The federal executive council (FEC) has approved the installation of electronic cargo tracking notes (ECTNs) for ports nationwide.

ECTN is an official marine waiver certificate document required by several African countries to effectively control and manage import/export traffic.

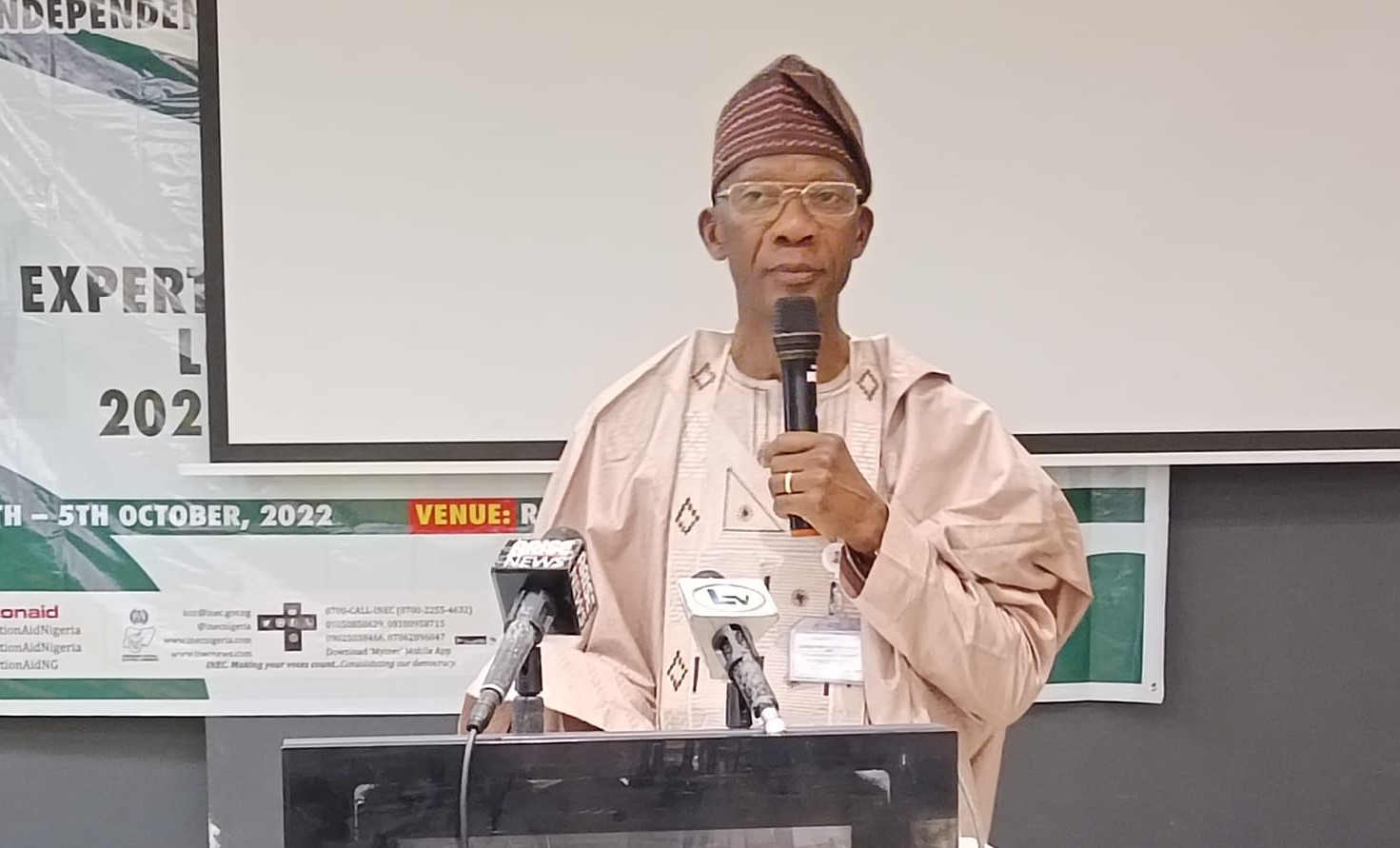

Mu’azu Sambo, minister of transportation, made the disclosure on Wednesday while briefing journalists after the FEC meeting presided over by President Muhammadu Buhari in Abuja.

Sambo said the scheme would block revenue leakages and is expected to generate between $90 million to $235 million annually for the government.

Advertisement

He added that the project will be co-implemented by a consortium of five Belgian companies and four indigenous logistics firms in a concession that will last 15 years.

The revenue sharing formula will be 60-40 percent, with the government at the centre ,taking the lion share, the minister said.

According to Sambo, the public-private partnership will track oil exports and reduce oil theft that has cost the government millions of dollars.

Advertisement

“Council considered our submission and approved our submission to put in place for Nigeria as it is in 26 other African countries, an electronic cargo tracking note scheme in order to, among other things, take care of under-declaration at ports, secure our imports and exports and provide transparency in cargo invoicing and declarations,” he said.

“The implementation of the scheme will abet the problems of under-declaration, concealment and wrong classification of cargo, which are the primary causes of revenue leakages, insecurity, and general security issues at the borders.

“The deployment and implementation of this state of the art ECT scheme will ensure the elimination of loopholes on border operations and boost the revenue of the Nigerian government in form of duties, port charges and levies.

“It is expected that this scheme will generate revenues to the Nigerian government ranging from about $90 million per annum to a peak of about $235 million per annum.”

Advertisement

Add a comment