Tax on imports provided by the Lagos state’s value-added tax (VAT) law may prove to be the next point of contention between the state and the federal government.

On Friday, Babajide Sanwo-Olu, governor of Lagos, signed into law the bill seeking to empower the state to collect value-added tax (VAT) — following the Rivers state’s VAT law.

The bill seeks to empower the Lagos government to collect VAT in the state instead of the Federal Inland Revenue System (FIRS), an agent of the federal government.

Gbenga Omotosho, the commissioner for information and strategy, said the governor signed the bill after returning from an official trip to Abuja.

Advertisement

Consumers pay VAT when they purchase goods or obtain services. All goods and services (produced within a country, including those imported into the country) are taxable except the goods and services specifically exempted under the VAT Act.

According to the law, Lagos will charge VAT at the rate of six percent on the value of goods and services.

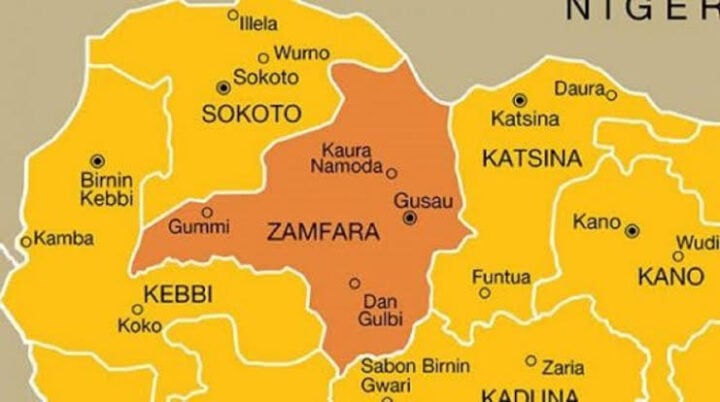

TheCable understands that the VAT on imported goods provision in the legislation encroached powers of the federal government as stated in the exclusive legislative list.

Advertisement

LAGOS VAT ON IMPORTS

Specifically, Section 6 of the Lagos VAT bill provides that the value of imported taxable goods shall be the amount that is equal to the price of the imported goods and includes all:

“(a) taxes, duties and other charges levied outside or for importation into Nigeria, other than the tax imposed by this Law; and

“(b) costs of parking, transportation, insurance and commission up to the port or place of importation.”

Advertisement

Section 16 (2) further states that “an importer of taxable goods shall pay to the Service (Lagos state internal revenue service) the tax on the goods before clearing”.

In Nigeria, the FIRS has always been in charge of VAT collection, which is then shared among the federal, state and local governments.

By attempting to tax imports, Lagos is challenging the constitution and moving towards the jurisdiction of the federal government as stated in the exclusive legislative list.

Only the federal government can legislate on the subjects in the exclusive list. Interference of state governments on matters in the exclusive list is considered unconstitutional.

Advertisement

EXCLUSIVE ITEMS

Item 62, Part I of the exclusive legislative list covers trade and commerce, and in particular:

Advertisement

“(a) trade and commerce between Nigeria and other countries including import of commodities into and export of commodities from Nigeria, and trade and commerce between the states;

(b) establishment of a purchasing authority with power to acquire for export or sale in world markets such agricultural produce as may be designated by the National Assembly;

Advertisement

(c) inspection of produce to be exported from Nigeria and the enforcement of grades and standards of quality in respect of produce so inspected;

(d) establishment of a body to prescribe and enforce standards of goods and commodities offered for sale;

Advertisement

(e) control of the prices of goods and commodities designated by the National Assembly as essential goods or commodities; and

(f) registration of business names.”

Other items in the exclusive list cover taxation of incomes, profits and capital gains, stamp duties, export duties and customs and excise duties.

VAT ON IMPORTS CHALLENGES FG POWERS

Taiwo Oyedele, fiscal policy partner and Africa tax leader at PwC, said that the imposition of state VAT on imports clearly encroaches federal powers as stated in the constitution.

“The state will be encroaching on the exclusive legislative list by seeking to impose the state VAT on imports,” Oyedele told TheCable.

“This position has also be established in a previous Supreme Court judgement in the case AG Ogun State v. Aberuagba.”

Meanwhile, a court of appeal in Abuja on Friday ruled that both Rivers and Lagos states should maintain status quo over the collection of value-added tax (VAT), pending the determination of an appeal filed by the Federal Inland Revenue Service (FIRS).

Add a comment