Did you receive total payments of up to N100 million through the banking system between 2010 and 2015 — a period of five years? The government is coming for you — if you did not pay commensurate taxes and are yet to take advantage of the tax amnesty programme.

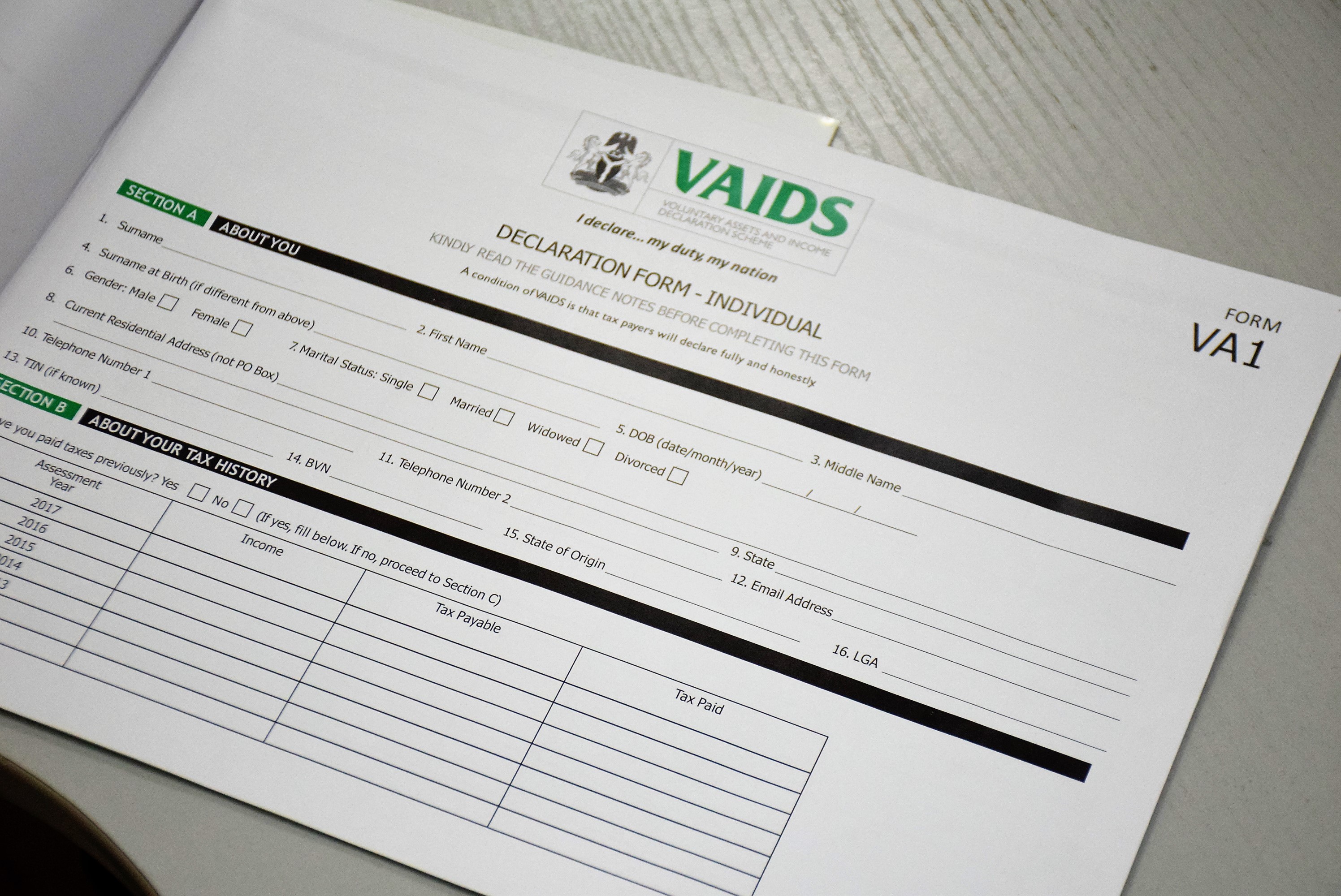

The finance ministry says the Voluntary Assets and Income Declaration Scheme (VAIDS) has commenced the collection of data on the income and assets of high net-worth individuals and companies in the country.

In a statement issued on Tuesday, it further said this is the first step in collecting intelligence that will ensure that corporate entities and individuals who may refuse to take advantage of VAIDS.

Data have already been mined from the Nigerian Customs Service and the Asset Management Corporation of Nigeria (AMCON) for all payments and receipts over N100 million between 2010 and 2015 — and personal bank accounts will be in the next round of data mining.

Advertisement

Data will also be collated from the Federal Inland Revenue Service, state lands departments, Corporate Affairs Commission (CAC), Securities and Exchange Commission (SEC), National Identity Management Commission (NIMC), land registries, treasury bills and Nigerian Inter-Bank Settlement System (NIBSS), Integrated Payroll and Personnel Information System (IPPIS), Nigerian Civil Aviation Authority (NCAA) and payment platforms such as Remitta.

“The data being collected is on individual and corporate liquid as well as fixed assets and income over the last five years both within and outside Nigeria. Data collected will be profiled against tax payments made by such individuals and corporate entities,” it said.

VAIDS is an initiative of the ministry of finance that provides a time-specific opportunity for taxpayers with tax liabilities to regularise their tax status by truthfully declaring previously undisclosed assets and income.

Advertisement

Taxpayers who take advantage of the window avoid penalties and interest on taxes owed, tax audits and prosecution for tax offences.

Federal government expects to generate $1 billion, raise the country’s tax-to-GDP ratio from an unimpressive 6 percent, one of the lowest in the world, to 20 percent by 2020 and provide vast tax education to boost voluntary tax compliance.

Add a comment