BY ZAYYAD I. MUHAMMAD

Taxes and royalties collection is a fundamental avenue for a government to generate revenue to fund the development of infrastructure and human capital. Adamawa state is in need of other sources of revenues apart from the free petrodollars from the centre but the state is poor, with a fragile economy including thousands of unemployed youths and people engaged in unproductive jobs.

The World Bank says most developing countries with fragile economies “often face the steepest challenges in collecting taxes”.

There is a correlation between the timing of the introduction of new taxes, peoples’ economic strength and politics. No government can survive local politics if it introduces new taxes at the wrong time – especially when it is facing a re-election bid. Ahmadu Umaru Fintiri is seeking re-election in the 2023 governorship election.

Advertisement

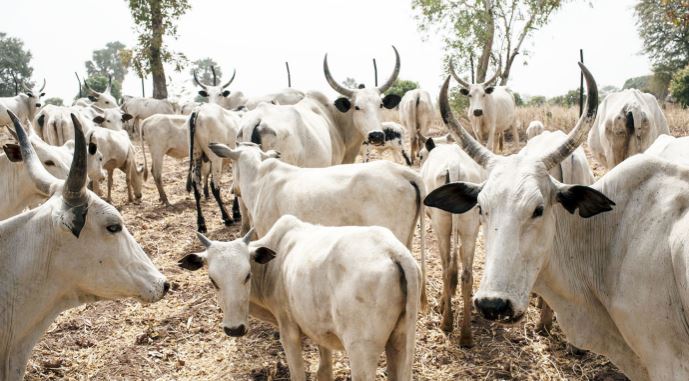

Ahmadu Umaru Fintiri’s introduction of a new cattle tax regime appears ill-timed, unplanned, and poorly communicated to the concerned people. So many explanations from the governor’s aides, yet no one understands them because the basics in tax administration were left out – new tax collection should be optimised but with minimal burden on the taxpayers, it should be fair, equitable, and at the appropriate time.

The Adamawa state government said that the Adamawa State Agribusiness Support Programme (ADAS) is designed to take full advantage of the agricultural opportunities within the state and will focus on three areas; crop value chain, livestock, and aquaculture. The government further said the Agric bond will draw N25 billion annually which will be used to offset many of the state’s liabilities and loans and open a window for generating huge revenue as well as galvanizing the market in the agriculture business, especially the livestock subsector including the upgrade of cattle markets in Mubi, Ganye, Song, Gombi, Ngurore, Tungo, Malabu, and Wuro Bokki.

The Fintiri government failed to do its homework in two areas — balancing the economic needs and political necessity. The cattle tax is as historic as northern Nigeria. The N5,000 imposed on every cattle is exorbitant and unaffordable according to many people in the business

Advertisement

On the other hand, there are thorny politics associated with the cattle tax and the people related to the business are complex and very important in the socio-political settings of northern Nigeria thus, before tinkering with the tax, there is a significant requirement for discussion, engagements, and understanding. The livestock business is a very important sector, so to speak!

As a result of poor timing and lack of discussion with stakeholders on the new increase in the cattle tax, the Mubi cattle market, one of the biggest in the north, didn’t operate last week and on Tuesday, September 13, 2022, the market was sealed by the security agents.

Well, the governor has found himself in a Catch-22 situation because the upward review on tax for cattle and grains was one of the conditions the government must fulfil in accessing the N100 billion agribusiness bond from the capital market. Fintiri has already collected N25 billion from the N100 billion. And the investors are the ones to be collecting the taxes

Fintiri is a student of history, policy, and strategy, but often some of his decisions lack political strategy.

Advertisement

Muhammad writes from Abuja. He can be reached via 08036070980 or [email protected]

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment