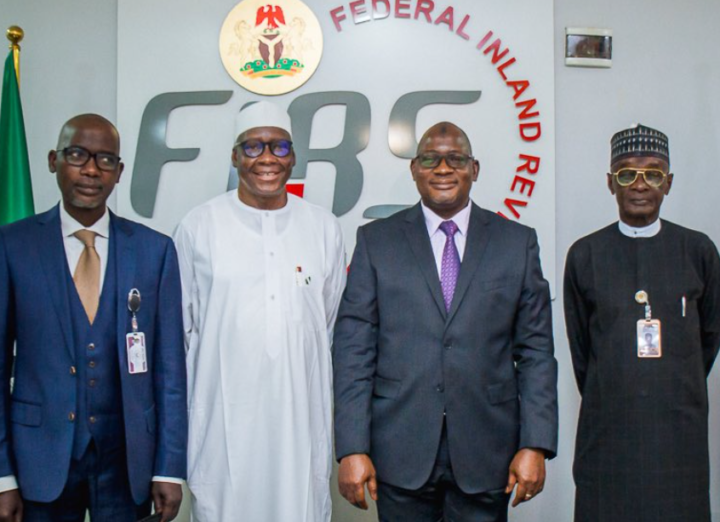

The Federal Inland Revenue Service(FIRS) has signed a Memorandum of Understanding (MoU) with the Nigerian Television Authority (NTA), Federal Radio Corporation of Nigeria (FRCN) and the National Orientation Agency (NOA).

The MOU will see government-owned media organisations and the tax collection agency collaborating to engage in a nationwide tax education campaign.

FIRS said this in a tweet on Monday.

The agency said it plans to increase awareness of the importance of tax payment by carrying out a nationwide campaign to educate and provide step by step instructions on taxes.

Advertisement

“Today the FIRS signed an MOU with the Nigeria Television Authority, the Federal Radio Corporation of Nigeria, & the National Orientation Agency, to commence a nationwide taxpayer education campaign that will focus on taxes to pay, how to pay, where to pay, when to pay & why we pay,” the tweet reads.

Recently, FIRS said it achieved over 100 percent of its collection target in 2021, and it is working towards achieving more.

Last week, the agency had said it would start collecting taxes on income derived by companies from bonds and short-term securities.

Advertisement

A bond is a fixed-income instrument (loan) made by an investor to a borrower (typically corporate or government).

The new directive, contained in a circular obtained by TheCable, FIRS mandates businesses to pay income tax on the profit earned from bonds and short-term government securities, exempting income tax on bonds issued by the federal government.

It listed short term government securities to include treasury bills and promissory notes; bonds issued by state and local governments and their agencies; and bonds issued by corporate bodies and supra-national.

Mohammed Nami, the executive chairman of the FIRS, had urged Nigerians to obey the law by ensuring prompt payment of taxes.

Advertisement

Add a comment