The federal government says it will issue $500 million domestic foreign currency-denominated bonds in August.

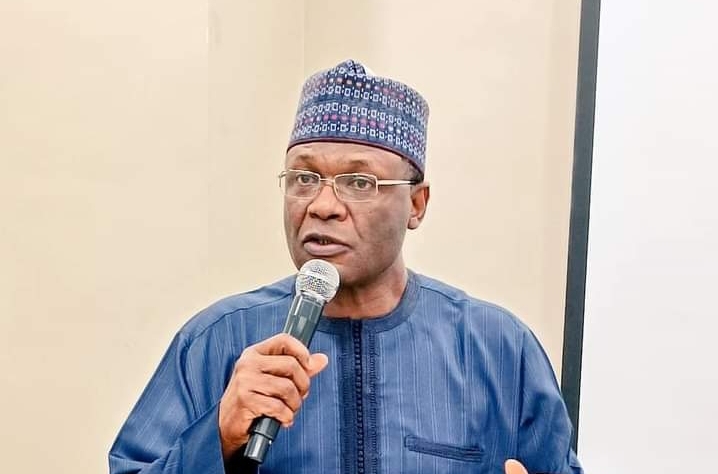

Wale Edun, minister of finance and coordinating minister of the economy, spoke on Thursday in Abuja during a quarterly press briefing to review the first half of 2024.

The meeting was themed ‘Economic Recovery And Growth: Progress and Prospects 2024’.

In April, the minister said the domestic foreign-denominated bonds would be issued in the second quarter (Q2) of the year.

Advertisement

Providing an update at the meeting on Thursday, Edun said the government needs to attract savings Nigerians held abroad.

“We have an open exchange rate system, it’s not illegal and so we have the issuance of a dollar-denominated security, not depending on the financial architecture of the western world, not depending on the kind of architecture that you use to raise eurobonds,” he said.

“We’re using the Nigerian financial system, the Securities and Exchange Commission (SEC), the banking system, the investment bankers to issue $500 million in the first instance that will be available and will attract foreign currency held by Nigerians abroad and anybody else who buys into the macroeconomic reform efforts of President Bola Tinubu.

Advertisement

“That issue is a challenge to the best and the brightest in the financial markets. It is due to open in the next three to four weeks maximum.”

‘NO PLANS TO RAISE EUROBOND’

Edun said the government is not currently planning to raise euro bonds, adding that moving forward with the idea will be dependent on the success of the domestic foreign currency-denominated bonds.

“Right now, depending on the success of that issue, there is no talk of looking to go to the international markets to raise the euro bond,” the minister said.

Advertisement

“It is one of the options that we have. It is the markets are open to us. Our ratings and our performance merit it.

“The market is open to us but we prefer in the first instance to challenge Nigerians to come home with their money and be part of the Nigerian reform success story that we believe that is where the economy is headed.

“Although these are very, very early stages we are in the right direction. We have turned the corner.”

He added that the economy is set for growth and success with the current plans of the federal government.

Advertisement

On March 13, a publication said Nigeria hired investment banks including Citibank NA, JPMorgan Chase & Co., and Goldman Sachs, to seek advice on its first eurobond issue since 2022.

Two days later, the Debt Management Office (DMO) denied receiving approval for the appointment of transaction advisers and eurobond issuance.

Advertisement

Add a comment