The Securities Exchange Commission (SEC) says it suspects that the management of Oando Plc declared false financial statements and unrealised profits.

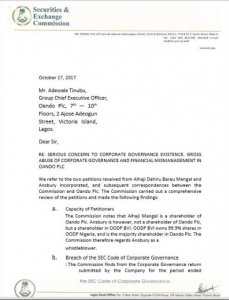

The commission made this known in a letter signed by Imoh Anast, head, SEC’s legal department, and sent to Wale Tinubu, group chief executive officer of the company, on October 17.

According to the letter, Dahiru Mangal, who petitioned the company alongside Ansbury Incorporated, is a shareholder of Oando, while Ansbury Incorporated is not a shareholder as earlier reported.

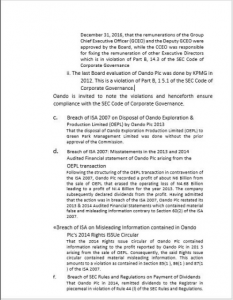

SEC said the company breached the code of corporate governance on two occasions: having different approval methods for the remuneration of the CEO and other executive directors and having KPMG carry out the last board evaluation of the company in 2012.

Advertisement

“Misstatements in the 2013 and 2014 audited financial statements of Oando Plc arising from the OEPL transaction: Following the structuring of the OEPL transaction in contravention of the ISA 2007, Oando Plc recorded a profit of about N6 billion leading to a profit of N1.4 billion for the year 2013,” the letter read.

“The company subsequently declared dividends from the profit. Having admitted that the action was in breach of the ISA 2007, Oando Plc restated its 2013 & 2014 audited financial statements which contained material false and misleading information contrary to section 60(2) of the ISA 2007.

“That the 2014 rights issue circular of Oando Plc contained information relating to the profit reported by Oando Plc in 2013 arising from the sale of OEPL. Consequently, the said rights issue circular contained material misleading information.

Advertisement

“That Oando Plc in 2014 remitted dividends to the registrar in piecemeal in violation of rule 44(I) of the SEC rules and regulations.

“The committee noted that Oando Plc declared dividends in 2013 and 2014 from unrealized profits.”

SEC also said certain persons with sensitive information about the company traded the company’s shares before it released its 2014 financial statement where it reported a loss of N83 billion.

Advertisement

NSE and Johannesburg Stock Exchange had previously suspended trading of the shares of the company on the advice of SEC.

At present, Oando’s shares are on technical suspension meaning that the shares can be traded but the price will remain unchanged.

Advertisement

Add a comment