NNPC's trucks waiting to load at Dangote refinery

On September 15, the Nigerian National Petroleum Company (NNPC) Limited Company commenced the lifting of petrol from the Dangote Petroleum Refinery after prolonged negotiations on pricing mechanisms.

At the close of loading on the aforementioned date, the NNPC disclosed that it bought petrol from the refinery at N898 per litre — above the N855 the NNPC had sold the product across its retail outlets since September 3.

As expected, the development triggered a backlash as critics wondered how the price of the commodity secured locally could be higher than the imported product.

The Dangote refinery countered NNPC’s claim, describing it as “both misleading and mischievous”. The refinery did not state the petrol cost price.

Advertisement

In a counter-claim, the NNPC released details of the pump price of petrol based on prices set by the refinery. The price format quoted refiner’s price per metric tonne (MT) $736 and $0.55 per litre.

The national oil company said the refinery arrived at the price using the Platts 10ppm benchmark of September 13 ($0.52) and a premium of $0.03.

Platts is a price benchmark service for the oil industry. Typically, Platts pricing plus a premium or minus a discount is the preferred pricing mechanism.

Advertisement

At an official exchange rate of N1,637.59 per dollar, the NNPC said the cost of a litre of petrol at the refinery was N898.78.

With the addition of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) fee (N4.495), midstream and gas infrastructure fund (N4.495), distribution cost and logistics cost for Lagos (N15.00), the NNPC said the estimated pump price would be N950 in Lagos and N999 in Abuja.

THE SUBSIDY EFFECT

The idea of a local refinery had excited Nigerians, primarily due to the expectation that petrol prices would crash significantly. But recent developments seemed to have left citizens disappointed as the price disclosed by the NNPC was higher than the existing pump price.

Advertisement

The difference between the present pricing mechanism and the template released by NNPC is subsidy.

On August 20, the NNPC said it was selling petrol at half the landing cost. At the time, the official pump price was N600/litre and the landing cost was N1,200/litre. This will suggest that the NNPC was paying more than N500 per litre in subsidies or under-recovery.

When the NNPCL raised prices to N855 per litre, the landing cost was said to be over N1,100 per litre, showing that the NNPC was still subsidising petrol by as much as N245 per litre.

If the same amount of subsidy is applied to the Dangote refinery price of N898 per litre, then the market price should be less than N700 per litre. Hence, petrol, as supplied by the Dangote refinery is lower compared to the imported product.

Advertisement

IS DANGOTE PETROL CHEAPER?

Speaking on the issue, Oyeyemi Oke, a partner at AO2LAW, said the absence of a “subsidy” line item in the NNPC’s breakdown makes a big difference as to whether the Dangote refinery product is less expensive.

Advertisement

“The pricing as at today, even if the government wants to accept it or not, appears subsidised because NNPC has come out itself to say they are selling the product at half the landing cost,” Oke said.

“How we should look at it is that if they are selling it at half the price or government is funding the shortfall and the amount based on the pricing that was received still puts it at N950, without any type of shortfall funding, what it means maybe is that it is cheaper at the Dangote refinery as opposed to importation, which the government claims to be selling at half the price.”

Advertisement

In a interview on Channels Television earlier today, John Kekeocha, the national welfare officer of the Independent Petroleum Marketers Association of Nigeria (IPMAN), said the prices shared by the NNPC could be discounted if petrol subsidy continues.

DOES DOMESTIC REFINING MEAN CHEAPER PRICES?

Advertisement

Jide Pratt, an oil and gas expert, said domestic production does not translate to cheaper petroleum products due to several factors.

“It is a fallacy to believe that once a refinery is up and running, it means prices will be cheaper, because the feed for every refinery is still going to be crude oil, which is a commodity that is sold in greenback,” he said.

“What makes petroleum products cheaper is that freight is affordable and the refinery is efficient.”

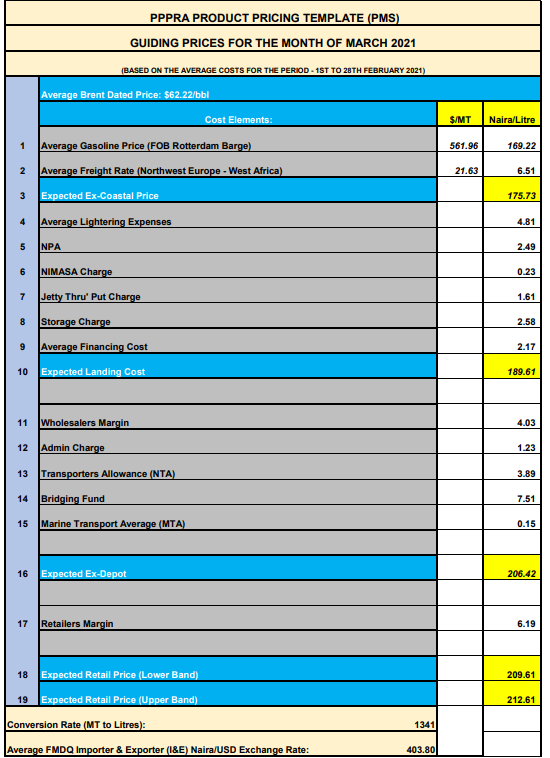

The only advantage to local refinery, from a price point, is the removal of import cost, which was present in previous NNPC pricing templates as shared by PPPRA.

WHY DID DANGOTE REFINERY SELL IN DOLLARS TO NNPC?

The NNPC had said it paid dollars for petrol from the Dangote refinery — a development earlier confirmed by the refining company.

Explaining the rationale behind the transaction, the Dangote refinery said it sold the products to NNPC in dollars because “our current stock of crude was procured in dollars”.

It was reported in July that the refinery planned to import feedstock from Brazil. A similar plan for imports from the US also made the news in May.

WOULD NAIRA-BASED CRUDE SALE MAKE A DIFFERENCE?

The government had said from October 1, the refinery would supply petrol and diesel to the domestic market in naira.

Oke said although the transaction would be made in naira to prevent foreign exchange (FX) pressures, “it doesn’t mean that it would not be benchmarked against the dollar”.

“Crude is an international commodity priced in dollars. When government and Dangote say they entered into an agreement and the prices will be on the basis of naira, what they are saying is that the payment in itself would be naira but the commodity pricing still has to be benchmarked against the dollar,” he said.

In addition, Pratt said some refining processes are benchmarked against the dollar as the refinery secured loans in dollars.

The difference, however, will be that the refinery saves on the cost of transporting crude from Europe, the United States, or Brazil, as was the case in the recent past. That savings is not based on local currency sales, but on the location of the crude, which will now be from Nigeria.

Add a comment