The federal government says the old 5% value-added tax (VAT) should be used for contracts signed before February 1.

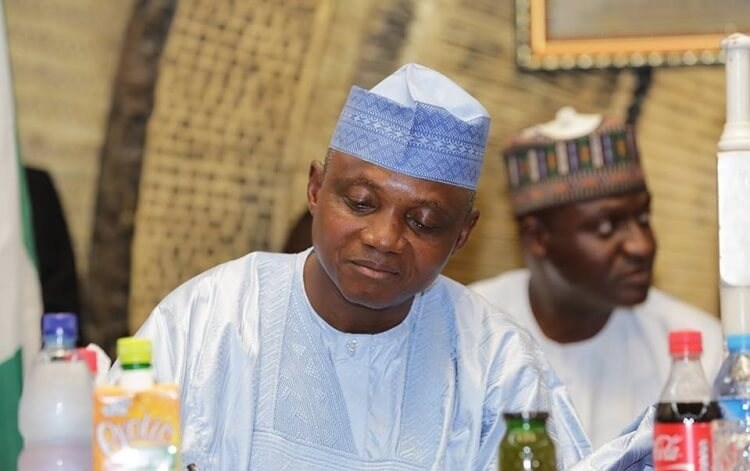

Garba Shehu, senior special assistant, media and publicity to the president, told journalists in Abuja on Wednesday after the FEC meeting that the announcement is aimed at clearing confusion arising from whether the old or new VAT rate should be applied to contracts.

“By law, the new VAT came into effect on February 1; the government was concerned about the implication of this on contracts that had been issued earlier than the set date.

“Some of the contracts been handled by various ministries, for instance, the ministry of works, are from several years back.

Advertisement

“So should the VAT on such payments be 7.5% or 5% as earlier signed?

“A final decision was made that new contracts onwards will attract a 7.5% VAT. Contracts signed on a 5% VAT earlier than February 1 will remain 5% so there is no more confusion on this matter.”

Ahmed Idris, the accountant general of the federation, had said implementation of the 7.5% VAT began in January.

Advertisement

At the time, Idris said he stopped payment for a contract which was carried out in December 2019 because 5% VAT was applied.

“Just yesterday (Tuesday), I saw a payment which was done last year in December and when I checked the payment, the VAT on it was 5% and I said no it must be 7.5% because the 5% VAT has been overtaken by events because that is the law as at today,” he said at the time.

“So I stopped it and asked them to go and recharge at 7.5%. You cannot implement something unless you have the instrument whether administrative or legal for it to be implemented.”

President Muhammadu Buhari has sent a bill to the national assembly for the amendment of the 2020 finance act.

Advertisement

The president is asking the legislature to include February 1 as the implementation date for the provisions in the act.

Add a comment