Nigerians spent over N1.2bn in cinemas between July-August

An Abuja-based entrepreneur claims that Nigeria’s cinema ticket prices rank as the highest in the world.

The entrepreneur, Yinka Ade-Aluko, is the chief executive at Doodle-Film Hub, a production and exhibition outfit in Abuja.

Ade-Aluko said Nigeria’s cinema subsector notoriously services only the middle class and elites, locking out the larger youth-dominated market.

The filmmaker stated that his company’s market research found that cinema in Nigeria “is the most expensive in the world” as it is “not affordable” enough and “not accessible” to average citizens.

Advertisement

He however did not state when the referenced market research was conducted.

But how much of the filmmaker’s claims are true?

WHAT CONSTITUTES CINEMA TICKET PRICE?

The price of a movie ticket reflects a combination of the base cost of cinema admission, fees associated with booking methods, taxes, discounts available at the time of purchase, concession stand items like snacks, and any additional services offered.

Advertisement

The base ticket price is the standard cost of being admitted to see a movie at the cinema. It covers the basic expenses associated with watching a film in the theatre such as the film’s licensing fee, the cinema’s operational costs, and the profit margin for the operators.

Some cinemas offer premium experiences such as IMAX which is a specialised and immersive film format/projection system that offers a larger screen size, enhanced image resolution, and improved sound quality compared to traditional cinema setups.

Like 3D or luxury seating options, they often come with an additional cost on top of the base ticket price.

Many cinemas allow customers to purchase tickets online through their website or mobile apps. In some cases, there may be convenience fees or booking fees associated with online ticket purchases which contribute to the overall price.

Advertisement

Some theatres may charge convenience fees for purchasing tickets at the box office or through automated on-site kiosks.

Depending on local regulations, movie tickets may be subject to sales or entertainment tax, adding to the final price paid by a viewer.

Cinemas can offer discounts on tickets to attract admissions. These can include matinee pricing offered for movie screenings that take place earlier in the day, student or senior rates, loyalty rewards, group discounts, or promotional offers tied to specific films or events.

Some cinemas may offer additional services or amenities such as reserved seating, in-seat food and beverage service, or access to exclusive lounges, which may be bundled into the ticket price or offered as optional add-ons for an extra fee.

Advertisement

TICKET PRICING AROUND THE WORLD

Ticket pricing for the same film in the same or a different country can often vary depending on the cinema’s location.

Cinemas situated in city centres or highbrow capitals may have costlier ticket prices due to increased operating costs and higher demand than those in the suburbs.

Advertisement

The specific cinema’s operating costs like rent, utilities, staff wages, and maintenance also factor into ticket prices.

The right to commercially exhibit a movie within a preset timeframe is usually sold to cinema operators in a licensing arrangement which can differ in their costs based on the publicity profile or popularity of each project.

Advertisement

The time of viewing, the technology of the cinema, and competition among theatres may also influence ticket pricing.

Economic factors including inflation rates and consumer spending power based on each market can affect ticket prices so that cinemas are forced to lower their rates during an economic crisis to stay in business.

Advertisement

Across the world, cinema and filmmaking are distinct businesses that entrepreneurs engage in for profit, so there is also a margin for that.

These factors and more account for why a ticket to see the 2024 Jason Statham action thriller ‘The Bee Keeper’ would cost well over $10 in a cinema within California, US and less than $4 at Filmhouse’s IMAX theatre in the Lekki highbrow of Lagos.

| Cinema Ticket Pricing by Country | |||||

| Country | Avg. Ticket Price | Avg. Hourly Min Wage | Minimum monthly Income | Wage Cost | Continent |

| United States | $16.96 | $7.25 | $1,160 | 1.46% | North America |

| Canada | $10.86 | $10 | $1,550.40 | 0.70% | North America |

| United Kingdom | $11.18 | $14.27 | $2,283.20 | 0.05% | Europe |

| Ukraine | $3 | $1.11 | $183.21 | 1.63% | Europe |

| India | $2.72 | $1.25 | $200 | 1.36% | Asia |

| China | $7.58 | $3.30 | $528 | 1.44% | Asia |

| Japan | $14.90 | $10.14 | $1,622 | 0.92% | Asia |

| South Africa | $7.93 | $1.34 | $214.40 | 3.71% | Africa |

| Nigeria | $6.08 | $0.15 | $18 | 33.75% | Africa |

| Brazil | $5.65 | $1.81 | $290 | 1.95% | South America |

| Venezuela | $4.00 | $0.03 | $5 | 74.07% | South America |

| Peru | $3.97 | $1.65 | $264.72 | 1.50% | South America |

| Australia | $12.16 | $18 | $2,880 | 0.42% | Australia |

| New Zealand | $13.03 | $14.23 | $2,276 | 0.58% | Australia |

| Bangladesh | $4.14 | $0.70 | $113 | 3.66% | Asia |

| Pakistan | $3.35 | $0.67 | $107 | 3.13% | Asia |

| Lebanon | $29.78 | $3.74 | $599 | 4.97% | Asia |

| Mali | $4.48 | $0.35 | $57 | 7.86% | Africa |

| Cambodia | $11.50 | $1.25 | $200 | 5.75% | Asia |

| Kenya | $8.24 | $0.28 | $52 | 15.85% | Africa |

Countries with a larger market size that is predictable and can be measured have enough “wiggle room” that potentially allows them to adopt relatively lower rates while making their return on investment by banking on their higher admission volume.

A PEEK INTO NIGERIAN CINEMA BUSINESS

Some major cinema operators in Nigeria include Silverbird, Lighthouse, Ozone, Filmhouse, and Genesis.

In Nigeria, theatre culture centred around live performances existed before the incursion of modern cinemas.

Silverbird Group was the first company to launch a series of modern cinema houses in Nigeria, mostly situated in affluent districts like Victoria Island’s Silverbird Galleria in Lagos which opened to the public back in 2004.

It would take the influx of content from indigenous filmmakers around 2008/2009 for Nigeria’s cinemagoers to shift from consuming predominantly foreign movies across the big screens to purchasing tickets to more and more Nollywood productions.

By the mid-2010s, DVDs had fallen prey to ravenous backstreet pirates and were all but obsolete as a mode of film distribution. Local filmmakers needed a reliable way of selling their content.

“You could spend ₦20 million to produce a movie, print it on DVDs, and don’t even make back ₦5 million due to piracy,” recounts cinematographer Allen Onyige. “That was when cinema started becoming a real culture, in 2016.”

Netflix would enter Sub-Saharan Africa in 2016 and a pandemic four years later would accelerate the adoption of streaming due to social restrictions and a safety-related crunch in the admission capacity of cinemas worldwide.

The cinema business in Nigeria was dealt a blow on multiple fronts. Streaming offered Nigerian viewers more diversity, quality control, and cost-effectiveness than cinemas ever did.

Data from Inside Nollywood show that yearly cinema admission (ticket sales) for Nigeria was growing steadily from 2.45 million in 2015 to 5.43 million in 2018. A dip started in 2019 and intensified with pandemic-driven streaming in 2020.

Nigerian cinemas have been struggling to recover and maintain a steady growth curve ever since.

In this light, it didn’t help that streamers made a much more compelling business case for filmmakers, offering as much as an estimated $90,000 to license a film and paying in the $3.8 million+ range to commission original productions.

In Nigeria, producers and cinemas have typically had a 40-40-20 profit-sharing formula where 40 percent of exhibition income goes to the theatre and the filmmaker each. The remaining 20 percent goes to cover the cost of promotion which is usually done by the cinema.

This 60-40 arrangement sometimes means that most Nigerian filmmakers are hardly able to recoup their production costs from a cinema run, hence a mass pivot to streaming.

In turn, some cinema operators ventured into production or upped their prices to stay afloat.

Nigeria’s inflation rate, which is currently at 29.9 percent, has further pushed cinema operators to the edge with diesel prices and the cost of input for concession stand items like popcorn hitting a high.

Cumulative box office revenue keeps growing yearly, driven by steadily rising ticket prices, but cinema admissions showed little promise.

“We are a business. Yes, our prices rose. But we can justify it,” says Patrick Lee, the immediate past president of the Cinema Exhibitors Association of Nigeria (CEAN).

“When we increase prices, it’s due to government policy that leads to inflation. The problem is with the wage of cinemagoers not being tied to inflation which means their disposable income will expectedly shrink.”

SO, IS NIGERIAN CINEMA THE PRICIEST?

TheCable contacted Yinka Ade-Aluko to possibly obtain data from his company’s market research and to also ascertain the grounds for his statement about Nigeria’s ticket pricing but the chief executive declined, citing the “sensitive” nature of business intelligence.

“If you could check the minimum wages versus cinema ticket prices as well as gross admissions versus population percentages of the three largest film industries (Nollywood, Hollywood, and Bollywood), it’s glaring,” the film entrepreneur later said.

Ade-Aluko’s idea of cost, from his commentary, is the total price of purchasing a ticket at any given cinema expressed as a percentage of the specific country’s minimum wage.

By his measure, a wage of ₦30,000 in Nigeria (a little over $18 at ₦1665/$) and a Silverbird blanket ticket price of ₦8000 (about $4.8) means a moviegoer earning that figure has to spend 26.7% of their monthly income on two hours of screentime and a cup of popcorn.

This, referencing the table above, is indeed a far cry from an American who only has to spend an hour or two’s worth of earnings and only 1.46% of their monthly income to enjoy the same privilege.

TheCable sampled data from a 2021 market survey on average ticket prices across 20 countries and six continents.

This sample was then weighed against the current minimum wage to ascertain if, by this metric, Nigerian cinemas could be considered the most expensive.

Venezuela, where the minimum wage is just over $4 (130 bolivars), is hardest hit at a wage cost of over 74 percent. The list is hardly exhaustive and was curated based on accessible data, where the worst-hit countries tend to be those with the lowest official minimum wage.

Ade-Aluko’s claim appears to ignore the need to distinguish the base price for the purchase of movie/cinema tickets and the conflated costs that arise from additional concession items.

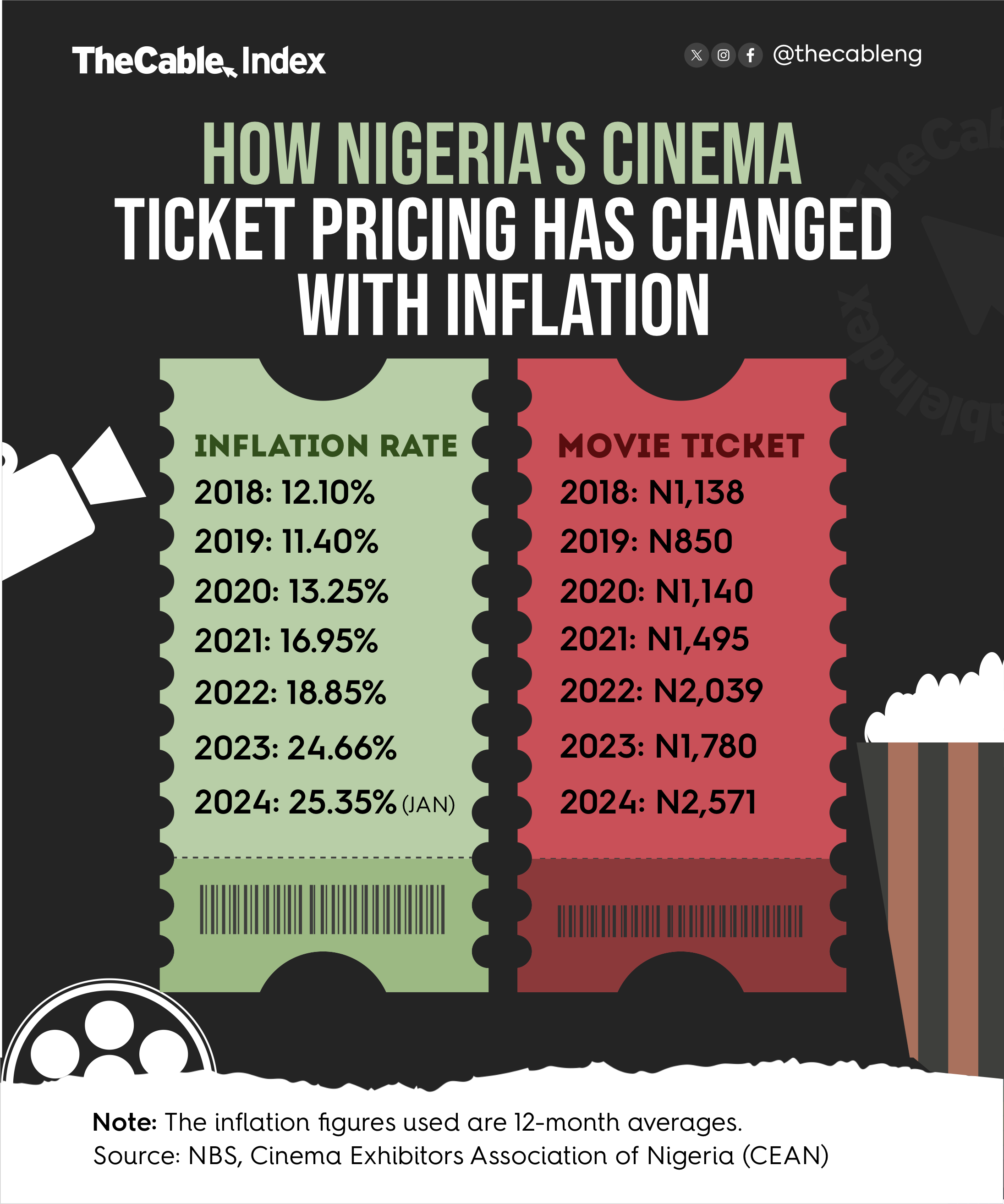

TheCable analysed and sampled Nigeria’s box office data from 2018 to 2024 to obtain the average price of movie tickets for each year.

Three films ranking in the box office’s top five were sampled from the first to fifth week of every given year while that of 2018 was sampled from December due to data availability constraints.

The weekly gross was then divided by the number of cinema admissions recorded for those seven days.

| Average Base Price of Movie Tickets in Nigeria | |

| Year | Average Price |

| 2018 | ₦1138 |

| 2019 | ₦850 |

| 2020 | ₦1140 |

| 2021 | ₦1495 |

| 2022 | ₦2039 |

| 2023 | ₦1780 |

| 2024 | ₦2571 |

This produced three values which were summed up and divided by three to obtain yearly averages. The result showed that actual tickets sold for ₦1138 on average in 2018 and later rose to an average of ₦2571 (about $1.54 per ticket) by January 2024.

Predictive analysis shows that tickets to Nigerian cinemas might have sold for as low as ₦500 further back in 2015.

In specific ticket prices, the highest-selling movies spotted among the samples were ‘A Tribe Called Judah’ at ₦3920, ‘Malaika’ at ₦3670, and ‘Aquaman: The Lost Kingdom’ at ₦4020 ($2.4 at ₦1665/$) — all from the year 2024.

THE TRUE MEASURE OF TICKET COST

Ope Ajayi, founder of the film distribution start-up Cinemax and a former general manager at Genesis Cinema, didn’t mince words when asked to comment on the claim that Nigerian cinema tickets “are the world’s most expensive”.

“I wonder if the analyst truly did research or wants to grab attention,” the film entrepreneur said.

Patrick Lee, versed in the exhibition business, berated the use of minimum wage as a benchmark to comparatively measure the cost of tickets.

He argued that Ade-Aluko’s claim also runs the risk of assuming that every cinemagoer in Nigeria earns the minimum wage.

“Who are the type of people that go to the cinema? I agree, the working and middle class who have disposable income to spare,” he said.

“But do we accept that ₦30,000 is the average minimum wage in Nigeria? The absence of verifiable data makes it difficult to determine if that should be considered the minimum wage across the board. It makes it difficult to compare Nigeria to other countries.”

Based on this observation and to eliminate the income class segregation, TheCable conducted further analysis, expressing the previously used pricing averages as a percentage of the monthly GDP per capita across the 20 countries sampled for this fact-check report.

GDP per capita measures a country’s economic output per person. It is calculated by dividing the total GDP of a country by its population.

This metric provides insight into the average economic well-being of individuals within a country, indicating their level of prosperity.

| Real Cost of Cinema Tickets | |||||

| Country | Av. Ticket Price | GDP Per Capita | Year Recorded | Monthly GDP Per Capita | Cost of Cinema |

| United States | $16.96 | $76,329.60 | 2022 | $6,360.80 | 0.27% |

| Canada | $10.86 | $55,522 | 2022 | $4,626.87 | 0.23% |

| United Kingdom | $11.18 | $46,125.30 | 2022 | $3,843.78 | 0.29% |

| Ukraine | $3 | $4,534.00 | 2022 | $377.83 | 0.79% |

| India | $2.72 | $2,410.90 | 2022 | $200.91 | 1.35% |

| China | $7.58 | $12,720.20 | 2022 | $1,060.02 | 0.72% |

| Japan | $14.90 | $34,017.30 | 2022 | $2,834.78 | 0.53% |

| South Africa | $7.93 | $6,766.50 | 2022 | $563.88 | 1.41% |

| Nigeria | $6.08 | $2,162.60 | 2022 | $180.22 | 3.37% |

| Brazil | $5.65 | $8,917.70 | 2022 | $743.14 | 0.76% |

| Venezuela | $4.00 | $15,975.70 | 2014 | $1,331.31 | 0.30% |

| Peru | $3.97 | $7,125.80 | 2022 | $593.82 | 0.67% |

| Australia | $12.16 | $65,100 | 2022 | $5,424.98 | 0.22% |

| New Zealand | $13.03 | $48,418.60 | 2022 | $4,034.88 | 0.32% |

| Bangladesh | $4.14 | $2,688.30 | 2022 | $224.03 | 1.85% |

| Pakistan | $3.35 | $1,588.90 | 2022 | $132.41 | 2.53% |

| Lebanon | $29.78 | $4,136.10 | 2021 | $344.68 | 8.64% |

| Mali | $4.48 | $833.30 | 2022 | $69.44 | 6.45% |

| Cambodia | $11.50 | $1,759.60 | 2022 | $146.63 | 7.84% |

| Kenya | $8.24 | $2,099.30 | 2022 | $174.94 | 4.71% |

Lebanon emerged as the most expensive, with the average ticket price in the Asian country gulping up to 8.64 percent of the monthly GDP per capita. This is followed by Cambodia at 7.84 percent. Then comes Mali in Africa at 6.45 percent and Kenya at 4.71 percent.

Nigeria ranks a distant fifth to gulp only 3.37 percent of the monthly GDP per capita, clearly not the most expensive as claimed.

THE DILEMMA OF PATRONAGE

Based on Yinka Ade-Aluko’s words, TheCable also examined the cinema admissions to population ratio of Nigeria.

Data was obtained from Inside Nollywood, showing Nigeria’s cinema admission numbers from 2015 to 2023.

This was then matched against population figures based on estimates gleaned from Statista.

TheCable worked based on an assumption that each admission count represents one cinema-goer, although a single individual can often patronise the cinema more than once and buy tickets for two or more movies in one year.

The findings showed that Nigeria does have a peculiar patronage problem. As of 2023, only 1.16% of Nigeria’s estimated 226 million population for that year saw a movie in the cinema.

For comparison, data show that cinema houses operating within the US (in Hollywood) sold a total of 849,598,661 tickets in 2023. A 2023 estimated population of 339,996,563 yields a staggering patronage rate of 249.88%.

In 2022, the box office in India sold over 981 million movie tickets. By the same measure and based on a 2019 population estimate of 1,417,173,173, this amounts to a 69.22% patronage rate for that year.

Nigeria’s box office has never come anywhere close to these figures, despite that the country’s movie industry is vaunted as the world’s second-largest by production volume.

However, while this fact might speak to the general perception of cinema culture in Nigeria, industry-specific peculiarities, and the country’s broader socio-economic environment, it hardly makes any direct statement on ticket cost as Ade-Aluko tried to establish.

VERDICT

Going by minimum wage as a measure of cost, Nigerian cinema is not the most expensive. Also going by monthly GDP per capita, Nigeria ranked a distant fifth in a sample of 20 countries.

Each cinema industry has country-specific economic realities by which it operates and film exhibitors tend to have bare minimums to remain operational.

All findings point in one direction. It is false, and misleading at best, to claim that Nigerian cinema is the world’s most expensive.

Add a comment