An air of caution swept across the financial markets during trading on Monday as doubts of a successful OPEC deal weigh heavily on global sentiment.

Stock markets were noticeably shaky with Asian shares trading in a lacklustre fashion after oil’s sharp depreciation soured investor risk appetite. European markets may be vulnerable to losses if the mounting political instability in Italy ahead of its referendum encourages participants to scatter away from riskier assets.

Although Wall Street concluded last week near historical highs, losses could be realised if Asia’s and Europe’s bearish contagion contaminate American shares.

An action-packed week lies ahead and such could place stock markets on another chaotic rollercoaster ride if the upcoming OPEC meeting; US GDP figures and heavily anticipated NFP create explosive levels of volatility.

Advertisement

Dollar bulls on a tea break

The Greenback retraced from gravity-defying levels on Monday as investors booked profits ahead of a data-packed week which could reinforce the firm expectations of the Fed raising US rates in December. November has been a game changer for the Dollar with Trump’s market shaking victory, repeated positive US data and hawkish comments from Fed officials ensuring Dollar strength remains a recurrent theme. Sentiment remains firmly bullish towards the Dollar with any depreciation seen as a correction for bulls to propel the Greenback even higher.

Much attention may be directed towards the pending third quarter GDP release and November’s NFP which could provide a clearer picture of how the world’s largest economy is faring. A solid GDP and rising employment may be critical chess pieces to solidify the already firm expectations of a December US rate increase.

Advertisement

The Dollar Index remains firmly bullish on the daily timeframe with bulls remaining in firm control above 100.00.

ECB Draghi discusses Brexit

The Brexit contagion has slowly spread its tentacles of uncertainty into the Eurozone economy which may place the nation under further pressure. Mario Draghi is due to testify on Monday in Brussels on economic developments and consequences of Brexit to Europe which should attract investor attention.

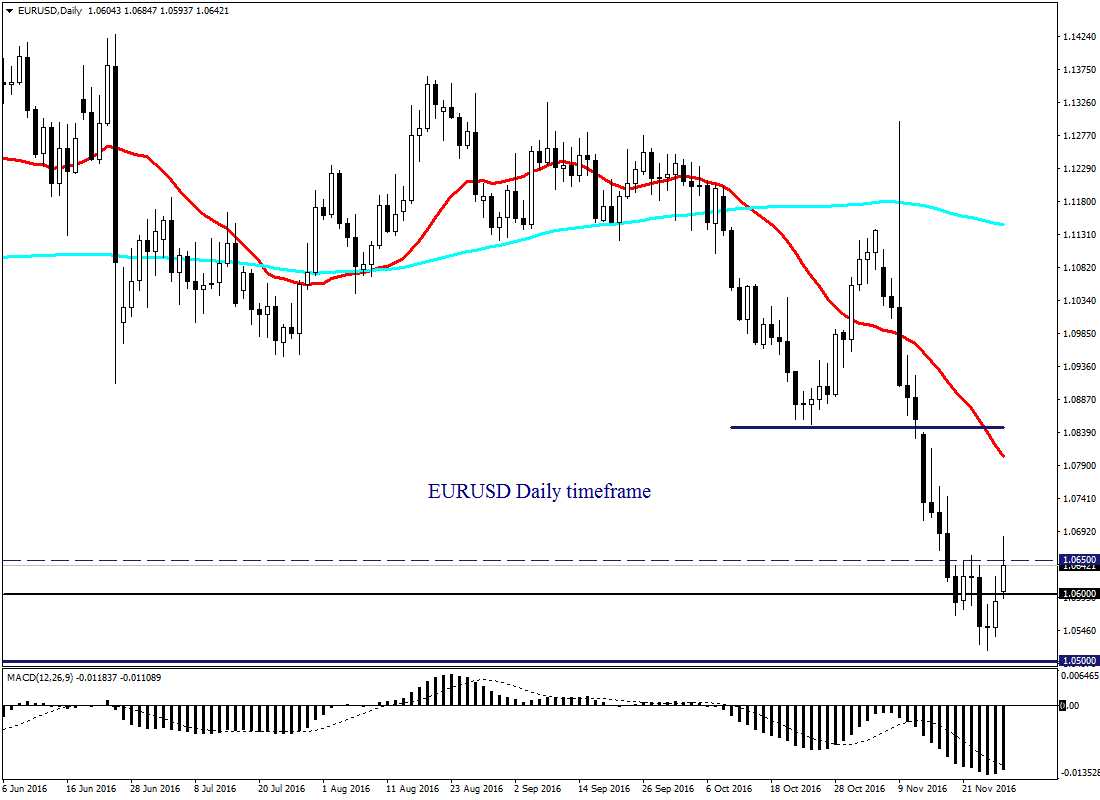

It is widely known that the Eurozone is entangled in a losing battle with faltering growth while political instability in Italy has left the Euro vulnerable to losses. A resurgent Dollar against the Euro is making the EURUSD a sellers dream with the parity reality materialising in the medium to longer term as bears install repeated rounds of selling. From a technical standpoint, the EURUSD may be in the process of a technical bounce with a breakdown back below 1.06 sparking a selloff towards 1.050.

Advertisement

Oil sinks lower

WTI Crude found itself vulnerable to painful losses last week Friday with prices sliding towards $46 as doubts were revived over the ability of OPEC members securing a meaningful freeze deal on Wednesday’s formal meeting in Vienna. Saudi Arabia’s absence from Monday’s pre-OPEC meeting coupled with Iran’s incessancy to an exemption from the output has sparked concerns over the success of the pending meeting.

Although OPEC may be repeatedly commended on their ability to create speculative boosts in oil via freeze deal hopes this may come at a very heavy price if nothing is achieved on Wednesday.

Advertisement

The classical prisoner’s dilemma OPEC members face coupled with the persistent oversupply woes could ensure low oil prices remains a recurrent theme in the medium to longer term. From a technical standpoint, bears are back in town and a breakdown below $45 could spark a further selloff towards $43.

Commodity spotlight – Gold

Advertisement

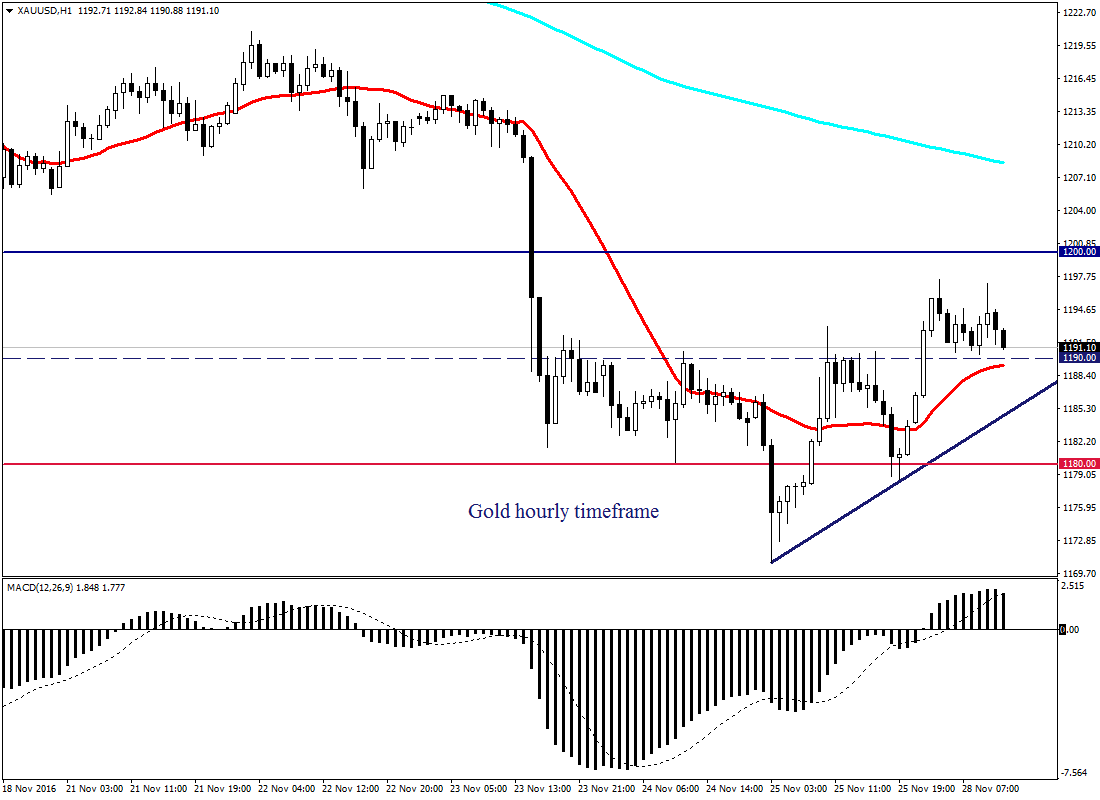

Gold displayed its safe-haven status on Monday with the metal edging higher towards $1195 as OPEC jitters triggered a wave of risk aversion. In times of uncertainty Gold is man’s best friend and such could become the theme this week if the combination of Dollar weakness and anxiety attract bullish investors. While bulls may enjoy the limelight in the short term, upside gains could be capped on Friday if the NFP exceeds expectations.

From a technical standpoint, intraday bulls have taken centre stage with prices bullish on the hourly timeframe. Previous intraday resistance at $1190 could transform into a dynamic support which encourages a further incline higher towards $1200. Intraday bulls remain in control above $1180.

Advertisement

Advertisement

Add a comment