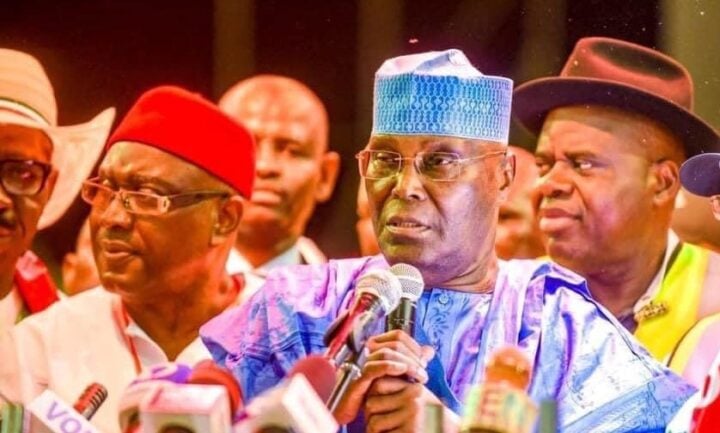

Former Vice-President Abubakar Atiku recently said the federal government’s directive to the Nigerian National Petroleum Company (NNPC) for the remittance of crude oil sales proceeds to the Central Bank of Nigeria (CBN) is illegal.

Atiku made the claim after Olayemi Cardoso, governor of CBN, had said the apex bank is partnering with the ministry of finance and the NNPC to ensure that “all our FX inflows are returned to the central bank”.

Reacting to the CBN governor’s statement, the former presidential candidate said the decision undermines the operational independence of the national oil company.

“Without prejudice to the possibility of any good that was intended in the decision of the federal government to make the Central Bank of Nigeria (CBN) take over the responsibility for crude oil sales proceeds from the Nigerian National Petroleum Company Limited (NNPCL), it must be clearly stated that the action is not legal in its application,” Atiku said.

Advertisement

“It’s an arbitrary order capable of undermining the operational independence of the NNPCL.”

Atiku asked the government to “respect the provisions of the law and allow the NNPCL to run as an independent company based on sound commercial objectives”.

VERIFYING THE CLAIM

Advertisement

The national oil company became a limited liability company in July 2022, transitioning into a commercial venture, in line with the provisions of the Petroleum Industry Act (PIA).

As such, the national oil firm, which was incorporated in September 2021 under the Companies and Allied Matters Act (CAMA), runs as a profit-oriented company.

Speaking at the unveiling of the company, former President Muhammadu Buhari said NNPC Limited will operate “free from institutional regulations, such as the treasury single account, public procurement, and Fiscal Responsibility Act”.

However, the federal government remains the sole shareholder of the company — even as the company intends to go public (sell shares to institutional investors) in the near future.

Advertisement

WHAT DOES THE LAW SAY?

The NNPC, according to the PIA, is expected to keep 20 percent of its profits as retained earnings, while 80 percent is to be remitted to the government as a shareholder.

Section 53 (7) of the PIA states that NNPC and any of its subsidiaries shall conduct their affairs on a commercial basis in a profitable and efficient manner “without recourse to government funds”.

Additionally, it states that NNPC “shall operate as a Companies and Allied Matters Act entity, declare dividends to its shareholders and retain 20% of profits as retained earnings to grow its business”.

Advertisement

The law also stipulates that where the NNPC has a participating interest or 100 percent interest in a lease or licence, the company will have to pay its share of all fees, rents, royalties, taxes, and profits.

The regulation further states that the NNPC is the concessionaire of all production-sharing contracts (PSC), profit-sharing and risk service contracts — on behalf of the federation.

Advertisement

According to section 64 (c) of the PIA, the NNPC is mandated to lift and sell oil under these contracts for an agreed commercial (management) fee. After deducting expenses and the cost of oil production, the NNPC and its partners will then share the proceeds, known as profit oil/gas.

Of the total profit oil/gas accrued to NNPC, 30 percent is to be set aside for exploring the country’s frontier basin.

Advertisement

After the deduction, the NNPC is mandated to promptly remit the remaining proceeds of the sales to the federation coffers — which can be via the CBN or other financial institutions as agreed upon by the government and the oil firm.

WHAT DO EXPERTS SAY?

Advertisement

Speaking on the issue, Oyeyemi Oke, a partner at AO2LAW, reiterated that the NNPC is a private limited liability company.

“What it means is that it is not a public company within the context of the CAMA Act. The NNPC Limited is owned by the Ministry of Finance Incorporated (MOFI) and the Ministry of Petroleum Incorporated (MOPI), which are government-owned entities,” he said.

“From a private revenue perspective, if a company is privately owned, who determines how the revenue will be managed will be the shareholders (MOFI and MOPI). If these two decide that the money of NNPC should go to the CBN, ordinarily, I do not think there is any violation of the rules of company law.”

Following a meeting in Abuja on February 8, 2024, the NNPC and the CBN announced that they had “reviewed the decision of the NNPCL to domicile a significant portion of its revenues and other banking services with the CBN”.

In a joint statement, both organisations said they had set limits for the management of the oil firm’s revenue, saying the remittance does not imply that NNPC would halt transactions with commercial banks.

Cardoso, on February 5, 2024, hinted that apart from the NNPC, some other ministries, departments, and agencies (MDAs) were also part of the arrangement to “move their funding straight to the central bank”.

These MDAs as well as other revenue-generating agencies (RGAs) remit earnings —comprising multiple accounts — to the federation account.

The fund is then disbursed by the federation account allocation committee (FAAC) to the three tiers of government.

“Ordinarily, proceeds from the NNPC should go to the federation account. The question would be, where is the federation account domiciled? Is it domiciled in private bank accounts, or it is domiciled with the CBN? Ordinarily, the CBN should be the custodian of inflows into the federation account,” Oke said.

If such an arrangement exists, Oke said it will not be unusual for the CBN and the NNPC to agree to send inflows directly to the apex bank as “the custodian of the federation account should be the CBN”.

Also speaking on the issue, Jide Pratt, an oil and gas expert, said the move by the CBN cannot be considered illegal, noting that although the NNPC is now a private entity, it is still 100 percent owned by the federal government.

As such, he said the Nigerian Upstream Petroleum Regulatory Company (NUPRC) regulations “will apply to NNPC with respect to crude oil operations”.

“For me, some level of probity has been introduced with respect to NNPC and accountability. In the past, so much was muddled up from DSDP that it was difficult to keep track of the FX,” he said.

Ayodele Oni, partner, energy practice group at Bloomfield LP, said the NNPC-CBN agreement is a move towards centralising correspondent banking.

“Whilst the objective of centralising corresponding activities is understood, this does not resolve the problem of limited FX in the country,” he said.

Oni added that the CBN governor “has already noted significant value of transactions that were part of the backlog illegally”.

In December 2023, Mele Kyari, NNPC’s group chief executive officer (GCEO), said the firm remitted N4.5 trillion into the federation account from January to October 2023.

VERDICT

Atiku’s claim suggesting that it is illegal to transfer crude oil proceeds to the CBN is false. The government is the major shareholder in the oil firm and is entitled to an 80 percent share of profits.