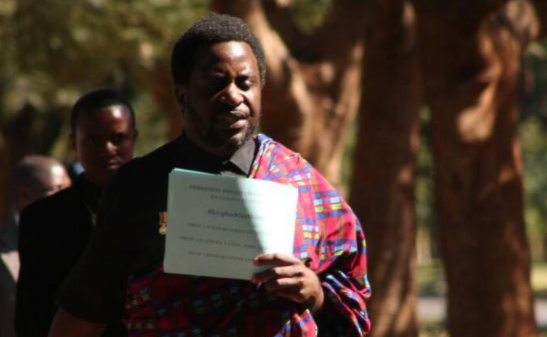

Okechukwu Enelamah, minister of industry, trade and investment, says the federal executive council has approved a three-year tax holiday for 27 new industries and products.

Enelamah, who made this known after the federal executive meeting on Wednesday said it was done in a bid to enable them to grow and expand investments.

He said: “The FEC gave approval to a memorandum that was presented to amend the list of pioneer industries and products that will enjoy pioneer status going forward.

“The pioneer incentive scheme is governed by the Industrial Development Income Tax Relief Act.

Advertisement

“The whole purpose of it is to give tax holidays to industries that we consider pioneer, not mature, to enable them to grow and attract investment in them.”

The minister said the pioneer status review was to capture the current realities that would enable the realisation of the economic recovery and growth plan and that the tax relief will cover three to five years.

“We have tried to remove all ambiguities in the definition of industries by reclassifying industries according to the international standard industrial classification, which is the same standard used by the Nigerian Bureau of Statistics.

Advertisement

“We also agreed that the pioneer list should be reviewed every two years and that in the case of additions to the list, it will be affected immediately.

“In case of deletion from the list, there will be a three-year window that will be allowed for those investing in that industry and enjoying pioneer status to carry on till the end of that three-year period.

“Against this backdrop, we then approved 27 industries that were recommended for addition to the pioneer list.”

He said the list would be made public and that mineral oil and cement firms are not part of the pioneer industries as mineral oil is already governed by the petroleum profit tax and Nigeria is already a net exporter of cement.

Advertisement

Enelamah said the status would not make the country lose revenue instead, it would enable new industries to enter the market and invest more, adding that it did not remove tax payments for existing industries.

“This is fairly a well-used policy and Nigeria had it before but we had to review it because it had not been reviewed since 2006” he said.

“The whole idea is that it is an incentive to attract people to invest more in sectors. It will increase our tax revenue instead of the reverse.”

Advertisement

Add a comment