The Securities and Exchange Commission (SEC) has asked Deloitte to go ahead with the forensic audit of Oando Plc.

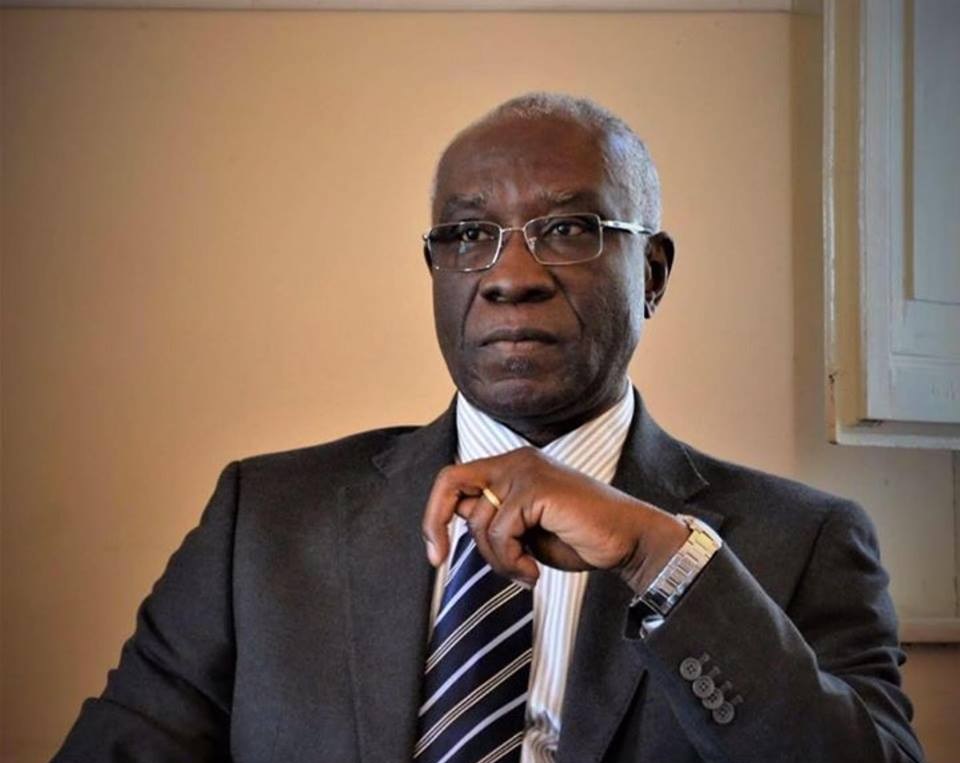

Abdul Zubair, acting director general of the commission, made this known at a news conference on Tuesday.

He said the lawsuits filed by Oando Plc and some of its shareholders to restrain the suit had been vacated.

The case began with complaints from Dahiru Mangal, a shareholder in the company. The company was accused of declaring false profits and insider trading, among others after a preliminary investigation by SEC.

Advertisement

He said the commission took steps to preserve the shareholders’ value and protect the investing public based on some of the findings from the investigation.

This, he said, led to the technical suspension of the shares of Oando Plc and the commencement of a forensic audit.

He, however, said that the audit was suspended because of two lawsuits that were initiated to stop the process.

Advertisement

“The two lawsuits were filed by Oando Plc and some shareholders of the company to restrain SEC and the Nigerian Stock Exchange (NSE) from effecting a technical suspension on the shares of Oando,” he said.

“The lawsuits were also intended to stop SEC from appointing a team of forensic auditors to conduct a forensic audit of the company.”

The DG said Oando had withdrawn the pending lawsuit against the commission by an application heard and granted by the court of appeal on March 5, 2017.

He also said that the application for withdrawal by the shareholders was heard and granted by the federal high court on February 21.

Advertisement

According to him, following the dismissal and the striking out of the two suits, SEC would be proceeding with the forensic audit.

“Following the dismissal and striking out of the suits, SEC has duly informed the firm of Deloitte to proceed with the forensic audit.

“The commission is committed to its primary mandate of protecting investors and will take all necessary steps to fulfil that mandate and uphold the integrity of the capital market.”

He assured all stakeholders that following the removal of the legal impediments, the audit of Oando Plc, would proceed in a transparent and thorough manner.

Advertisement

Zubair did not give a timeframe for the completion of the audit but assured that it would be done in the shortest possible time.

He also assured that the commission would not interfere with the audit so that the outcome would be satisfactory.

Advertisement

Add a comment