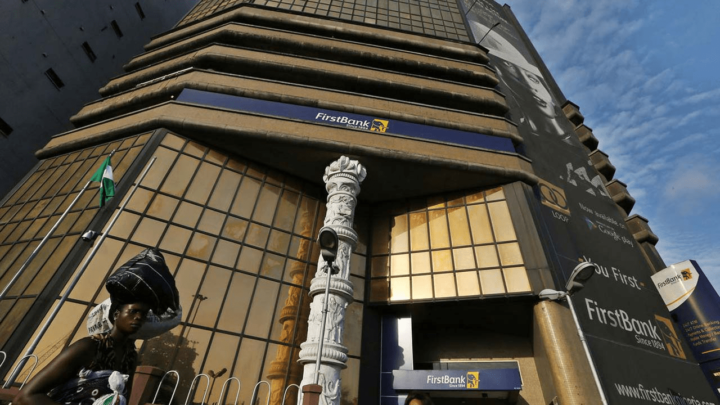

FBN Holdings has become the most capitalised bank in the Nigerian stock market after the company’s valuation closed at N1.22 trillion on February 26, 2024.

The market value of FBN Holdings, the parent company of First Bank of Nigeria, rose by N107.68 billion from N1.11 trillion reported by the Nigerian Exchange Limited (NGX) on February 23.

NGX oversees the Nigerian stock market.

The increase followed a 9.68 percent appreciation in the company’s share price, as it closed at N34, up from N31.

Advertisement

According to data from NGX, there are three banks in the trillion naira category; Guaranty Trust Holding Company (GTCO), the parent company of GTBank, and Zenith Bank.

The data showed FBN Holdings surpassed GTCO, which was previously the most capitalised company in the banking industry.

After trading hours, GTCO’s market valuation was N1.16 trillion, rising slightly from N1.14 trillion.

Advertisement

However, Zenith Bank did not record an increase in its market capitalisation, as the valuation remained at N1.10 trillion.

The increase in FBN Holdings’ market capitalisation is coming less than one month after the firm appointed Femi Otedola, a serial investor, as the new chairman of its board of directors on January 23, 2024.

Prior to his appointment, on January 19, Otedola was reported to have acquired an undisclosed amount of shares in Dangote Cement.

The investment led to an increase in the market capitalisation of the cement company and pushed Aliko Dangote, its majority shareholder, back to the list of the world’s top 100 billionaires.

Advertisement

Add a comment