The Association of Bureaux De Change Operators of Nigeria (ABCON) says exemption from value added tax (VAT) and removing or reducing minimum bank charges on their operations will help improve the forex market.

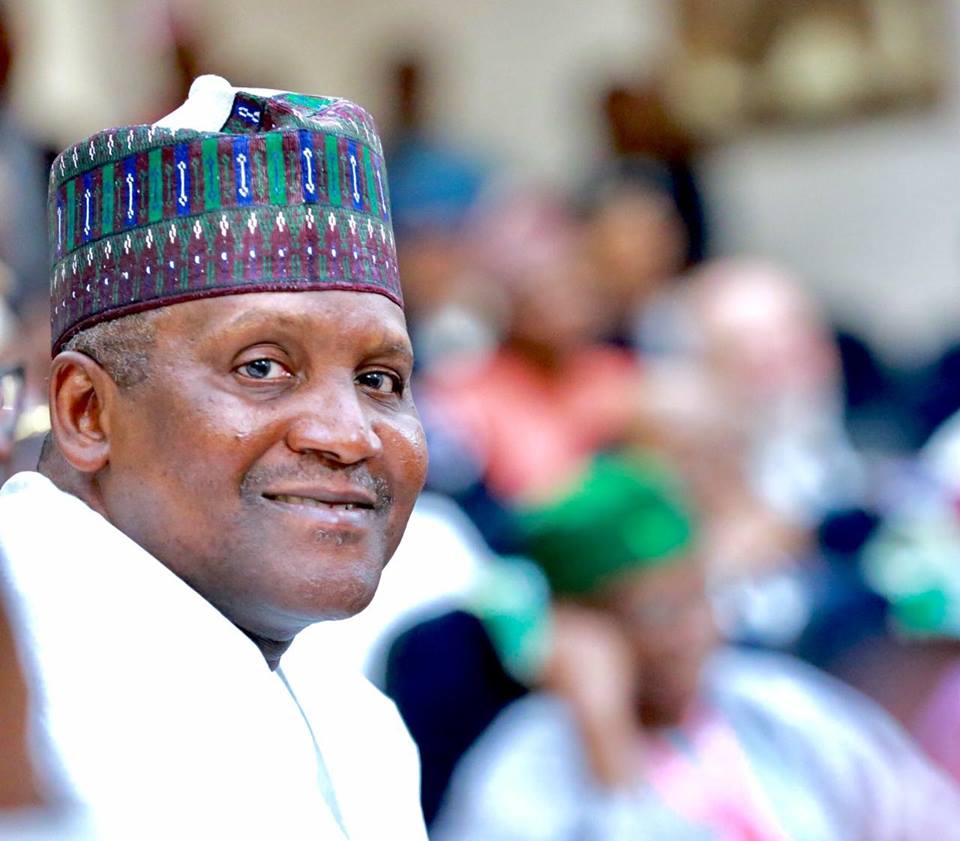

Aminu Gwadabe, ABCON president, made these recommendations on Wednesday after meeting other operators to chart how to stabilise the market and make the naira stronger.

In addition, he asked the CBN to review the annual license renewal of the BDCs, considering their numerical strength.

Gwadabe urged the CBN to ensure the convergence of deposit money banks rate and that of the BDCs, for a healthy competition that would achieve a stronger naira.

Advertisement

He called for the deepening of the BDC’s scope of operations by allowing them to transact on SME remittances.

According to him, allowing the BDCs to remit upkeep and accommodation fees for Nigerian students abroad will help to mitigate parents’ problems in sourcing the dollar.

He appealed to the CBN to allow the BDCs to have access to the investors/exporters window and to also make BDC operators direct agents of the International Money Transfer Organisations “as was done in other advanced economies”.

Advertisement

Gwadabe urged the CBN to allow the BDCs to do live programmes on the rendition of returns/operations, to ensure greater transparency.

Other recipes listed by the group included the exemption of BDC transactions from VAT payments as observed in the UK and the US and the reduction of complex documentation requirements on BDC transactions.

He added that the approval of additional disbursement centres in Port Harcourt, Maiduguri, Benin and Ibadan, would facilitate access to FOREX in those areas.

In 2016, the economy slipped into a recession which saw the naira lose value against the dollar and traded as high as N520/$.

Advertisement

To help the naira regain value, the CBN increased allocations to BDCs, opened an investors and exporters window and allowed banks provide forex for basic travel allowance, medical and tuition expenses.

Add a comment