The Federal Inland Revenue Service (FIRS) says that the 2021 finance bill will enable an efficient tax system that will work for every Nigerian.

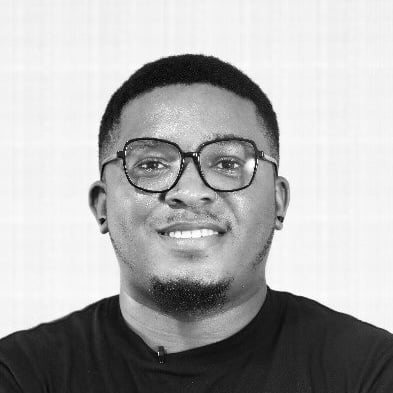

Muhammad Nami, executive chairman FIRS, disclosed this in a statement released by Johannes Wajuol, his special assistant on media and communications, on Monday in Abuja.

According to Nami, the laws and policies must first and foremost work for the Nigerian people, who they have either been elected or appointed to serve.

“Whatever proposals that have been submitted for consideration should be looked at critically vis-a-vis what works for Nigeria, the business community, the taxpayers, tax consultants, and the Nigerian system altogether,” Nami said.

Advertisement

“It will help us more if we realise that our collective effort and service is not about us. It is about our country.

“We must build a tax system that is not only robust, but that will outlive our respective services to this nation; whether as members of the executive, the judiciary, or the legislature.

”In other words, these laws must be made in a manner that reflects not just what we feel is right, but what is indeed right — yesterday, today, and continues to be right tomorrow.”

Advertisement

The FIRS boss also noted that the Fiscal Policy Reform Committee and the House Committee on Finance should continue to make laws that stand the test of time and reflect economic realities.

“The Finance Bills have accorded the Federal Government and the Fiscal Policy Reform Committee the opportunity to annually review and identify gaps in our tax system, to fix them and ensure that government can earn the much-needed revenue for the execution of its mandate,” he added.

“Without the commitment of the National Assembly leadership and members of the Executive, from day one to the fiscal reforms that the Finance Bills were aimed to achieve, we would not have been able to attain the resounding successes we have recorded since 2020.”

Nami said it was the 2020 Finance Act that gave the FIRS the powers to deploy its digital tax administration solution, TaxPro Max, with its attendant results.

Advertisement

“That single revolutionary amendment to the FIRS Establishment Act gave us the power to deploy our homegrown digital Tax Administration Solution called the TaxPro-Max,” he said.

“This platform allows for seamless electronic registration of taxpayers, electronic filing of returns, and payment of taxes.

“Consequently, it is not surprising that the FIRS was able to collect over N5 trillion between January this year to date while we are confident that we will achieve our total VAT target for the year.”

Advertisement

Add a comment