Omokore as his telephone line was switched off on Friday morning when attempts were made to get his reaction.

Advertisement

PROTECTION FROM HARASSMENT

The current management of Skye Bank also sought the assistance of the federal government to get protection from harassment by the law enforcement agencies.

“We seek assistance in directing the law enforcement agencies to cease and desist from what has become incessant harassment of the current management of the bank, especially Adetokunbo Abiru, with regards to infractions which occurred prior to his appointment as GMD of the bank,” the letter to Osinbajo read.

Advertisement

“It is ironic that the current executive management, which has brought it on July 4, 2017, is now being harassed for the same infractions that it was brought in to correct.”

Citing some discrepancies, the Central Bank of Nigreia (CBN) took over Skye Bank on July 4, 2016.

Before that, the apex bank had issued several warnings to Skye Bank over its failure to meet the regulator’s minimum key liquidity and capital adequacy ratios.

Godwin Emefiele, governor of CBN, had announced a new management after the resignation of Tunde Ayeni, chairman and Timothy Oguntayo, group managing director (GMD).

Muhammad Ahmad was named the new chairman, while Adetokunbo Abiru took over from Oguntayo.

As soon as the new management came on board, it embarked on an audit which exposed the illegal dealings of those in charge of the bank in the past.

Add a comment