The federal government has proposed to borrow over N11 trillion to finance the proposed 2023 budget deficit, a development far above the stipulated threshold in the Fiscal Responsibility Act.

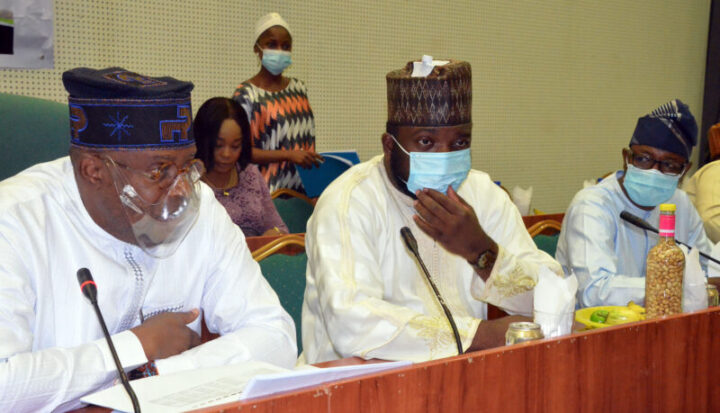

Zainab Ahmed, minister of finance, budget and national planning, said this on Monday while appearing before the house of representatives committee on finance to defend the 2023-2025 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).

She said the government’s budget deficit is expected to exceed N12.42 trillion if the federal government keep the petroleum subsidy for the entire 2023 fiscal cycle.

Reeling out numbers to the committee, Ahmed said the 2023 budget proposal is based on two options.

Advertisement

On the first option, the deficit is projected to be N12.41 trillion in 2023, up from N7.35 trillion budgeted in 2022, representing 196 percent of total revenue or 5.50 percent of the estimated GDP.

Based on this, Ahmed said the federal government would spend N6.72 trillion on subsidy payments.

On the second option, if the federal government keeps subsidy payments till June 2023, the budget deficit would amount to N11.30 trillion, which is N5.01 trillion of the estimated GDP. In this option, the PMS subsidy is projected to gulp N3.3 trillion.

Advertisement

The minister further said the first option is not likely to be achievable based on the current trend, while the second option would require tighter enforcement.

She said the new borrowings would come from local and international sources. Ahmed said N9.32 trillion in new borrowings, comprising N7.4 trillion from domestic sources and N1.8 trillion from foreign sources, adding that the government is expected to generate N206.1 billion from privatisation proceeds and N1.7 trillion in multilateral project-tied loans.

On the two proposals, Ahmed said they have budget deficits far above the stipulated threshold in the Fiscal Responsibility Act.

The fiscal responsibility law provides a limit of 3 percent threshold for sustainability but the president can “exceed the ceiling if there is a clear and present threat to national security or sovereignty of Nigeria”.

Advertisement

In 2020, the federal government exceeded the fiscal borrowing threshold, citing the COVID-19 pandemic.

2023 BUDGET BENCHMARK PROPOSALS

The minister said oil production for 2023 would be pegged at 1.69 million barrels per day. A real GDP growth rate of 3.7 percent and an inflation rate of 17.16 percent for the year. She added that the budget would be premised on $70 per barrel of crude oil and an exchange rate of N435.57 to the dollar.

REVENUE

Advertisement

Ahmed said the government was projecting revenue of N8.46 trillion for 2023 — N1.9 trillion of which would come from oil-related sources while the balance would come from non-oil sources.

ON SUBSIDY

Advertisement

Ahmed said the petrol subsidy regime would remain up to a mid-2023 sequel to the 18-month extension announced early in 2021.

She added that N3.36 trillion would be provided to pay the subsidy in 2023.

Advertisement

The minister also told the session that there would be tighter enforcement of the performance management framework for government-owned enterprises “which would significantly increase operating surplus/dividend remittances in 2023”.

DEBT SERVICING

Advertisement

She said there were no projections that Nigeria would default on her debt services in the nearest future.

While the amount currently used in debt servicing had overshot appropriation in the 2022 budget, she said systems are put in place to manage the situation.

“We planned that 60 percent of revenue would be spent on debt servicing, but in some months, the ratio went up to 90 percent,” she said.

“We have been able to, consistently without fail, service our debt, and we do not have any projections even in the near future that we will fail.

“We actually follow the Medium Term Debt Management Strategy very strictly; the debts are not taken haphazardly, and they are planned.

“They are appropriated, and then we borrow against appropriation.”

The minister acknowledged, however, that the government was under pressure to manage debt servicing following the drop in revenue generation.