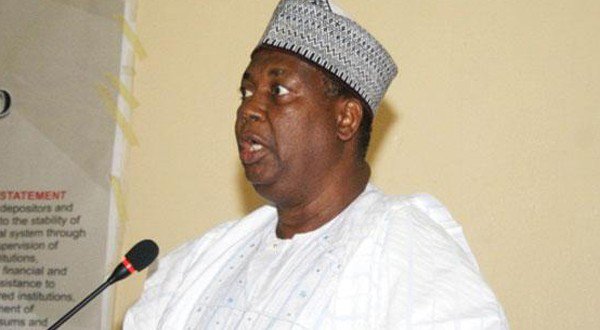

Nigeria will not cut spending while crude prices remain above the benchmark used for this year’s budget, Olusegun Aganga, minister of trade and investment, has said.

“Through a coordinated approach between the monetary and the fiscal side of things, I think we can wade through this,” Aganga told Bloomberg.

“I don’t see any immediate cuts in spending because everything is still above the benchmark.”

Nigeria based its 2014 budget on an oil price of $77.50 a barrel and a daily output of 2.39 million barrels. Africa’s biggest economy and most populous nation of about 170 million people relies on oil for 70 per cent of government revenue and 95 per cent of export earnings.

Advertisement

Average crude prices among members of the Organisation of Petroleum Exporting Countries have dropped below $80 a barrel for the first time in four years. Brent crude, which compares with Nigeria’s light crude, traded at $83.62 a barrel on Monday.

The naira fell to an all-time low of N170.25 against the dollar on November 6, as foreign investors exited the market amid tumbling crude prices, prompting the central bank to intervene by selling dollars.

Slumping oil prices may curb the West African nation’s ability to keep defending the naira, according to Samir Gadio, head of African strategy at Standard Chartered Plc.

Advertisement

The immediate impact of lower oil prices is to cut the amount of money that accrues above the price used for the budget, which goes to the Excess Crude Account, Aganga said.

The fund currently has a balance of $4.11 billion, according to the finance ministry.

“The medium-to-long-term strategy here is more about how we diversify the economy of the country away from oil,” Aganga said.

“We must invest in assembly and increase our local content, and be part of the global value chain for the auto industry.”

Advertisement

Add a comment